The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

UK Residential Land Price Index Dips in Q2, Despite Being Land Constrained

Residential News » Europe Residential News Edition | By Michael Gerrity | August 3, 2012 9:30 AM ET

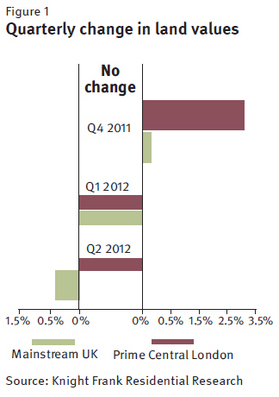

Based on global real estate consulting firm Knight Frank's latest UK Residential Land Development Index for Q2, 2012, London's development land held on to last year's 20.3% price increases, while prices in the rest of the UK have fallen by 0.4% in the last Quarter.

Knight Frank's Gráinne Gilmore tells World Property Channel that their development land index signals that prices slipped slightly outside London in Q2, partly reversing the 1.3% rise seen last year. London prices remained unchanged for the second quarter in a row.

UK Residential Land Index Results for Q2

- The average value of residential land slid by 0.4% in England and Wales between April and June 2012.

- Prime central London development land prices remained unchanged for the second consecutive quarter.

- Supply of residential development land is still constrained

The UK

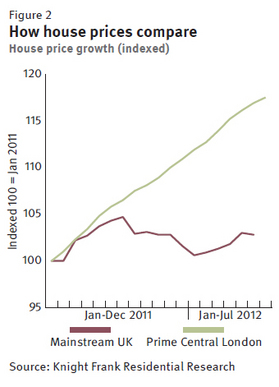

The price of development land across the UK fell marginally between April and June, after no change in the first quarter of the year. This comes after a 1.3% rise in values last year. Land prices are broadly mirroring the movement of mainstream house prices in the UK, which have fallen by around 0.3% since the start of the year.

Given the lack of house price growth across the UK, there is little reason to expect further increases in land values in the short term.

Given the lack of house price growth across the UK, there is little reason to expect further increases in land values in the short term.On the other hand, the finite supply of development land, caused partly by the backlogs and uncertainty in the planning system, is to some extent putting a floor under land prices.

But there are concerns that the new Community Infrastructure Levy (CIL) which is currently being looked at across the UK could change this balance.

Any additional cost levied on house builders or developers is likely to have a negative effect on development land values as this is where such a cost would be recouped.

The CIL is being viewed as just such a cost. There is also disquiet that the levy has yet to be finally decided in many areas, creating uncertainty over what the charge might be.

The outlook is for no sharp price movements for UK development land in the near future, unless the extra cost of CIL tips the balance, or house prices take a sharp downward turn.

Prime Central London

Development land values remained unchanged again in the second quarter, after jumping by 20.3% last year.

The trend in the market in the second quarter also remained much the same as in the first three months of the year, with good levels of demand for stock where developers and investors see opportunities for a realistic and deliverable margin.

The trend in the market in the second quarter also remained much the same as in the first three months of the year, with good levels of demand for stock where developers and investors see opportunities for a realistic and deliverable margin.While the market has an appetite for development risk, it will not speculate on planning risk. As a consequence, the unconditional trading market now has a sensible risk-reward arbitrage. We see this position remaining for the long term.

The funding environment remains tough and as a consequence the market is becoming increasingly dominated by balance sheet buyers and high-net-worth investor developers. Pure equity investors are finding the market a difficult environment to place capital into as their IRR expectations are suppressing their bidding competitiveness.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More