The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

9.1 Million U.S. Homes Still 'Underwater', Down 26 Percent

Residential News » North America Residential News Edition | By Michael Gerrity | April 17, 2014 9:00 AM ET

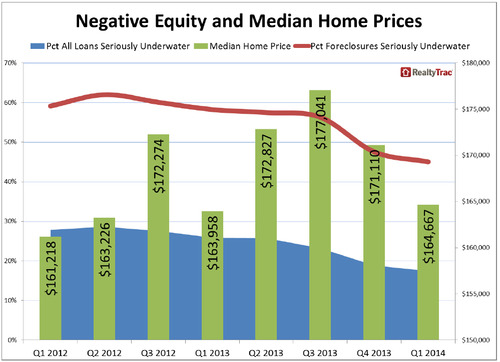

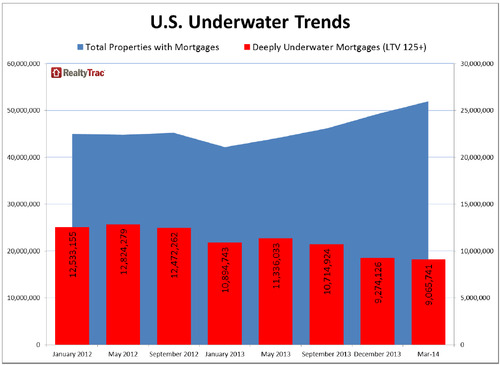

According to RealtyTrac's latest U.S. Home Equity & Underwater Report for the first quarter of 2014, 9.1 million U.S. residential properties were seriously underwater -- where the combined loan amount secured by the property is at least 25 percent higher than the property's estimated market value -- representing 17 percent of all properties with a mortgage in the first quarter.

- 17 Percent of U.S. Properties Seriously Underwater, Down From 26 Percent Year Ago

- 9.9 Million Properties With 50 Percent Equity or More, Up From 9.1 Million in Q4 2013

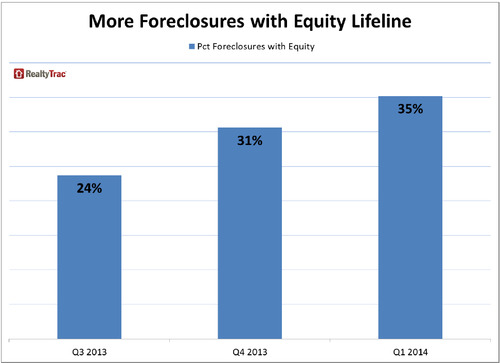

- 35 Percent of Residential Properties in Foreclosure Process With Positive Equity

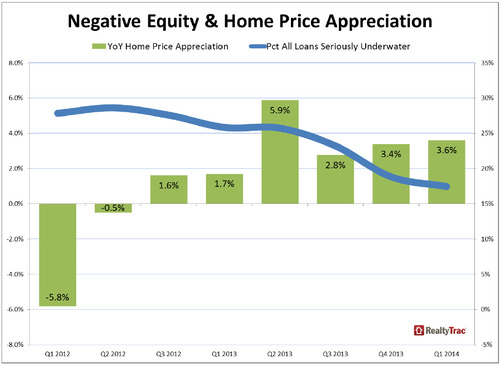

The first quarter negative equity numbers were down to the lowest level since RealtyTrac began reporting negative equity in the first quarter of 2012. In the fourth quarter of 2013, 9.3 million residential properties representing 19 percent of all properties with a mortgage were seriously underwater, and in the first quarter of 2013 10.9 million residential properties representing 26 percent of all properties with a mortgage were seriously underwater. The recent peak in negative equity was the second quarter of 2012, when 12.8 million U.S. residential properties representing 29 percent of all properties with a mortgage were seriously underwater.

The first quarter negative equity numbers were down to the lowest level since RealtyTrac began reporting negative equity in the first quarter of 2012. In the fourth quarter of 2013, 9.3 million residential properties representing 19 percent of all properties with a mortgage were seriously underwater, and in the first quarter of 2013 10.9 million residential properties representing 26 percent of all properties with a mortgage were seriously underwater. The recent peak in negative equity was the second quarter of 2012, when 12.8 million U.S. residential properties representing 29 percent of all properties with a mortgage were seriously underwater.The universe of equity-rich properties -- those with at least 50 percent equity -- grew to 9.9 million representing 19 percent of all properties with a mortgage in the first quarter, up from 9.1 million representing 18 percent of all properties with a mortgage in the fourth quarter of 2013.

RealtyTrac also reports another 8.5 million properties were on the verge of resurfacing in the first quarter, with between 10 percent negative equity and 10 percent positive equity. This segment represented 16 percent of all properties with a mortgage in the first quarter. That was compared to 8.3 million properties representing 17 percent of all properties with a mortgage in the fourth quarter of 2013.

RealtyTrac also reports another 8.5 million properties were on the verge of resurfacing in the first quarter, with between 10 percent negative equity and 10 percent positive equity. This segment represented 16 percent of all properties with a mortgage in the first quarter. That was compared to 8.3 million properties representing 17 percent of all properties with a mortgage in the fourth quarter of 2013.Fewer distressed properties had negative equity in the first quarter, with 45 percent of all properties in the foreclosure process seriously underwater -- down from 48 percent in the fourth quarter of 2013 and down from 58 percent in the first quarter of 2013. Conversely, the share of foreclosures with positive equity increased to 35 percent in the first quarter, up from 31 percent in the fourth quarter and up from 24 percent in the third quarter of 2013.

"U.S. homeowners are continuing to recover equity lost during the Great Recession, but the pace of that recovering equity slowed in the first quarter, corresponding to slowing home price appreciation," said Daren Blomquist, vice president at RealtyTrac. "Slower price appreciation means the 9 million homeowners seriously underwater could still have a long road back to positive equity.

"The relatively high percentage of foreclosures with equity is surprising to many because it would seem homeowners with equity could easily avoid foreclosure by leveraging that equity by refinancing or with an equity sale of the home," Blomquist noted. "But many distressed homeowners with equity may not realize they have equity and in some cases have vacated the property already, assuming that foreclosure is inevitable."

"Underwater properties have become an insignificant part of the housing market in Orange County," said Chris Pollinger, senior vice president of sales at First Team Real Estate, covering the Southern California market. "Out of the nearly 40,000 properties we currently have listed only about 3,000 of those are distressed or short sale properties, proving that the continual rise in home prices is relieving the housing market of underwater homeowners."

"Underwater properties have become an insignificant part of the housing market in Orange County," said Chris Pollinger, senior vice president of sales at First Team Real Estate, covering the Southern California market. "Out of the nearly 40,000 properties we currently have listed only about 3,000 of those are distressed or short sale properties, proving that the continual rise in home prices is relieving the housing market of underwater homeowners."Markets with most negative equity

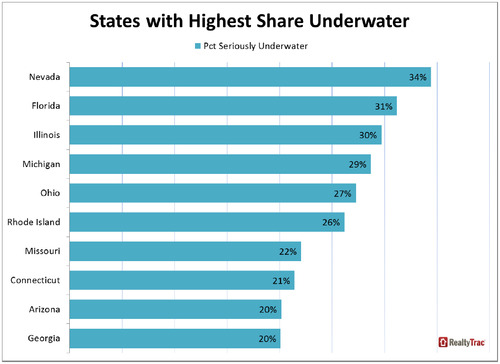

States with the highest percentage of residential properties seriously underwater in the first quarter were Nevada (34 percent), Florida (31 percent), Illinois (30 percent), Michigan (29 percent), and Ohio (27 percent).

Major metropolitan statistical areas (population 500,000 or more) with the highest percentage of residential properties seriously underwater were Las Vegas (37 percent), Lakeland, Fla., (36 percent), Palm Bay-Melbourne-Titusville, Fla., (35 percent), Cleveland (35 percent), Akron, Ohio (34 percent), and Detroit (33 percent).

Markets with most resurfacing equity

Major metro areas with the highest percentage of resurfacing equity -- between negative 10 percent and positive 10 percent -- were Louisville, Ky., (37 percent), Columbia, S.C. (28 percent), Colorado Springs, Colo., (28 percent), Little Rock, Ark., (28 percent), and Tulsa, Okla., (27 percent).

Major metro areas with the highest percentage of resurfacing equity -- between negative 10 percent and positive 10 percent -- were Louisville, Ky., (37 percent), Columbia, S.C. (28 percent), Colorado Springs, Colo., (28 percent), Little Rock, Ark., (28 percent), and Tulsa, Okla., (27 percent)."Homeowners are no longer underwater on their homes like they were at the peak of 2012," said Sheldon Detrick, CEO of Prudential Detrick/Alliance Realty, covering the Oklahoma City and Tulsa, Okla., markets. "Low housing inventory and more buyers are causing home prices to rise and sell over list price, giving homeowners who are moderately underwater a chance to avoid the foreclosure process."

Markets with most equity-rich properties

Major metro areas with the highest percentage of equity rich properties -- those with at least 50 percent equity -- were San Jose, Calif., (39 percent), Honolulu (35 percent), San Francisco (35 percent), Poughkeepsie, N.Y., (34 percent), and Los Angeles (32 percent).

Markets with most positive-equity foreclosures

Major metro areas with more than 50 percent of properties in foreclosure with equity included Denver (64 percent), Boston (58 percent), Minneapolis (58 percent), Houston (54 percent), and Washington, D.C. (52 percent).

Major metro areas with more than 50 percent of properties in foreclosure with equity included Denver (64 percent), Boston (58 percent), Minneapolis (58 percent), Houston (54 percent), and Washington, D.C. (52 percent)."Home prices continue to rise due to record-low inventory levels. Our median closing price is now up to $313,846, which is substantially higher than it was a year ago, so there is no question that there are significantly fewer people who are underwater on their homes," said Phil Shell, a managing broker at RE/MAX Alliance, covering the Denver, Colo. market.

"The short sale market really dried up about nine months ago, but we do still see some short sale transactions with higher-priced homes in the $700,000 to $800,000 plus range," added Heidi Greer, also a managing broker at RE/MAX Alliance.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More