Residential Real Estate News

Hong Kong's Residential Property Market Faces More Challenges in 2024

Residential News » Hong Kong Edition | By Michael Gerrity | December 13, 2023 9:59 AM ET

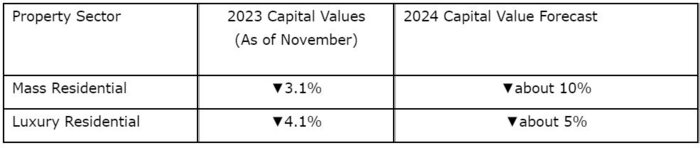

According to global property consultant JLL, Hong Kong's residential market turned more sluggish in the second half of 2023 as buyers are cautious amid rising interest rates and the challenging external environment. Mass residential saw a decline of 3.1% in capital values as of November 2023, bringing them back to the price level of March 2017.

Prices of luxury residential fell 4.1% during the same period. However, luxury residential rents rebounded by 4.9%, as there was sustained demand from potential buyers switching to the leasing market and the inflow of talents and non-local families.

Total residential sales remained low, with the average monthly transaction volume in the first 10 months of the year being 25% below the previous four-year average.

Joseph Tsang, Chairman of JLL in Hong Kong said, "The policy relaxation had no impact on the housing market. Developers started offering double-digit price discounts to clear inventory more aggressively than before. The underperformance of the stock market has had a lagged effect on the housing market. Although consensus anticipates rate cuts starting in mid-2024, local banks may not immediately align due to tight liquidity and currently higher deposit rates compared to mortgage rates. Furthermore, even with potential decreases in mortgage rates next year, it is mistaken to presume that this will automatically lead to a rebound in prices. We believe the housing prices will continue to fall, with mass residential prices expected to decline by a further of about 10% in 2024, reaching levels last seen in 2016."

Tsang believes home prices are unlikely to experience a significant rebound due to the government plans to build 39,100 subsidized sale flats in the next five years, which will dampen demand in the private housing market. Buying demand from mainland Chinese will be limited and primarily focused on the luxury market.

Without support for the downward momentum, negative equities are expected to increase to about 30,000 cases if home prices drop 10% further next year.

"The weakening property market will negatively impact the city's economic growth and consumer spending. It will also depress the government's land revenue, which is a major source of income," Tsang added. "The government should revise the housing policies to support the residential market."

Tsang suggested the followings:

1. Remove all cooling measures.

2. Provide interest-free loans to assist the young generation of first-time buyers in getting on the property ladder.

3. Prioritize public rental housing and set a clear distinction between private and public housing markets.

4. Speed up infrastructure developments in existing residential clusters, especially in Kai Tak.

Hong Kong Residential Indicator - % Change

Hong Kong Land Market

As of November, only 14.2% of the current fiscal year land premium revenue target was achieved and six government land sites were withdrawn from tender. With only one quarter left in the fiscal year, it is unlikely that the land sale revenue will reach the estimated target of HKD 85 billion.

High interest rates and weak home sales are causing developers to be conservative in tender, which could lead to more withdrawals in the coming months. Such frequent withdrawal of government land tender will significantly reduce land revenue, funding for future infrastructure developments, and market sentiments.

For lease modification and land exchanges, developers are increasingly opting for the traditional land premium application scheme instead of Standard Rates. This shift is driven by the sharp fall in land prices. For example, a developer paid at least 39% less by utilising the traditional scheme for the redevelopment of a cold storage in Yau Tong into a residential project, compared to the Standard Rate.

The growing disparity between market prices and Standard Rates will diminish the effectiveness of Standard Rates in expediting the land premium procedure, further slowing down urban renewal and new area development.

Alkan Au, Senior Director of Value and Risk Advisory at JLL commented, "Therefore, it is time for the government to review land policies to alleviate the current stalemate and at least improve the probability of continuing the land sale to keep the city's development moving."

He suggested the following:

- Review Standard Rates more frequently, ideally every six months.

- Resume government land sales by application list to increase the likelihood of successful land sales and avoid damaging knock-on effects on the market.

- Prioritize projects with stronger interests from developers and slow down less time-pressing mega projects such as Kau Yi Chau Artificial Island, given the decline in land revenue and limited funding for future infrastructure projects.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Housing Market Tilts Toward Buyers as Prices Cool

- Ultra-Luxury Home Sales Surge Globally in Late 2025 as 555 Mega-Deals Close

- U.S. Luxury Home Prices Outpaced the Broader Market in 2025

- U.S. Homeowner Equity Growth Cooled in 2025 but Remained Historically Strong

- U.S. Homebuyers Scored Biggest Price Discounts Since 2012 as Market Shifts

- Ten Key Takeaways from the U.S. Housing Market in January

- Hong Kong Stock Market Front-Runs Local Home Prices by Two Months

- Mass Exodus: U.S. Homebuyers Cancel Deals at Record Levels

- U.S. Housing Outlook for 2026 Darkens After Sharp December Pullback in Contract Signings

- America's Housing 'Silver Tsunami' Is Turning Into a Trickle

- Builders Tell Congress Government Rules Are Pricing Americans Out of Housing

- California Housing Market Poised for Balanced Growth in 2026

- U.S. Housing Market Hits Largest Buyer-Seller Imbalance on Record

- Miami Housing Market Ends 2025 on Firmer Ground

- U.S. Homebuilder Confidence Dips at Start of 2026

- Remodeling Outlook Improves as U.S. Homeowners Tap Equity

- U.S. Home Sales Hit Three-Year High in December as Rates Ease

- Las Vegas Area Home Sales Hit 18-Year Low in 2025

- U.S. Mortgage Rates Hit Three-Year Low in January

- U.S. Home Affordability Closed Out 2025 Near Record Lows

- Ireland Home Prices Uptick 5.5 Percent in 2025 Amid Supply Shortages

- One Year After Los Angeles Wildfires, Investors Snap Up Burned Lots

- Greater Palm Beach Area Home Sales Surge in Late 2025

- U.S. Homebuilder Sentiment Ends 2025 in Negative Territory

- America's Single-Family Rent Boom Loses Steam in Late 2025

- Miami Home Price Gains Extend 14-Year Run in 2025

- Why Pre-Biden Mortgages Froze the U.S. Housing Market

- From Bricks to Blockchain: How Digital Dollars Could Soon Rewire Global Real Estate

- U.S. Home Sales Slightly Uptick in November

- Greater Orlando Area Home Sales Dive 22 Percent in November

- World Property Exchange Aims to Make Real Estate Ownership Instantly Tradeable and Democratized on a Planetary Scale

- Falling Home Prices Slash U.S. Homeowner Equity by $13,400 on Average in 2025

- Home Listings in U.S. See Sharpest Drop in Two Years Amid Cooling Buyer Demand

- Dutch Investors Pour Record $4.2 Billion in New Rental Housing in 2025

- U.S. Housing Markets Poised for 2026 Rebound, NAR Says

- Las Vegas Home Prices Hit Record High in November as Inventory Swells, Sales Cool

- Investors Accounted for 30 Percent of All U.S. Home Purchases in 2025

- Canadian Home Sales Recovery Continues in October

- Global Luxury Home Price Growth Cools to 2-Year Low in September

- U.S. Housing Market Recovery to Remain Fragile in 2026