The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

India's Office Market Rebounding in Q3 from COVID-19 Downturn

Commercial News » Mumbai Edition | By Michael Gerrity | October 6, 2020 9:00 AM ET

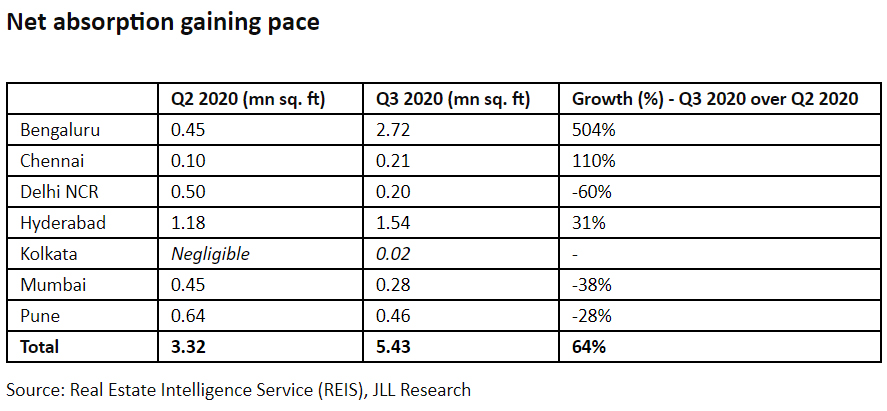

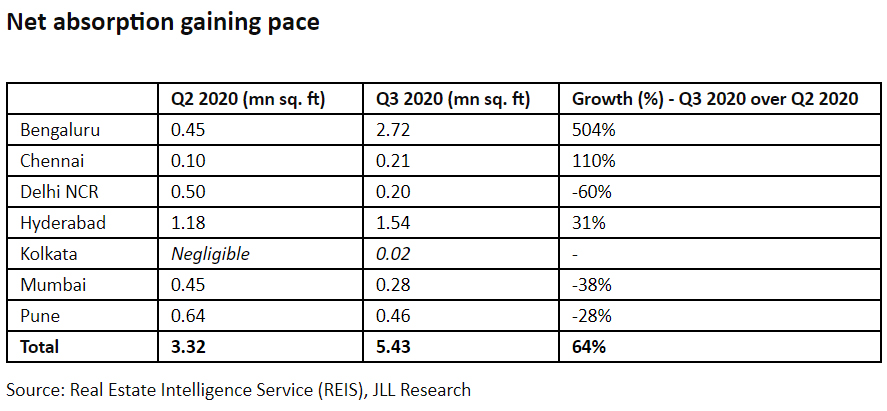

According to new data by JLL Research, India's office market witnessed a net absorption of 5.4 million sq. ft in quarter ending September 2020 (Q3), an increase of 64% versus quarter ending June 2020 (Q2). This is an encouraging trend especially after net absorption dipped almost at a similar rate in the second quarter.

The third quarter office rebound growth was led by Bengaluru and Hyderabad, which together accounted for nearly 80% of the net absorption in Q3 2020. The heightened activity in Bengaluru indicates a gradual resurgence in take up of spaces coupled with the translation of pent up demand from Q2 this year.

"While we continue to see the impact of the pandemic on various businesses, there is a significant surge in activity across most office markets under consideration. This is seen in gross leasing which more than doubled from the previous quarter at 13.8 million sq. ft. At the same time, it is important to note that large and mid-sized occupiers across major markets continue to review their real estate portfolios in a bid to optimize cost, higher emphasis is being given on sustainability and employee well-being as well as adoption of flexible working practices." said Ramesh Nair, CEO and Country Head, India, JLL.

While the share of IT/ITeS occupiers in gross leasing dipped to 43% in Q3 2020 from 61% in Q2 2020, e-commerce and manufacturing sectors gained significant shares during the third quarter forming 16% (negligible in Q2 2020) and 17% (5% in Q2 2020) respectively, owing to surging demand of e-commerce during COVID19.

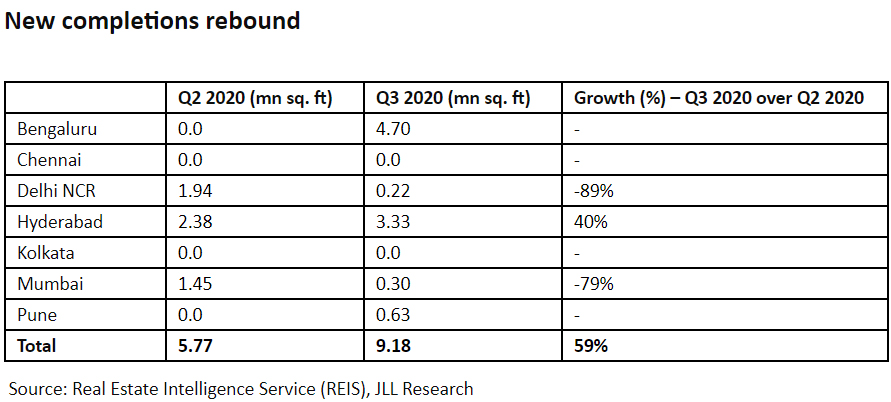

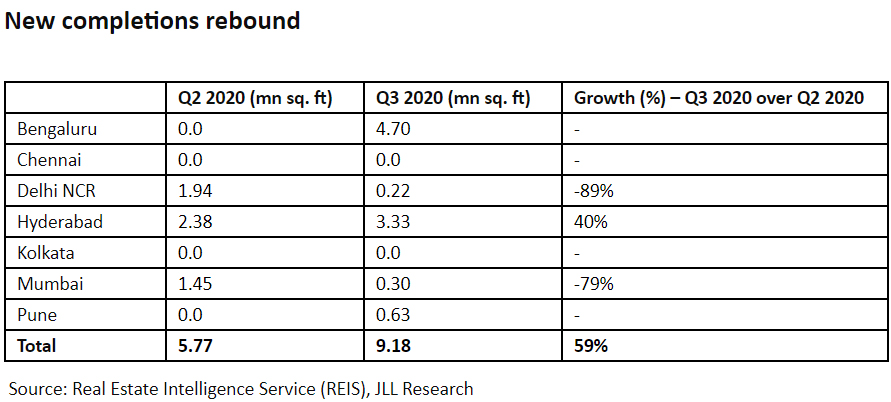

Confidence in new completions

New completions during Q3 2020 increased by 59% quarter-on-quarter with 9.2 million sq. ft of new stock coming to market. "With lockdown restrictions being relaxed in the third quarter in most of the markets under review, office projects in the final stages of construction or pending receipt of occupancy certificates came onboard. This resulted in an increase in the supply of office space, even surpassing 8.6 million sq. ft witnessed in Q1 2020," said Dr. Samantak Das, Chief Economist and Head of Research & REIS, India, JLL.

In sync with net absorption, Bengaluru and Hyderabad led the increase in new completions accounting for 87% of the total new completions in Q3 2020. Notably, new completions in both these markets even went past the average new completion levels witnessed in the four quarters of 2019.

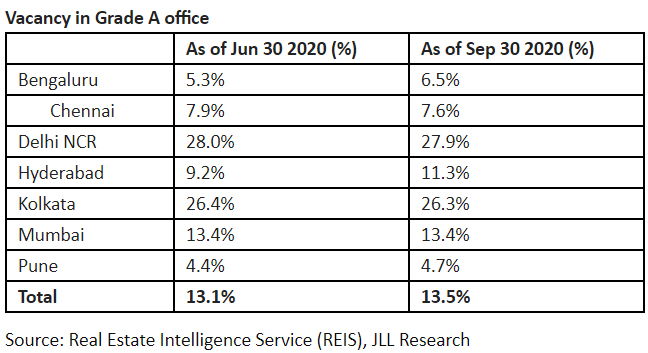

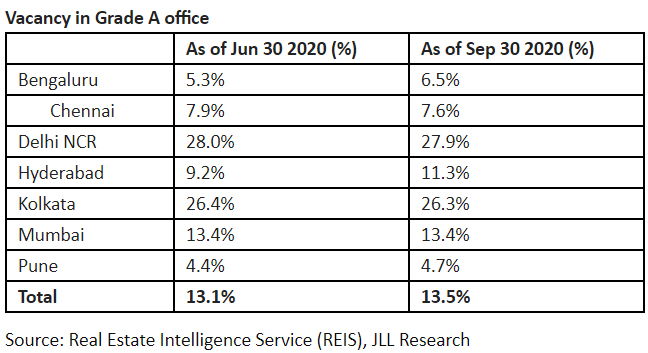

Vacancies go up in Grade A offices

Increased office space consolidation and optimization strategies of corporate occupiers resulted in subdued net absorption levels, which could not keep pace with new completions. This resulted in overall vacancy increasing from 13.1% in Q2 2020 to 13.5% in Q3 2020. Despite the rise in vacancy levels in southern markets, Bengaluru, Chennai and Pune continued to hover in single digits. This augurs well for a strong rebound in these markets when economic and business conditions improve in the coming quarters.

Rentals across markets remain stable

Except for Bengaluru, which witnessed a marginal increase in rents, office rents in Q3 2020 vs. Q2 2020 remained stable across all markets under review. With stable rental values and low vacancy levels, the office market in India continues to be landlord favorable. However, it is important to note that landlords across markets have become more flexible in providing increased rent-free periods, reduced rental escalation and fully furnished deals to prominent occupiers, which reduces their net outgo.

The third quarter office rebound growth was led by Bengaluru and Hyderabad, which together accounted for nearly 80% of the net absorption in Q3 2020. The heightened activity in Bengaluru indicates a gradual resurgence in take up of spaces coupled with the translation of pent up demand from Q2 this year.

"While we continue to see the impact of the pandemic on various businesses, there is a significant surge in activity across most office markets under consideration. This is seen in gross leasing which more than doubled from the previous quarter at 13.8 million sq. ft. At the same time, it is important to note that large and mid-sized occupiers across major markets continue to review their real estate portfolios in a bid to optimize cost, higher emphasis is being given on sustainability and employee well-being as well as adoption of flexible working practices." said Ramesh Nair, CEO and Country Head, India, JLL.

While the share of IT/ITeS occupiers in gross leasing dipped to 43% in Q3 2020 from 61% in Q2 2020, e-commerce and manufacturing sectors gained significant shares during the third quarter forming 16% (negligible in Q2 2020) and 17% (5% in Q2 2020) respectively, owing to surging demand of e-commerce during COVID19.

Confidence in new completions

New completions during Q3 2020 increased by 59% quarter-on-quarter with 9.2 million sq. ft of new stock coming to market. "With lockdown restrictions being relaxed in the third quarter in most of the markets under review, office projects in the final stages of construction or pending receipt of occupancy certificates came onboard. This resulted in an increase in the supply of office space, even surpassing 8.6 million sq. ft witnessed in Q1 2020," said Dr. Samantak Das, Chief Economist and Head of Research & REIS, India, JLL.

In sync with net absorption, Bengaluru and Hyderabad led the increase in new completions accounting for 87% of the total new completions in Q3 2020. Notably, new completions in both these markets even went past the average new completion levels witnessed in the four quarters of 2019.

Vacancies go up in Grade A offices

Increased office space consolidation and optimization strategies of corporate occupiers resulted in subdued net absorption levels, which could not keep pace with new completions. This resulted in overall vacancy increasing from 13.1% in Q2 2020 to 13.5% in Q3 2020. Despite the rise in vacancy levels in southern markets, Bengaluru, Chennai and Pune continued to hover in single digits. This augurs well for a strong rebound in these markets when economic and business conditions improve in the coming quarters.

Rentals across markets remain stable

Except for Bengaluru, which witnessed a marginal increase in rents, office rents in Q3 2020 vs. Q2 2020 remained stable across all markets under review. With stable rental values and low vacancy levels, the office market in India continues to be landlord favorable. However, it is important to note that landlords across markets have become more flexible in providing increased rent-free periods, reduced rental escalation and fully furnished deals to prominent occupiers, which reduces their net outgo.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More