The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Hong Kong Office Rent Slide Slows in August, New Lettings Uptick

Commercial News » Hong Kong Edition | By Michael Gerrity | September 25, 2020 9:00 AM ET

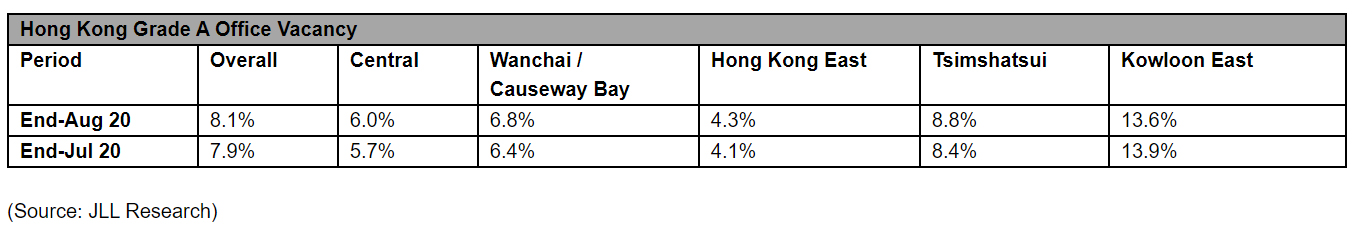

According to JLL's latest Property Market Monitor report released this week, Hong Kong's overall Grade A office rental market is declining at a more moderate level in August 2020, as the COVID-19 pandemic's third wave recedes.

Momentum in new lettings also picked up modestly, with an increase of 10% month-on-month in August. Net take-up improved, albeit still in negative territory, amounting to -147,500 square feet, the least negative figure so far in 2020. Outward movement from Central continued as tenants remained firmly in cost-saving mode. Among the more notable transactions, Hong Kong Mortgage Corporation reportedly leased 73,000 sq. ft (gross floor area or GFA) at Two Harbour Square in Kwun Tong to relocate out of Central.

Alex Barnes, Head of Markets at JLL in Hong Kong says, "Rental decline in August was relatively modest compared to the first half of 2020. Overall office rents dropped 1.7% month-on-month last month, while on average, office rents fell more than 2% per month in the first six months. More businesses are actively in the market looking at their real estate needs in the second half of the year, albeit cost saving remains a key consideration. The reduction in rent has encouraged some isolated upgrading activity in Central, and is likely to continue to do so towards the end of 2020 and in 2021."

Alex Barnes, Head of Markets at JLL in Hong Kong says, "Rental decline in August was relatively modest compared to the first half of 2020. Overall office rents dropped 1.7% month-on-month last month, while on average, office rents fell more than 2% per month in the first six months. More businesses are actively in the market looking at their real estate needs in the second half of the year, albeit cost saving remains a key consideration. The reduction in rent has encouraged some isolated upgrading activity in Central, and is likely to continue to do so towards the end of 2020 and in 2021."

In August, the greatest rental drop was recorded in Central at -2.5% month-on-month as the vacancy rate rose to 6%, the first time since December 2005. New lettings were limited, with some transactions coming from cost-saving tenants relocating to incentivized options within the submarket. Surrender space in the submarket continued to increase, amounting to about 520,000 sq. ft NFA (2.2% of the Grade A office stock), breaching 500,000 sq. ft mark for the first time since October 2002.

In retail market, Nelson Wong, Head of Research at JLL in Greater China also commented, "The leasing market was generally slow, with rental value of high street shops under pressure with hiking vacancy in prime locations."

In retail market, Nelson Wong, Head of Research at JLL in Greater China also commented, "The leasing market was generally slow, with rental value of high street shops under pressure with hiking vacancy in prime locations."

According to market sources, Bauhaus leased two connected street shop units (1,266 sq. ft) at Sun Kong House in Mongkok with a monthly rent of HKD 260,000, paying 68% less than the previous tenant, Nature Republic.

Momentum in new lettings also picked up modestly, with an increase of 10% month-on-month in August. Net take-up improved, albeit still in negative territory, amounting to -147,500 square feet, the least negative figure so far in 2020. Outward movement from Central continued as tenants remained firmly in cost-saving mode. Among the more notable transactions, Hong Kong Mortgage Corporation reportedly leased 73,000 sq. ft (gross floor area or GFA) at Two Harbour Square in Kwun Tong to relocate out of Central.

Alex Barnes

In August, the greatest rental drop was recorded in Central at -2.5% month-on-month as the vacancy rate rose to 6%, the first time since December 2005. New lettings were limited, with some transactions coming from cost-saving tenants relocating to incentivized options within the submarket. Surrender space in the submarket continued to increase, amounting to about 520,000 sq. ft NFA (2.2% of the Grade A office stock), breaching 500,000 sq. ft mark for the first time since October 2002.

Nelson Wong

According to market sources, Bauhaus leased two connected street shop units (1,266 sq. ft) at Sun Kong House in Mongkok with a monthly rent of HKD 260,000, paying 68% less than the previous tenant, Nature Republic.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More