The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

Miami, London, Nairobi and Jakarta Buck Global Price Trend as Value of Prime Residential Property in World's Key Cities Dip in Q1

Residential News » North America Residential News Edition | By Michael Gerrity | May 11, 2012 1:55 PM ET

According to London-based real estate consulting firm Knight Frank, the value of prime property in the world's key cities fell by 0.4% in the first quarter of 2012. This represents the index's first quarterly fall since the depths of the global recession.

Global Markets Residential Price Index Results for Q1 2012:

- The index recorded its first quarterly fall since 2009 with prices falling on average by 0.4% in Q1 2012.

- Overall, the index rose 1.4% in the 12 months to March 2012.

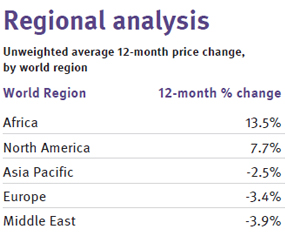

- Prime markets in North America performed strongly, prices increased by 7.7% on average in the last 12 months.

- Nairobi (up 24%) was the strongest performer in the last 12 months.

- Prices in Dubai (up 4%) rose the most in the last 3 months.

Although a milestone, the index's negative quarterly growth is not surprising. Quarterly price growth has been below 2% since Q1 2010 and it averaged only 0.6% in 2011.

The first three months of 2012 brought with it little new momentum. The Eurozone debt crisis remained at the forefront of the global economic agenda, several critical elections were on the horizon (Russia, France, Greece) and Asia's highly-effective cooling measures showed no sign of being relaxed. Against this backdrop some luxury buyers took to the side-lines to observe their market's trajectory.

Despite the overall index's sluggish performance four prime markets achieved double-digit growth over a 12-month period; Nairobi, Jakarta, Miami and London. Perhaps most surprisingly is the fact that the top five performing cities were spread across four continents - North America to be the only continent to appear twice.

Despite the overall index's sluggish performance four prime markets achieved double-digit growth over a 12-month period; Nairobi, Jakarta, Miami and London. Perhaps most surprisingly is the fact that the top five performing cities were spread across four continents - North America to be the only continent to appear twice.London and Singapore are proof that there is still a level of resilience in the prime markets with both cities shrugging off the introduction of new stamp duties in the first quarter of 2012. In London both prices and applicant numbers increased despite the stamp duty rise to 7% for individuals buying homes over £2m.

In Singapore the new 10% stamp duty for foreign buyers, which was introduced in December 2011, dented demand but not prices according to Nicholas Holt, Knight Frank's Asia-Pacific Research Director. Nicholas comments, "Prices not only held up but actually increased slightly at the very top end of the Singapore market in Q1 2012. This was not only due to fairly resilient domestic demand, but also due to wealthy Chinese, Indonesian and Indian buyers who continued to buy in this segment of the market undeterred by the surtax."

Knight Frank's view is that the overall index will remain subdued in 2012 fluctuating between marginal price falls and rises (with London, Moscow, Jakarta, Nairobi and Singapore expected to be the strongest performers) but it seems unlikely we are on the cusp of a new deflationary cycle in luxury global house prices.

The safe-haven argument still resonates. Capital flight will continue to focus on cities with low political risk, transparent legal systems, good security and ideally those with an HNWI-friendly tax regime.

"Despite the overall index's sluggish performance four prime markets achieved double digit growth over a 12-month period", said Kate Everett-Allen, head of international residential research of Knight Frank.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More