The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Hong Kong Office, Retail Sectors Post Mixed Results in Early 2016

Commercial News » Hong Kong Edition | By Michael Gerrity | April 15, 2016 10:00 AM ET

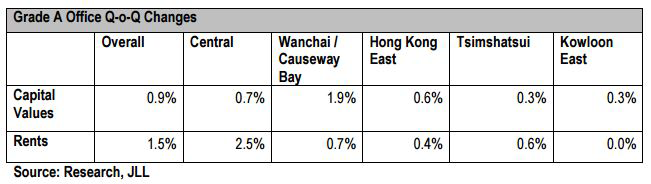

According to global real estate consultant JLL, Grade A rents in Hong Kong's office market grew by 1.5% quarter-over-quarter in Q1 of 2016, led by rising rents in the Central District, which grew 2.5% on the quarter-- one of the only two submarkets (the other one was Tsimshatsui) to see growth accelerate over the previous quarter.

Office leasing activity outside of Central remained subdued, reflecting the tight vacancy environment and the Chinese New Year holidays. Still the market continued to record steady growth from the banking and finance and insurance sectors with PRC corporates continuing to set rental benchmarks. In one of the largest leasing transactions in Central during the quarter, the Hong Kong Stock Exchange leased four floors at One Exchange Square to facilitate the consolidation of their offices.

The realization of pre-committed leasing space at the West Tower of One Harbour Gate in Hunghom contributed to the net take-up for the overall market to reach 278,400 sq. ft. in 1Q16.

PRC corporates also continued to show strong interest in the office investment market. Following on the heels of purchases made by Evergrande Group and China Life at the end of last year, China Everbright acquired Dah Sing Financial Centre in Wanchai for HKD 10 billion (HKD 24,993 per sq. ft.). PRC buyers have now been involved in three of the four largest en-bloc office building transactions on record.

Alex Barnes, Head of Hong Kong Markets at JLL tells World Property Journal, "Given that developers continue to capitalize on the recovery of office rentals in core areas where the overall vacancy is extremely low, we expect rents of overall Grade A offices to climb towards 5% in 2016, with sustained demand coming from PRC companies seeking office space in landmark buildings."

Hong Kong's Retail Sector Still Facing Economic Challenges

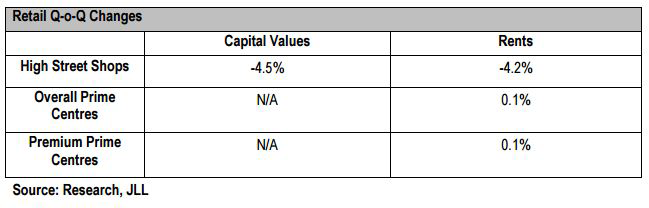

Hong Kong's Retail Sector Still Facing Economic ChallengesIn the retail property market, leasing activity was largely dominated by lease renewals as more street shop landlords cratered to retailer demands in rental negotiations. F&B, services industry, lifestyle retailers and retailers focus on local consumers continued to be the most active players in the leasing market though some jewelry and fashion retailers have more recently expressed a desire to terminate leases early in the wake of flagging retail sales.

Rents of high street shops dropped 4.2% quarter-over-quarter in 1Q16, compared with a fall of 5.1% quarter-over-quarter in 4Q15. Though rents of prime shopping centers edged up 0.1% quarter-over-quarter, performance amongst individual centers continued to be mixed with some landlords turning more accommodative.

Terence Chan, Head of Retail at JLL Hong Kong also commented, "Mid-priced overseas retailers are still very much interested in expanding in Hong Kong. However, they are looking for the shops in shopping centers. High street shop rents are still under downward pressure, particularly in Causeway Bay where vacancy on prime shopping strips such as Yun Ping Road remains stubbornly high. But with landlords now more willing to meet retailer demands in lease negotiations, we may see vacancy and retail rents stabilize in the coming months. Still, we expect high street shop rents to drop 10-15% this year."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More