Residential Real Estate News

Sydney is Highest Appreciating Luxury Housing Market in the World

Residential News » Sydney Edition | By Michael Gerrity | July 23, 2021 9:06 AM ET

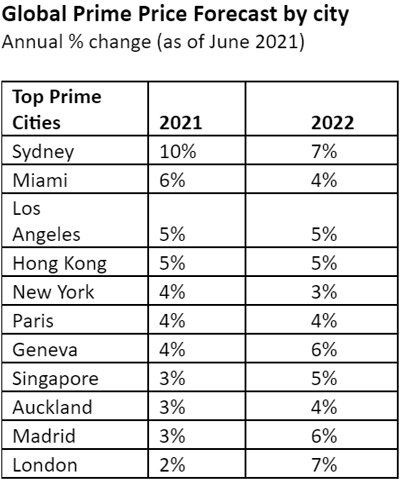

Miami, Los Angeles take second and third place for global cities with highest luxury price appreciation in 2021

According to Knight Frank's prime residential price forecast in 2021, with luxury prices in the city expected to rise 10% over the year, Sydney is leading the way. New research from Knight Frank reveals that luxury residential prices are forecast to rise faster than envisaged just six months ago.

However, in 2022, Australia's largest city will share the top spot with London, with both cities forecast to see prime prices accelerate 7% year-on-year. This rise would represent prime central London's strongest annual price performance in almost seven years.

Since the start of the pandemic Knight Frank's global research team has undertaken three prime price forecasts, with the average overall forecast tracking higher each time. Back in May 2020, Knight Frank envisaged prime prices climbing 1% on average in 2021, this changed to 3% in December 2020 and in July 2021 now sits at 4%.

Revealing what has driven the forecast, Kate Everett-Allen, head of international residential research at Knight Frank said, "Government fiscal stimulus measures have been revised upwards, protecting jobs and incomes via furlough schemes meaning there have been few forced property sales. Banks in key developed markets offered mortgage holidays to customers reducing repossessions and foreclosures. Households accrued a total of over $5 trillion globally in savings during lockdown, enabling some homeowners to undertake home improvements but others have opted to relocate, upsize, downsize or buy a second home/investment property."

Tax and lending incentives also motivated buyers. From stamp duty holidays to relaxed loan-to-value ratios many householders took advantage of lower purchase costs and/or accessed mortgage finance with smaller deposits. Construction rates slowed due to lockdowns and social distancing exacerbated the lack of new supply in several key cities putting upward pressure on prices. Changes to working patterns prompted some homeowners to rethink their lifestyles rendering the five-day commute obsolete for some industries and enabling a move to the suburbs or countryside.

The award for most improved market goes to Sydney with our 2021 forecast rising from 3% in December 2020 to 10% in July 2021, a rise of 7%. Closed borders have seen wealthy Australians purchase at home instead of abroad. The first quarter of 2021 saw 1,429 prime sales recorded, the highest quarterly figure on record for Sydney and despite recent lockdowns momentum is being maintained.

Hong Kong and New York aren't far behind Sydney with their 2021 forecasts shifting up by 5% and 4% respectively between December 2020 and June 2021.

According to Martin Wong, head of research and consultancy at Knight Frank Greater China, "Despite four waves of the virus, Hong Kong's luxury residential market has proved resilient with several transactions of note taking place in The Peak and Mid-Levels in the first half of 2021. Economic forecasts have been revised upwards, 35% of the population has now had their first vaccination and sentiment is improving with capital flows from the Chinese mainland a key driver."

The outlook is even more upbeat in New York. As Liam Bailey, Knight Frank's Global Head of Research noted, "New York is back, restaurants are crowded, flights are packed, the Yankee Stadium is at full capacity and corporate America is calling its workers back.

Much like London, the 4% price growth we envisage in 2021 will mark New York's return to positive price growth for the first time since 2018 and its strongest performance since 2015

Prime markets have arguably operated against a more challenging backdrop during the pandemic than mainstream housing markets due to their strong international bias and the stringent travel bans put in place. For some cities this means it's likely to be 2022 before the effects of looser travel arrangements starts to be felt and prime sales gain traction, but for other cities such as Miami, Auckland, Hong Kong and Geneva their domestic prime buyers are compensating for the absence of non-residents.

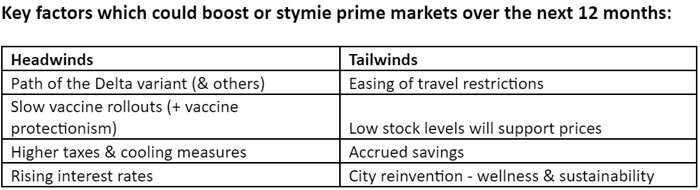

The outlook for prime residential markets will be closely tied to the ease with which cross-border transactions can start to normalize, and whilst virtual viewings and improved technology have assisted in this area, the reality is the resumption of commercial air travel will be key.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Housing Market Tilts Toward Buyers as Prices Cool

- Ultra-Luxury Home Sales Surge Globally in Late 2025 as 555 Mega-Deals Close

- U.S. Luxury Home Prices Outpaced the Broader Market in 2025

- U.S. Homeowner Equity Growth Cooled in 2025 but Remained Historically Strong

- U.S. Homebuyers Scored Biggest Price Discounts Since 2012 as Market Shifts

- Ten Key Takeaways from the U.S. Housing Market in January

- Hong Kong Stock Market Front-Runs Local Home Prices by Two Months

- Mass Exodus: U.S. Homebuyers Cancel Deals at Record Levels

- U.S. Housing Outlook for 2026 Darkens After Sharp December Pullback in Contract Signings

- America's Housing 'Silver Tsunami' Is Turning Into a Trickle

- Builders Tell Congress Government Rules Are Pricing Americans Out of Housing

- California Housing Market Poised for Balanced Growth in 2026

- U.S. Housing Market Hits Largest Buyer-Seller Imbalance on Record

- Miami Housing Market Ends 2025 on Firmer Ground

- U.S. Homebuilder Confidence Dips at Start of 2026

- Remodeling Outlook Improves as U.S. Homeowners Tap Equity

- U.S. Home Sales Hit Three-Year High in December as Rates Ease

- Las Vegas Area Home Sales Hit 18-Year Low in 2025

- U.S. Mortgage Rates Hit Three-Year Low in January

- U.S. Home Affordability Closed Out 2025 Near Record Lows

- Ireland Home Prices Uptick 5.5 Percent in 2025 Amid Supply Shortages

- One Year After Los Angeles Wildfires, Investors Snap Up Burned Lots

- Greater Palm Beach Area Home Sales Surge in Late 2025

- U.S. Homebuilder Sentiment Ends 2025 in Negative Territory

- America's Single-Family Rent Boom Loses Steam in Late 2025

- Miami Home Price Gains Extend 14-Year Run in 2025

- Why Pre-Biden Mortgages Froze the U.S. Housing Market

- From Bricks to Blockchain: How Digital Dollars Could Soon Rewire Global Real Estate

- U.S. Home Sales Slightly Uptick in November

- Greater Orlando Area Home Sales Dive 22 Percent in November

- World Property Exchange Aims to Make Real Estate Ownership Instantly Tradeable and Democratized on a Planetary Scale

- Falling Home Prices Slash U.S. Homeowner Equity by $13,400 on Average in 2025

- Home Listings in U.S. See Sharpest Drop in Two Years Amid Cooling Buyer Demand

- Dutch Investors Pour Record $4.2 Billion in New Rental Housing in 2025

- U.S. Housing Markets Poised for 2026 Rebound, NAR Says

- Las Vegas Home Prices Hit Record High in November as Inventory Swells, Sales Cool

- Investors Accounted for 30 Percent of All U.S. Home Purchases in 2025

- Canadian Home Sales Recovery Continues in October

- Global Luxury Home Price Growth Cools to 2-Year Low in September

- U.S. Housing Market Recovery to Remain Fragile in 2026