The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Pre-Brexit, Ireland Enjoyed Strong Commercial Investment Activity in Q2

Commercial News » Dublin Edition | By Michael Gerrity | July 11, 2016 8:01 AM ET

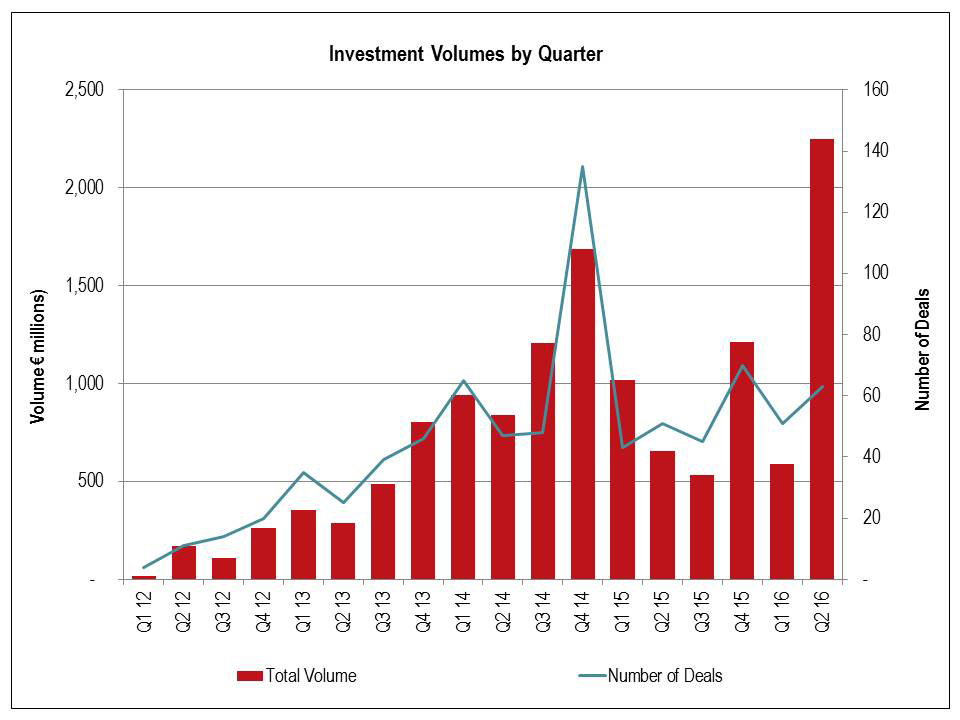

According to global real estate consultant JLL, â¬2.3 billion ($2.54b USD) of commercial property has traded in last 3 months in Ireland. Year-to-date total volumes now stand at â¬2.9 billion ($3.2b USD).

Ireland's Q2, 2016 investment volumes were boosted by 4 large deals greater than â¬80 million, which accounted for 60% of this total. This included the sale of Blanchardstown Town Centre, which comprised Blanchardstown shopping centre, 2 retail parks and office space. Green Property sold the Centre and it was purchased by Blackstone for â¬950 million. The other significant sales were One Spencer Dock (Dublin 1 office), which was purchased by a Middle Eastern fund for over â¬240 million, Project Kells (Dublin office portfolio) purchased by Meyer Bergman and BCP from Aviva for â¬93 million, and LXV, St Stephens Green (Dublin 2 office), which was purchased by CNP Insurance for â¬85 million.

Hannah Dwyer, Associate Director and Head of Research at JLL said that "Q2 has exceeded expectations in terms of investment market activity, with a few large transactions boosting totals for the quarter. â¬2.3 billion of investment deals have traded in the last 3 months, which is more than 3 times the volume that traded in the same quarter last year (â¬660 million). At the mid-point in the year, this is already close to the year-end figure for 2015 which was â¬3.4 billion. A notable feature of this volume is that the number of transactions is down but their value is up".

Hannah added, "It is difficult to gauge where investment volumes will end up at this point in the year. Ireland is well-positioned from an occupier and investor perspective to benefit from some of the post-Brexit uncertainty, and we are expecting to see a positive short-term bounce in demand from these sectors. However, we cannot ignore that we are entering a very sensitive period for global markets, and Ireland's close links to the UK is of concern from an economic perspective. It is too early to predict how Brexit will unfold and its longer-term impact on the Irish economy".

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More