The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Trans-Pacific Shipping Costs, Growing 'Megapolitans' Impacting U.S. Industrial Markets

Commercial News » North America Commercial News Edition | By Michael Gerrity | August 1, 2014 9:57 AM ET

According to the latest report from CBRE Group, Inc., Transportation Cost Equivalence Line: East Coast vs. West Coast Ports, the ever-evolving global supply chain is prompting distribution companies that process freight shipments between the U.S. and Asia to optimize their U.S. industrial real estate portfolios to increase efficiencies and cost savings.

These companies are heavily scrutinizing transportation costs in East Coast and West Coast seaports--and inland cities with strong transportation links--locating facilities in markets best able to serve established and emerging "megapolitan" areas in a quick, cost-effective manner.

"Distribution and fulfillment users need a real estate footprint that allows them to move freight through the U.S. transportation network as fast as economically feasible," said Scott Marshall, Executive Managing Director, Industrial Services, Americas, CBRE. "Future location decisions will largely be driven based on population growth--the East Coast and West Coast ports with the infrastructure and transportation links to serve the largest and fastest growing regions in the country will also be home to strong-performing industrial real estate markets."

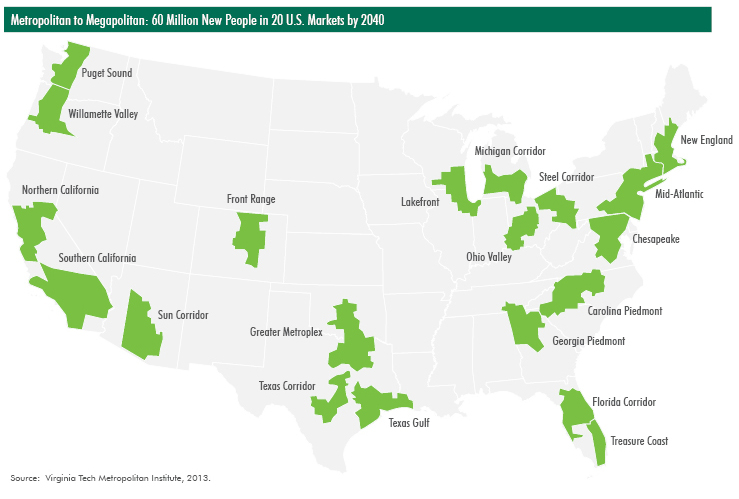

Between 2005 and 2040, the U.S. population is expected to grow by 100 million people--60 million of which are expected to reside within 20 markets characterized as megapolitans. These megapolitan markets comprise cities and counties linked by shared transportation networks, labor markets and/or water supplies. These 20 megapolitan areas, which can be further combined into 10 clusters, are projected to house about two-thirds of the U.S. population by 2040 and will capture the lion's share of total investment dollars spent on development and growth.

The impact of population shifts on supply chain networks and industrial real estate in the coming years will be significant. However, the additional volume moving through these megapolitan regions could result in increased congestion and loss of productivity. As such, the continued investment in transportation infrastructure is crucial.

In order to capitalize on the greater container volume that will soon traverse the expanded Panama Canal, many seaports have recently invested millions in infrastructure, creating alternative transportation solutions including short haul rail and barge systems to accommodate post-Panamax ships. However, the expansion of the Panama Canal is not expected to have a major impact in the movement of freight within the U.S., as separate strategies are required for high-value, time-sensitive freight (quicker delivery) and for low-value, low-cost freight (cost effective delivery).

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More