Commercial Real Estate News

Hong Kong's Office Market Still Impacted by Coronavirus Fears as Rents Slip in January

Commercial News » Hong Kong Edition | By Michael Gerrity | February 24, 2021 8:45 AM ET

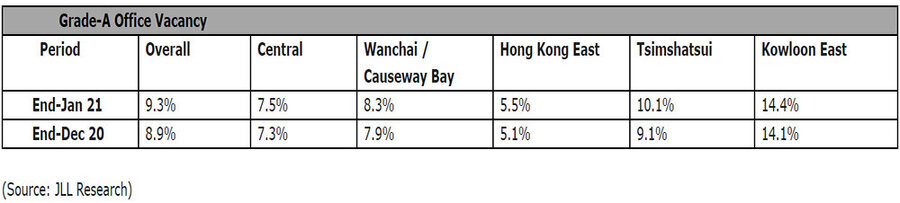

According to JLL's latest Hong Kong Property Market Monitor released today, the decline of office rents has slowly abated in January 2021, with net effective rents in the overall market dipping by 0.6%.

The rental fall was moderate, compared with the overall drop in Grade-A office rents of 1.1% m-o-m in December last year. Office rents in core business districts, Central and Tsimshatsui, were relatively stable last month. However, Wanchai/Causeway Bay experienced the most significant rental contraction and fell 1.4% month-over-month.

Central's vacancy rate continued to increase, reaching 7.5% as of the end of January. Tenant decentralization remained an ongoing trend as corporate tenants looked to cut rental expenses in the midst of recession and relocate to more cost-effective office locations.

Alex Barnes, Head of Office Leasing Advisory at JLL in Hong Kong reports, "The Grade-A office market recorded an overall net withdrawal of 366,200 sq. ft in January as downsizing among occupiers remained in view. We believe Hong Kong will rebound quicker than most comparable markets because of its importance to the Mainland China market. Although the total number of regional headquarters in Hong Kong decreased by 2.4% in 2020, companies from the U.S., Mainland China and Italy rose 1.4%, 10.2% and 15% respectively. More Mainland China firms set up a regional office in Hong Kong in 2020 compared to 2019. Hong Kong's office leasing market will benefit from this in the long term,"

In the retail market, Nelson Wong, Head of Research at JLL in Greater China also commented, "In view of the weak market conditions, street shop landlords are increasingly willing to soften asking rentals and be flexible on leasing terms. Consequently, some retailers took advantage of the tenant-favorable terms to open and expand."

China Construction Bank (Asia) has reportedly relocated to and expanded in Circle Plaza in Causeway Bay, committing to a four-story shop size of 8,024 sq. ft. The bank is currently renting a 4,098 sq. ft shop at Causeway Bay Phase 1 at the same consideration.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3