The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Debt Levels of Commercial Real Estate Borrowers Set to Increase 40% in 2012

Commercial News » North America Commercial News Edition | By Michael Gerrity | February 8, 2012 8:55 AM ET

As lenders converge at the Mortgage Bankers Association conference in Atlanta this week, borrowers will keep a close eye on the amount of debt and equity capital raising planned by commercial banks, life companies and private investors in 2012.

As lenders converge at the Mortgage Bankers Association conference in Atlanta this week, borrowers will keep a close eye on the amount of debt and equity capital raising planned by commercial banks, life companies and private investors in 2012. To define the likely universe of capital available for commercial real estate lending in 2012, Jones Lang LaSalle and Penton Media Research partnered to conduct a proprietary survey that compiled direct feedback from 186 borrowers and 136 lenders that together comprise a median $73.3 million in commercial real estate asset value.

This report details the borrowers' sentiments for 2012 funding aims. In the last 12 months, these borrower respondents borrowed a median $21.1 million for commercial real estate ventures.

2012 Borrower Sentiment Highlights

- Borrowers find commercial banks are the most active lenders, as 77 percent of respondents borrowed from banks in 2011. One in three borrowed from life companies and one in four borrowed from private equity investors in 2011, signaling a trend expected to increase in 2012 as more borrowers seek funds from alternative sources.

- Most borrowers (74 percent) are sourcing primary loans or short-term construction loans (41 percent) followed by 30 percent sourcing a line of credit.

- The debt process is improving as commercial real estate borrowers report feeling satisfied with the certainty of execution from lenders, which they prioritize as the most important factor when seeking a loan origination provider.

- Expectations for an increase in long-term mortgage rates have subsided. Only 57 percent of borrowers predict an uptick in interest rates in 2012, while 78 percent thought rates would rise in 2011.

- Borrowers need more debt in 2012, as 40 percent expect their total portfolio debt to increase in 2012, up six percent over 2011 increase expectations.

- The health of the United States economy has the greatest impact on borrowers' ability to obtain financing.

"With $415 billion of mortgage maturities on the horizon in 2012 alone, and opportunistic plays in the market, it makes sense that a majority of borrowers still need more capital lending in 2012 and they're finding challenges that economic volatility throws at the commercial debt markets," predicts Tom Fish, Co-Head and Executive Managing Director of Jones Lang LaSalle's real estate investment banking business. "Even with the existing global economic concerns, debt financing will remain very strong in the core space from life companies and domestic banks and we expect the CMBS market to continue to regain footing in 2012."

Mike Melody, Co-Head and Executive Managing Director of Jones Lang LaSalle's real estate investment banking business concurs, "The traditional lenders are all still relatively cautious in their underwriting as they can still find good relative risk in mortgage loans relative to alternative bonds or other fixed-rate alternatives. That's resulting in bigger allocations to commercial real estate this year from the life companies and pension funds that have worked through most of their problem accounts and are well-positioned lenders in 2012."

Financing Requirements

In 2012, debt in all forms, deleveraging, bank stability and currency movements, will dominate the global financial picture. Domestic borrowers indicated the majority of their 2011 financing needs (51 percent) were used for refinancing, followed by 42 percent that financed acquisitions where opportunistic buys existed. Contrary to typical wisdom, a large portion of borrowers' funding in the last year went to new development (24 percent).

"Multifamily construction has already begun in several markets and some office product has launched as borrowers, developers and prime lenders prepare to start selective development in 2012," said Fish. "We won't see a wave of new construction hit the market but selective development makes financial sense where there are pockets of demand."

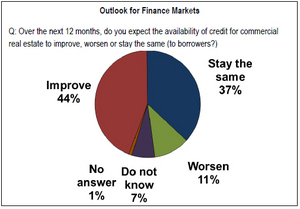

The increasing level of available credit is music to borrowers' ears as 44 percent of borrowers and 56 percent of lenders expect credit to increase in 2012.

Deal Execution

To close deals today, borrowers state that lenders need to provide certainty of execution as the number one factor that nearly all borrower respondents consider in the loan origination process. Flexibility of loan terms ranks second and lowest available rate ranks third.

To close deals today, borrowers state that lenders need to provide certainty of execution as the number one factor that nearly all borrower respondents consider in the loan origination process. Flexibility of loan terms ranks second and lowest available rate ranks third. "Borrowers are making informed decisions as to lenders with whom they wish to transact. The debt markets are clearly improving and borrowers are able to secure attractive pricing from both bank and life company lenders who can be counted on to close," added Tom Melody, Co-Head and Executive Managing Director of Jones Lang LaSalle's real estate investment banking business. "The areas where we used to hear the most lamentation from borrowers related to the slow loan closing speed and the post-closing service process, which also scored the lowest satisfaction rate in our survey; however, both areas have improved as of late and we anticipate that improvement will continue throughout the year. It is a great time to be a borrower."

Rate Lock?

Borrowers' expectations for an increase in long-term mortgage rates have subsided. Only 57 percent of borrowers predict an uptick in interest rates in 2012, while 78 percent of respondents predicted interest rates would rise in 2011.

"Trying to predict the bond market is always somewhat dangerous, but the market is expecting rates to remain low during 2012 with generally favorable commercial loan pricing," added Mike Melody. "We're at an absolute 25-year low for fixed rate loans on the best, low leveraged, quality assets. Borrowers with core, well-located properties will have a lot of competition and bidding wars from lenders willing to be aggressive on their pricing even though absolute rates are low given the spreads to those benchmark interest rates are still extremely attractive."

The low interest rate environment is broadening the world of financeable assets because it helps support property values and results in lower cap rates, particularly for high-quality assets. Mike Melody cautions, "Remember that not all properties and all markets are created equal. There is still a remaining second tier of markets with unstabilized assets, and a less efficient debt market to finance them because the CMBS market that was financing that space paused in the back half of 2011. We believe CMBS will come back in 2012, but borrowers with those assets still have to face that market volatility in 2012."

Lingering Concerns

Among the greatest concerns for borrowers is the health of the U.S. economy as respondents indicated it had the most impact on their ability to obtain financing in 2011. Borrowers also noted that debt-service coverage ratios and loan to value ratios also impacted their ability to refinance.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More