The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

Muscat's Residential Market Enjoying a Flight to Quality

Residential News » Middle East and Africa Residential News Edition | By WPJ Staff | June 17, 2014 11:15 AM ET

According to the Cluttons' Muscat Spring 2014 Residential Market Outlook Report, tenant demand has improved in line with increased job creation. This has been in part driven by the government's heavy investment in transportation and energy infrastructure upgrades.

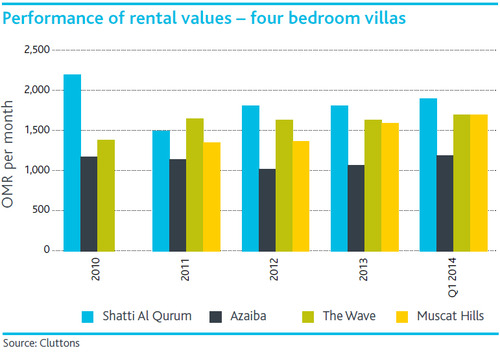

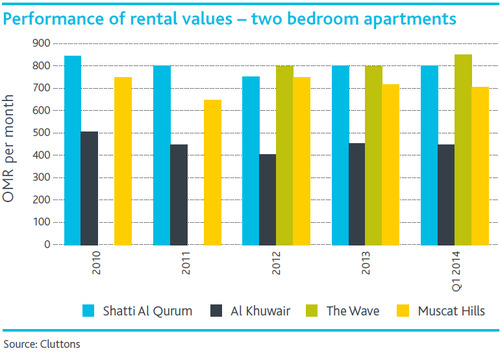

In the rental market, where attention is centered on schemes perceived to offer better quality accommodation, two-bedroom apartments and four-bedroom villas remain the most sought after across Muscat. In addition, strong demand for larger villas in particular, coupled with limited new supply, has helped to drive up rents during Q1 2014. Monthly rents for four-bedroom villas have risen across most submarkets, with Azaiba (9%) showing the strongest growth this quarter. On the other hand, rents for two bedroom apartments have remained largely stable over the same period.

In the rental market, where attention is centered on schemes perceived to offer better quality accommodation, two-bedroom apartments and four-bedroom villas remain the most sought after across Muscat. In addition, strong demand for larger villas in particular, coupled with limited new supply, has helped to drive up rents during Q1 2014. Monthly rents for four-bedroom villas have risen across most submarkets, with Azaiba (9%) showing the strongest growth this quarter. On the other hand, rents for two bedroom apartments have remained largely stable over the same period.According to Philip Paul, Head of Cluttons, Oman; "With an increased emphasis on quality, The Wave and Muscat Hills are two developments that are currently enjoying a resurgence in demand, with The Wave recently bringing forward the release of its Reehan Residences to satisfy investor appetite. At the same time, the rising levels of inventory here will help to address some of the pent up tenant demand for The Wave."

The increased interest in higher quality properties is set to lead to a widening gap between prime and secondary locations throughout the city in the near term.

The report asserts that the sales market is showing a significant increase in demand for completed residential properties. At The Wave and Muscat Hills, which are Integrated Tourism Complexes (ITC), prices average OMR 1,000 psm. Some Omani investors are being attracted to the ITC properties due to the attractive rental yields, while others are driven by the desire to transition to home ownership.

The report asserts that the sales market is showing a significant increase in demand for completed residential properties. At The Wave and Muscat Hills, which are Integrated Tourism Complexes (ITC), prices average OMR 1,000 psm. Some Omani investors are being attracted to the ITC properties due to the attractive rental yields, while others are driven by the desire to transition to home ownership.A degree of pent up demand from Omani nationals, which is being driven by a gradual build-up of home ownership aspirations since the 'great' recession, has resulted in many households now opting to step on to the property ladder, buoyed by rising market confidence levels.

Paul comments, "On the supply front, we feel the market has room to absorb further residential schemes and prices are, to a large extent, currently being supported by the dearth of stock. With no substantive new ITC schemes likely to be delivered over the next six months, we expect capital values to continue edging upwards over the course of the year. That said, developers are mobilizing on sites such as Saraya as they move to capitalize on the strengthening appetite to purchase"

According to the report, foreign investment in to Oman's residential property market has also risen in the past year, in particular from UAE-based non-resident Indian (NRI) buyers. With Oman's long and close history to the Indian subcontinent, NRI buyers are increasingly attracted to Omani cities such as Muscat, which offers excellent air and road links to nearby Dubai. In addition, there is the added benefit of a residential visa linked to property ownership. This is something other regional locations are unable to offer, or guarantee.

Steve Morgan, CEO Cluttons Middle East concludes, "We have recorded an upturn in the number of non-resident Indian buyers from the United Arab Emirates entering the market over the past six months. With prices rebounding in Dubai, an affordability threshold may have been breached and with regulations surrounding retirement properties not entirely clear, it would logical sense for this group to look at nearby markets such as Muscat. While this trend is yet to remove substantive quantities of stock from the market, the propensity for the creation of several "buy-to-leave" homes, as the limited supply is further depleted, will no doubt place further upward pressure on capital values."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More