The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

Orlando Home Prices Jump 12% in December, End 2011 in the Black

Residential News » North America Residential News Edition | By David Barley | January 16, 2012 1:16 PM ET

(ORLANDO, FL) -- According to the Orlando Regional Realtor Association (ORRA), Orlando's median home price spiked in December and was enough to nudge the 2011 cumulative year-end median 1.29 percent above that of 2010, and end the year in the black. The cumulative year-end median in 2011 was $109,900; the cumulative year-end median price in 2010 was $108,500.

The median price of homes sold in Orlando during December 2011 ($118,000) was 12.38 percent higher than the median price in December 2010 ($105,000). During 2011, Orlando's median price climbed 24.34 percent from a low of $94,900 in January to a high of $118,000 in December.

The median price of "normal" sales that closed in December 2011 was $159,900 (representing a decrease of 0.06 percent compared to December 2010). The median price for short sales in December 2011 was $105,000 (an increase of 10.53 percent compared to December 2010), and the median price for bank-owned sales in December was $80,000 (an increase of 6.67 percent compared to December 2010).

ORRA members participated in 13.86 percent less home sales in December of this year than in December of 2010: 2,125 and 2,467, respectively. At year's end, the number of sales for all of 2011 (27,703) was 3.48 less than in all of 2010 (28,701).

"I am pleased to see a year-end sales tally that is very similar to 2010, which offered the homebuyer tax credit incentives to stimulate sales," says ORRA Chairman Stephen Baker, RE/MAX Central Realty. "Buyers are taking note of Orlando's historic affordability conditions, consistent increases in prices, and dramatically declining inventory and taking action. In addition, I expect to see even more sales activity once the problem of contract failures - estimated by the National Association of REALTORS® to be as much as 33 percent nationwide - is resolved by an easing of unnecessarily restrictive lending standards."

In month-over-month comparisons, sales of foreclosed homes declined 56.29 percent in December 2011 compared to December 2010. Short sales and "normal" sales both increased (by 24.41 percent and 14.15 percent, respectively) in December 2011 compared to December 2010.

Normal sales (871) accounted for 40.99 percent of all transactions in December 2011, while short sales (785) accounted for 36.94 percent and bank-owned sales (469) made up the remaining 22.07.

Normal sales (871) accounted for 40.99 percent of all transactions in December 2011, while short sales (785) accounted for 36.94 percent and bank-owned sales (469) made up the remaining 22.07.The Orlando average interest has dropped to a new low once again. Buyers who purchased an Orlando area home in December paid an average interest rate of 3.99 percent, which is the lowest since the ORRA began tracking the statistic in January of 1995.

Homes of all types spent an average of 103 days on the market before coming under contract in December 2011, and the average home sold for 92.40 percent of its listing price. In December 2010 those numbers were 97 days and 94.45 percent, respectively.

Pendings

Pending sales - those under contract and awaiting closing - are currently at 8,095. The number of pending sales in December 2011 is 9.14 percent lower than it was in November 2011 (8,909) and 3.2 percent lower than it was December 2010 (8,363).

Short sales -- which take much longer to process from contract to close -- made up 75.26 percent of pending sales in December 2011. "Normal" properties accounted for 12.87 percent of pendings, while bank-owned properties accounted for 11.87 percent. In December 2010, short sales were 64 percent of all pendings while normal properties were 14 percent and bank-owned properties were 23 percent of the total.

Inventory

Current overall inventory is down 35.09 percent compared to December 2010, and down 3.99 percent compared to November 2011. Single-family home inventory is down 34.50 compared to December 2010, while current condo inventory is down 32.14 percent compared to December 2010.

At the current pace of sales, there is a 4.58-month supply of homes in Orlando's inventory (down from a 5.00-month supply in November 2011 and down from a 6.08-month supply in December 2010).

Affordability

The Orlando affordability index decreased three percentage points in December, to 250.44 percent, as a result of the increase in median price. (An affordability index of 99 percent means that buyers earning the state-reported median income are 1 percent short of the income necessary to purchase a median-priced home. Conversely, an affordability index that is over 100 means that median-income earners make more than is necessary to qualify for a median-priced home.)

Buyers who earn the reported median income of $54,131 can qualify to purchase one of 5,703 homes in Orange and Seminole counties currently listed in the local multiple listing service for $295,519 or less.

First-time homebuyer affordability in December decreased to 178.09 percent from last month's 180.21 percent. First-time buyers who earn the reported median income of $36,809 can qualify to purchase one of the 4,223 homes in Orange and Seminole counties currently listed in the local multiple listing service for $178,625 or less.

Condos and Town Homes/Duplexes/Villas

The sales of condos in the Orlando area (338) decreased by 35.62 percent in December when compared to December of 2010 (525).

The most (129) condos in a single price category that changed hands in December were yet again in the $1 - $50,000 price range and account for 38.17 percent of all condo sales. While low-price condos still dominate closings, the number of sold units in this price category have steadily declined from a high of 288 in January.

Orlando homebuyers purchased 211 duplexes, town homes, and villas in December 2011, which a 9.44 percent decrease compared to December 2010. Most (39) fell within the $100,000 - $120,000 price range.

MSA Numbers

Sales of existing homes within the entire Orlando MSA (Lake, Orange, Osceola, and Seminole counties) in December were down by 10.30 percent when compared to December of 2010. Throughout the MSA, 2,717 homes were sold in December 2011 compared with 3,029 in December 2010. For all of 2011, sales in the MSA are down 1.34 percent.

Each individual county's monthly sales comparisons are as follows:

Lake: 4.63 percent above December 2010 (384 homes sold in December 2011 compared to 367 in December 2010);

Orange: 14.96 percent below December 2010 (1,359 homes sold in December 2011 compared to 1,598 in December 2010);

Osceola: 12.87 percent below December 2010 (467 homes sold in December 2011 compared to 536 in December 2010); and

Seminole: 3.98 percent below December 2010 (507 sold in December 2011 compared to 528 in December 2010).

2011 Year-end Recap

- Overall sales in 2011 were down by 3.48 percent over 2010. A total of 27,703 homes were sold in 2011 compared to 28,701 the previous year.

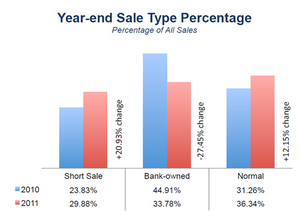

- Sales of normal homes in 2011 increased 12.15 percent over 2010. Short sales increased by 20.93 percent while bank-owned sales declined by 27.35 percent.

- The 2011 year-end year-to-date median price increased 1.29 percent to $109,900 compared 2010's $108,500.

- By year's end in 2011, 34,670 homes were sold in the Orlando MSA while 35,140 homes had been sold by year's end in 2010 (for a 1.34 percent decrease).

Each county's 2011 year-end sales comparisons are as follows:

- Lake: 3.26 percent above 2010 (4,343 homes sold in 2011 compared to 4,206 in 2010);

- Orange: 4.92 percent below 2010 (17,965 homes sold in 2011 compared to 18,894 in 2010);

- Osceola: 1.03 percent above 2010 (6,401 homes sold in 2011 compared to 6,336 in 2010);

- Seminole: 4.51 percent above 2010 (5,961 sold in 2011 compared to 5,704 in 2010).

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More