The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

U.S. Home Price Gains Slows in 63 Percent of U.S. Markets

Residential News » North America Residential News Edition | By WPJ Staff | September 29, 2014 8:00 AM ET

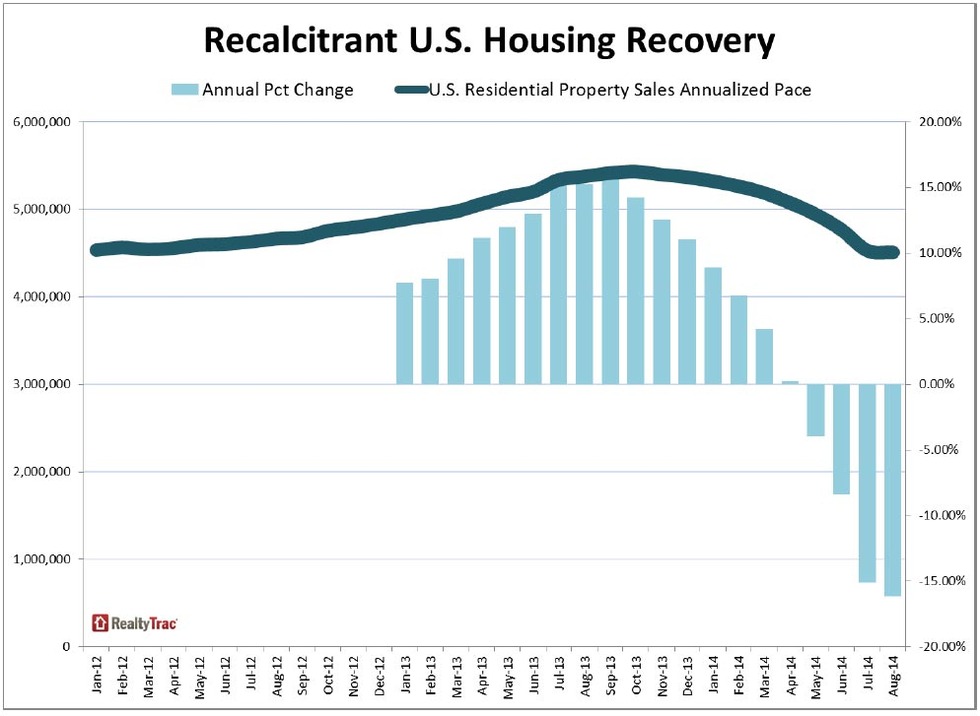

According to RealtyTrac's August 2014 U.S Residential & Foreclosure Sales Report, U.S. residential properties, including single family homes, condominiums and townhomes, sold at an estimated annual pace of 4,508,559 in August, down one-half percent from the previous month and down 16 percent from a year ago -- the fourth consecutive month where annualized sales volume has decreased on a year-over-year basis.

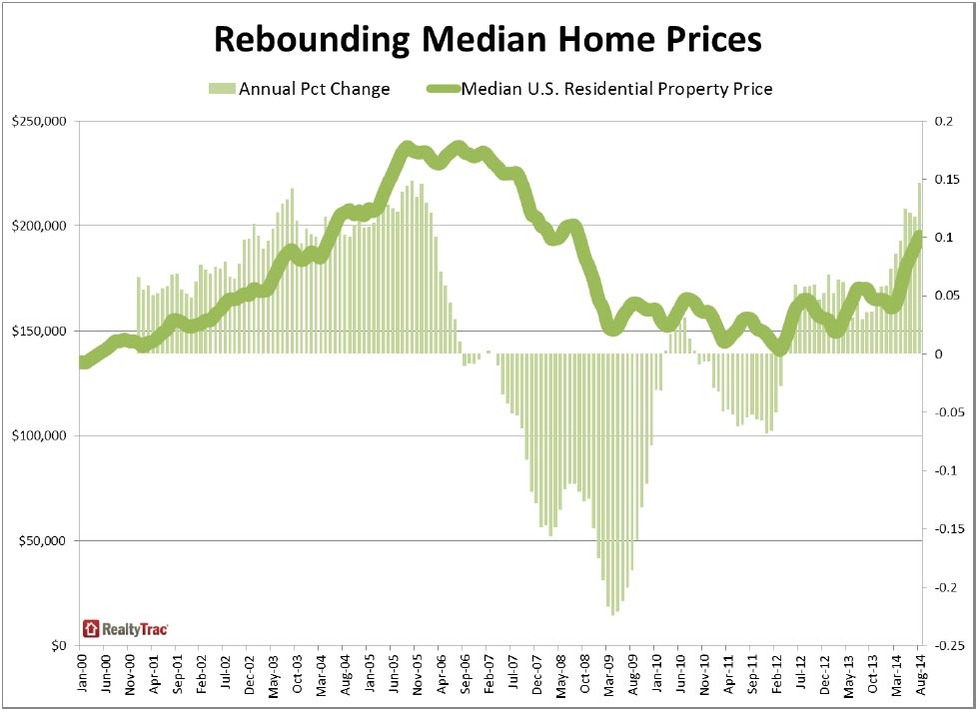

The median price of U.S. residential properties sold in August -- including both distressed and non-distressed sales -- was $195,000, up 3 percent from the previous month, and up 15 percent from a year ago to the highest level since August 2008, a six-year high.

"Higher-end properties are taking up a bigger share of a smaller home sales pie, boosting the median home price nationwide higher even as home price appreciation slows to single digits in many of last year's red-hot local housing markets," said Daren Blomquist, vice president at RealtyTrac. "On the other hand, markets where large institutional investors and other buyers have not picked clean lower-priced inventory are continuing to see strong, double-digit increases in median home prices."

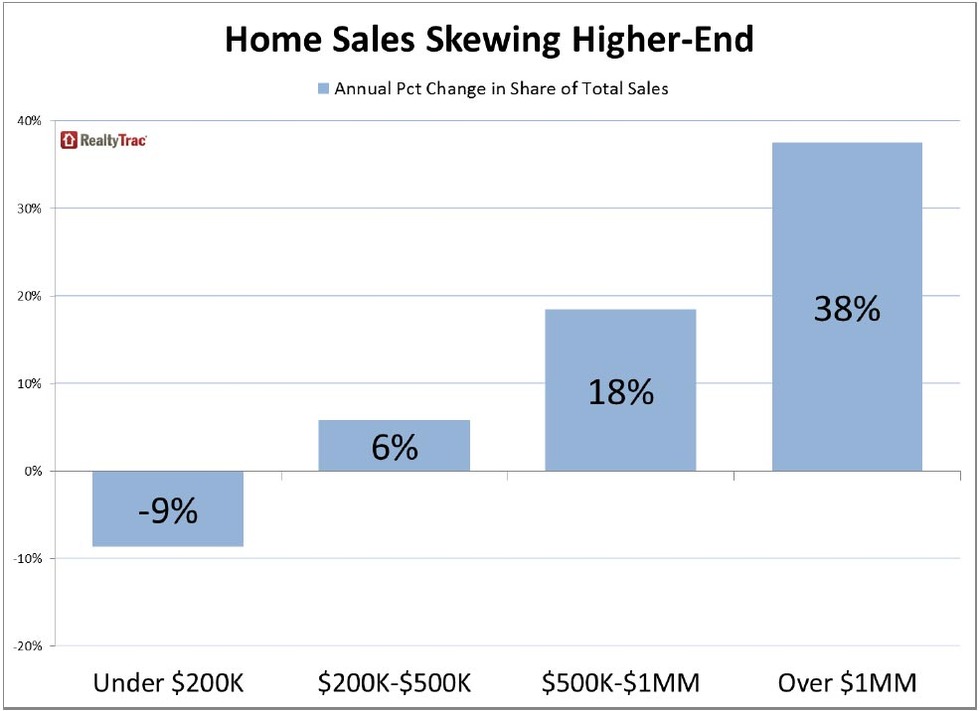

Home sales skew toward higher-end

The share of sales in the $200,000-and-below price range was down 9 percent from a year ago, while the share of sales in the above-$200,000 price range increased 10 percent from a year ago.

Breaking down the above-$200,000 price range further, the share of sales in the $500,000-to-$1 million price range increased 18 percent from a year ago while the share of sales in the over-$1 million price range increased 38 percent from a year ago. Overall the share of sales above $500,000 increased 23 percent from a year ago.

"Housing sales in Seattle continue to be very healthy across the board, but one area in particular that has shown strong growth this year is the luxury market," said OB Jacobi, president of Windermere Real Estate, covering the Seattle market. "In August, homes priced above $2 million saw a 38 percent increase in sales compared to a year ago. I attribute this to Seattle's economic boom, which is attracting an increasing number of high-paying, executive-level professionals as well as international interest from buyers who are competing for multi-million dollar homes."

Home price appreciation slows in 63 percent of markets

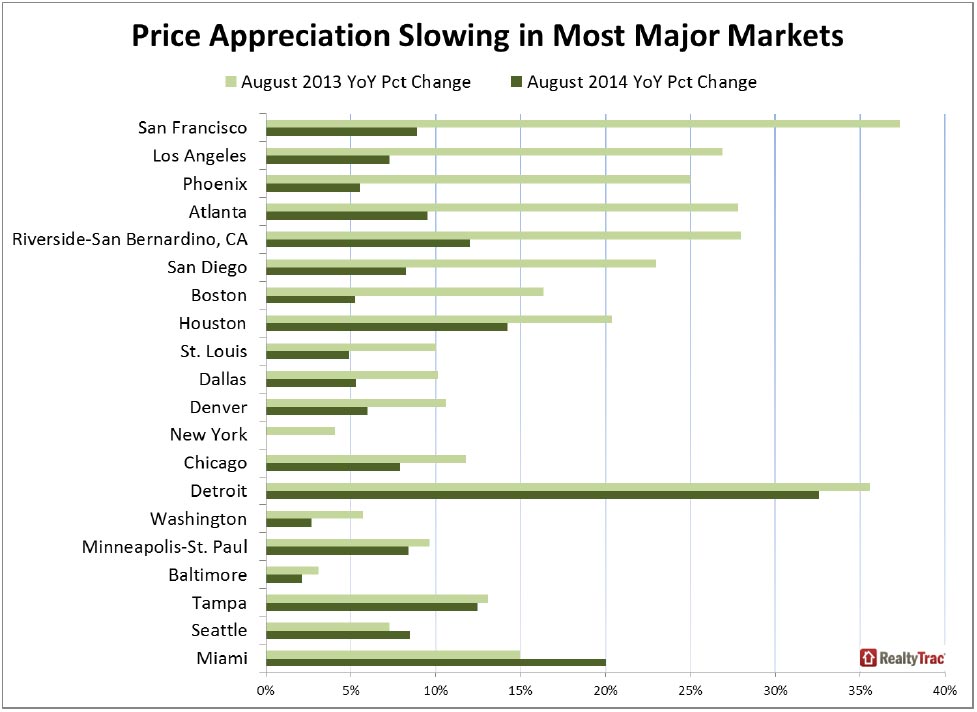

Among 197 metropolitan statistical areas with a population of 200,000 or more and with sufficient sales data, 124 (63 percent) saw lower annual home price appreciation in August 2014 compared to August 2013.

Home price appreciation slowed in 36 of the nation's 50 largest markets (72 percent) and in 18 of the nation's 20 largest markets (90 percent).

Major markets with decelerating home price appreciation in August 2014 compared to a year ago included San Francisco (9 percent annual appreciation in August compared to 37 percent a year ago); Los Angeles (7 percent annual appreciation in August compared to 27 percent a year ago); Phoenix (6 percent annual appreciation in August compared to 25 percent a year ago); Atlanta (10 percent annual appreciation in August compared to 28 percent a year ago); and Las Vegas (8 percent annual appreciation in August compared to 26 percent a year ago).

"We continue to see the traditional housing cycle this year with most of the price appreciation happening in the spring and early summer months," said Chris Pollinger, senior vice president of sales at First Team Real Estate, covering the Southern California market. "Inventory in the Southern California coastal markets has become far more balanced, giving buyers a good level of choice and a moderate amount of negotiating room."

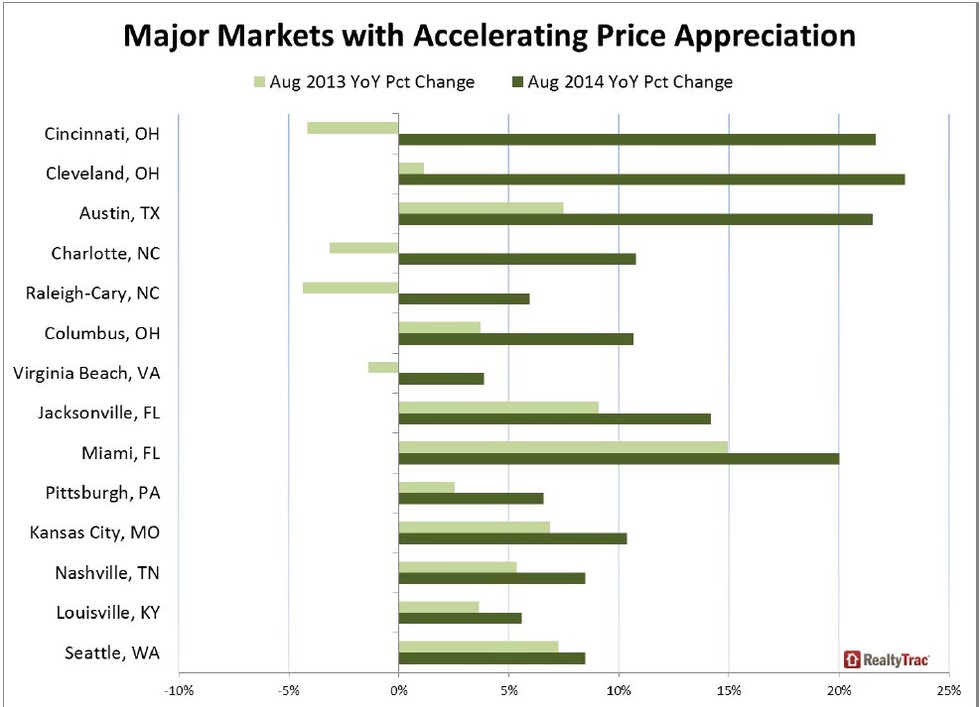

Markets with accelerating appreciation and hitting new home price peaks

Major markets where home price appreciation in August was still accelerating compared to a year ago included Cincinnati (22 percent annual appreciation in August compared to 4 percent depreciation a year ago); Cleveland (23 percent annual appreciation in August compared to 1 percent a year ago); Miami (20 percent annual appreciation in August compared to 15 percent a year ago); Pittsburgh (7 percent annual appreciation in August compared to 3 percent a year ago); and Seattle (8 percent annual appreciation in August compared to 7 percent a year ago).

Out of the 197 major markets, 22 (11 percent) reached new median home price peaks in August, including Pittsburgh, Cincinnati, Columbus, Charlotte, and Austin, Texas.

"The Ohio markets continue to experience an increase in overall pricing, but a noticeable decline in total units sold," said Michael Mahon, executive vice president/broker at HER Realtors, covering the Cincinnati, Columbus and Dayton, Ohio markets. "The declining year-over-year sales unit numbers can be attributed to the lack of available inventory, particularly within the first-time home buyer price range. As cash sales continue to decline within the Ohio markets, the available inventory is continuing to experience improvement, which shows further stability and growth of the Ohio housing stock."

Short sales and distressed sales account for 13.5 percent of all residential sales

The median price of U.S. distressed sales -- properties in the foreclosure process or bank-owned -- was $129,000 in August, up 2 percent from the previous month and up 15 percent from a year ago, but still 37 percent below the median price of non-distressed sales: $205,000.

Short sales and distressed sales (properties in some stage of foreclosure or bank-owned when sold) accounted for 13.5 percent of all U.S. residential property sales in August, up from 10.7 percent in the previous month but still down from 14.3 percent in August 2013.

Markets with the highest share of combined short sales and distressed sales in August were Modesto, Calif., (36.1 percent), Lakeland, Fla. (35.9 percent), Stockton, Calif., (33.4 percent), Las Vegas (33.2 percent), and Orlando (29.3 percent).

Short sales accounted for 4.6 percent of all sales, while bank-owned (REO) sales accounted for 7.8 percent of all sales and sales at the foreclosure auction accounted for 1.0 percent of all sales -- and the share of sales was down compared to a year ago for all three of these categories of sales.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More