The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Middle East Capital to Invest $15 Billion in Foreign Property Markets

Commercial News » U.A.E. (Dubai) Edition | By Michael Gerrity | August 4, 2015 9:35 AM ET

According to CBRE Group, an average of $15.0 billion per year will flow out of the Middle East into direct real estate globally in the near-term, with investors from the region increasingly targeting U.S markets.

The Middle East continues to be one of the most important sources of cross-regional capital into the global real estate market, with $14.0 billion invested outside of the home region in 2014--the third largest source of capital globally. Qatar, driven by its sovereign wealth funds (SWFs), was by far the largest source of outbound capital with $4.9 billion invested. Saudi Arabia has emerged as a significant new source of capital globally, investing $2.3 billion in 2014, up from almost no reported investment in 2013.

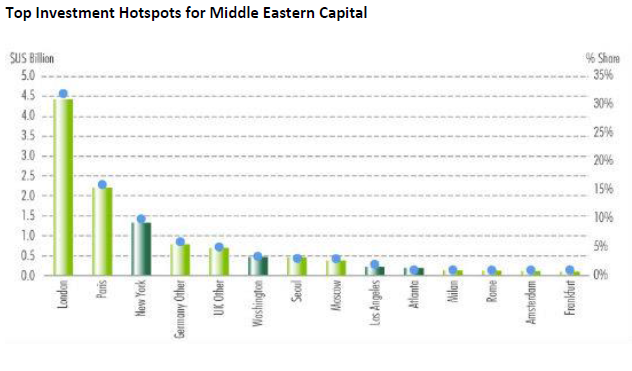

The Middle Eastern investor base has expanded, fueled by weakening oil prices; this has led to a major shift in global investment strategies towards greater geographic and sector diversification, with activity spreading across gateway markets to second-tier locations in Europe and the Americas. A greater proportion of Middle Eastern capital is now targeting the U.S.--the $5.0 billion invested globally in Q1 2015 was almost equally split between Europe and Americas, with New York, Washington, D.C., Los Angeles, and Atlanta targeted. London, while retaining the top position, is no longer as dominant, with a 32 per cent share of all Middle East outbound investment in 2014, compared to 45 per cent in 2013.

Middle Eastern investors are becoming more active across a wider range of sectors. This is clearly evident in the U.S. where, historically, these investors have bought office buildings and trophy hotels in New York, Los Angeles and other gateway markets. Competition from Chinese investors and other global capital sources means that these investors are increasingly seeking alternatives, such as Abu Dhabi Investment Authority's $725 million acquisition this year of a 14.2 million-sq.-ft. industrial portfolio.

Middle Eastern investors are becoming more active across a wider range of sectors. This is clearly evident in the U.S. where, historically, these investors have bought office buildings and trophy hotels in New York, Los Angeles and other gateway markets. Competition from Chinese investors and other global capital sources means that these investors are increasingly seeking alternatives, such as Abu Dhabi Investment Authority's $725 million acquisition this year of a 14.2 million-sq.-ft. industrial portfolio."While not back to the peak levels of the pre-global financial crisis, Middle Eastern capital flows into the U.S. continue to be strong, growing and diversifying in nature. As the big sovereigns continue to seek safe havens and long-term stable growth potential, the flow of capital from the Middle East will become even stronger. We expect a greater amount of this capital to start looking beyond the gateway markets to achieve its objectives," said Spencer Levy, Americas Head of Research, CBRE.

Private, non-institutional investors (property companies, high net worth individuals (HNWI), equity funds and any other form of private capital) have emerged as a major and increasing source of outbound capital from the Middle East. With a greater allocation to real estate and more concentration on geographical diversification away from the home region, the potential for non-institutional investors to expand their global real estate investments is of growing importance. Weaker oil prices are a strong contributing factor to this, triggering and accelerating global deployment of capital, with value-add investments in high demand. CBRE forecasts that global real estate investment by non-institutional capital from the Middle East will range from $6.0 to $7.0 billion per annum in the near-term, if not higher, increasing from approximately $5.0 billion per year during 2010 to 2013.

"Private capital from the Middle East is once again becoming a measurably more important investor group globally. The most immediate change will bring down the average lot size, as non-institutional investors tend to target assets at circa $50.0 million. This extends naturally to a more diverse investment strategy--a trend already felt in the market so far in 2015 and is expected to become more pronounced in the next six to 18 months. In particular, we expect the Americas region to see more capital flows from the Middle East, with Europe less dominant than it has been over the last five years," said Chris Ludeman, Global President, CBRE Capital Markets.

In addition to private capital, SWFs from the Middle East are also expected to remain important market-makers, albeit not as strong in their acquisition strategies as they would have been if oil prices had not fallen. It is very unlikely that regional governments will make radical decisions to affect the existing capital allocations, with only new allocations likely to be affected. CBRE expects $7.0 to $9.0 billion per annum of Middle Eastern SWF investment to flow into direct global real estate in the near- to mid-term, compared to what would have otherwise been in the range of $9.0 to $11.0 billion per annum had oil prices remained at levels above $100 per barrel.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More