The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

Despite Rise in Prices in 2Q, Global Housing Markets Remain Fragile

Residential News » Europe Residential News Edition | By Michael Gerrity | September 11, 2012 9:50 AM ET

According to London-based real estate consulting firm Knight Frank, global house prices rose by 1.1% on average in the three months to June 2012, which represents the index's strongest quarterly rise since Q4 2009.

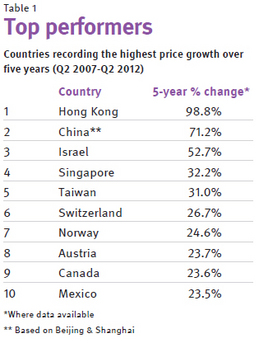

According to London-based real estate consulting firm Knight Frank, global house prices rose by 1.1% on average in the three months to June 2012, which represents the index's strongest quarterly rise since Q4 2009.The modest recovery is largely due to the steady performance of a core group of countries - prices in 25 of the 55 countries monitored are now rising at a faster rate than they were a year ago. Added to this are a few stellar performances by some of the world's most influential economies. House prices in the US, Canada and Hong Kong for example rose by 6.9%, 3.2% and 7.6% in Q2, up from -1.7%, 0.4% and 1.8% respectively in Q1.

The results for Q2 2012 show 13 of the 17 Eurozone members are in the bottom half of the table when ranked according to price growth in the three months to June. The summer period has seen the Eurozone's status quo preserved but the autumn months are expected to bring renewed debate and more instability as the potential 'Grexit' enters the minds of policymakers and the global media once more.

China, which alongside the US has the largest bearing on the world's housing markets and has largely propped up the index since early 2009, is now providing mixed messages.

Although prices here are down 7.1% in annual terms they fell by just 0.1% in the last quarter. A range of cooling measures have helped to curb speculative demand but two interest rate cuts since June are reinvigorating the new homes market with prices now edging upwards in 49 of China's 70 key cities. Having seen prices fall by 34.7% peak-to-trough (between Q2 2006 and Q1 2012), the US housing market is gaining traction and prices are finally rising. Mortgage demand is up, new construction levels are improving and foreclosures are at their lowest level since Q4 2007.

Although prices here are down 7.1% in annual terms they fell by just 0.1% in the last quarter. A range of cooling measures have helped to curb speculative demand but two interest rate cuts since June are reinvigorating the new homes market with prices now edging upwards in 49 of China's 70 key cities. Having seen prices fall by 34.7% peak-to-trough (between Q2 2006 and Q1 2012), the US housing market is gaining traction and prices are finally rising. Mortgage demand is up, new construction levels are improving and foreclosures are at their lowest level since Q4 2007.Despite the index's 1.1% growth this quarter, there is likely to be little stimulus for the world's housing markets in the near future.

In Asia large-scale house building programs, higher property taxes and the deterrence of 'hot' foreign money will keep a lid on price inflation. In the Eurozone there is little prospect of a confidence-inducing resolution to the debt crisis. Only the US seems capable of providing any meaningful impetus but the forthcoming U.S. Presidential Election in November and debate over the direction of future housing policy could contain growth, at least in the third quarter.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More