The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

UK Enjoys Highest Property Transaction Volumes Since 2008 in Q1

Residential News » Europe Residential News Edition | By Michael Gerrity | May 8, 2012 12:22 PM ET

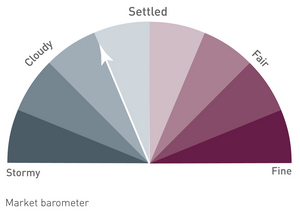

According to a new Chesterton Humberts Residential Observer report, residential transaction volumes in the UK during Q1 2012 were at their highest levels since Q1 2008. A total of 198,000 transactions were completed which was 14.5% higher than in the first quarter of the previous year.

Chesterton Humberts' CEO Robert Bartlett commented, "The double dip recession may be claiming the headlines but fundamentally on the street it feels that the residential property sector is finally showing signs of a more sustained recovery. Transaction volumes are up, and judging by our pipeline, they look to be strengthening. Crucial to the ongoing recovery is the availability of mortgage funding at reasonable rates.

"Although the early part of the year looked encouraging in terms of mortgage borrowing, it is now clear that the banks are restricting lending once again. The market is seeing horrendous delays on sales as a result of banks, and particularly HSBC, taking extended time to make mortgage offers available. In the case of HSBC, who now have about a 15% share of the UK mortgage market, this seems partly due to the company's decision to introduce a restricted panel of solicitors to handle conveyancing checks on their behalf which has severely slowed the conversion of sales. It is essential for sensible levels of mortgage funding to be forthcoming and provided this happens, we are confident that the housing market will continue to recover, albeit slowly.

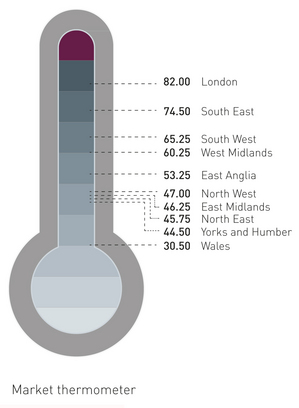

"Although the early part of the year looked encouraging in terms of mortgage borrowing, it is now clear that the banks are restricting lending once again. The market is seeing horrendous delays on sales as a result of banks, and particularly HSBC, taking extended time to make mortgage offers available. In the case of HSBC, who now have about a 15% share of the UK mortgage market, this seems partly due to the company's decision to introduce a restricted panel of solicitors to handle conveyancing checks on their behalf which has severely slowed the conversion of sales. It is essential for sensible levels of mortgage funding to be forthcoming and provided this happens, we are confident that the housing market will continue to recover, albeit slowly."Perhaps the most exciting thing in 2012 so far has been the marked increase in volume of the regional markets and it is encouraging to see activity picking up in the north although a significant revival is not yet visible.

UK Market Highlights Include:

UK Market Highlights Include:- Despite the economy having dipped back into recession there have been some encouragingly positive indicators. HMRC reported that Q1 saw the highest first quarter transaction volume in the UK since Q1 2008 - a total of 198,000 transactions were recorded which was 14.5% higher than in the first quarter of the previous year.

- Meanwhile, the Nationwide consumer confidence index reached a nine month high in March and average achieved to-asking prices have risen in each of the first three months of the year according to Hometrack. Rightmove additionally report that average asking prices rose by 2.9% in April to reach an all-time high of £243,737, 0.5% higher than the previous record set in May 2008.

- Nonetheless, average monthly house price inflation in England & Wales turned negative in March (-0.6%) compared to the modest 0.1% increase recorded in February according to Land Registry data. Average prices are now 12.2% below their pre-recession peak of November 2007. On an annual measure, average prices also fell by 0.6% for the second month in succession.

- According to data from the British Bankers' Association, the number of loans approved for house purchase in March was a hefty 22.5% higher than in February - although 5.3% lower than in March 2011. Notwithstanding this, many households are still reducing or repaying their borrowing where possible.

- Although Bank Rate remains on hold a number of high street banks have raised their standard variable interest rates in response to the higher cost of raising money from wholesale markets due to the Eurozone crisis - although there is likely also an element of ongoing balance sheet maintenance at play. The gap between Bank Rate and the average mortgage rate is now the highest since records began 17 years ago.

- More positively, HSBC has announced it will increase its LTV for new build properties from 75% to 85% which may persuade other banks to follow suit and provide welcome impetus for this segment of the market.

- The private rented sector has enjoyed a similarly buoyant start to 2012. Survey evidence from ARLA and Paragon point to improved rental returns and modest increases in tenant demand in Q1. Moreover, landlords are generally optimistic about market prospects going forward.

Bartlett concluded, "While some high value property sales to international buyers have fallen through due to the stamp duty measures announced last month, the full effect remains to be seen. The proposed introduction of an annual levy on residential property valued at more than £2m held in a corporate wrapper and the introduction of a capital gains tax on disposal of these properties could trigger a spurt of sales, boosting stock levels which remain very tight.

"Attention will now be focused on the political changes underway on the Continent. Our Government must hold its nerve and ensure the financial credibility of the UK as an ongoing safe haven. Above all Government must resist killing the goose that lays the golden egg. Heaven only knows the UK needs the investment".

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More