Commercial Real Estate News

Hong Kong Class A Office Leasing Volume Upticked in Q1

Commercial News » Hong Kong Edition | By WPJ Staff | April 28, 2021 9:14 AM ET

Central Hong Kong office vacancy rate improved marginally as market shows signs of stabilization

According to JLL's latest Hong Kong Property Market Monitor report, Hong Kong's leasing volume in the Grade-A office market improved in the first quarter of 2021 as occupiers started to resume making real estate decisions.

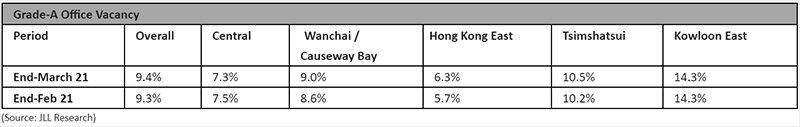

Central's Grade-A office rents have dropped 29.7% from the market peak at the beginning of June 2019 to a more attractive level, there was a positive net take up of office space (40,400 sq. ft) in the submarket during the month. Central vacancy decreased slightly from 7.5% to 7.3% as of the end of March. A notable leasing deal was rating agency S&P Global committing to office space at Three Exchange Square in Central, relocating from International Commerce Centre in West Kowloon.

Alex Barnes, Head of Office Leasing Advisory at JLL in Hong Kong says, "Office leasing demand will improve in the coming quarters as occupiers continue to execute real estate decisions that were heavily muted in 2020. Workplace upgrades and a flight to quality will continue to be a key theme of this demand."

"We expect the downward pressure in the office market to remain this year, but the overall fall in rental will be moderate in the second half of 2021. In March, the overall Grade-A office rents declined by 0.5% m-o-m. Among major office submarkets, Kowloon East experienced the biggest rental drop, whereas rents in Central were relatively stable," commented Nelson Wong, Head of Research at JLL in Greater China.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3