Commercial Real Estate News

Commercial Property Investment in Japan to Weaken in 2024

Commercial News » Tokyo Edition | By Michael Gerrity | January 12, 2024 9:52 AM ET

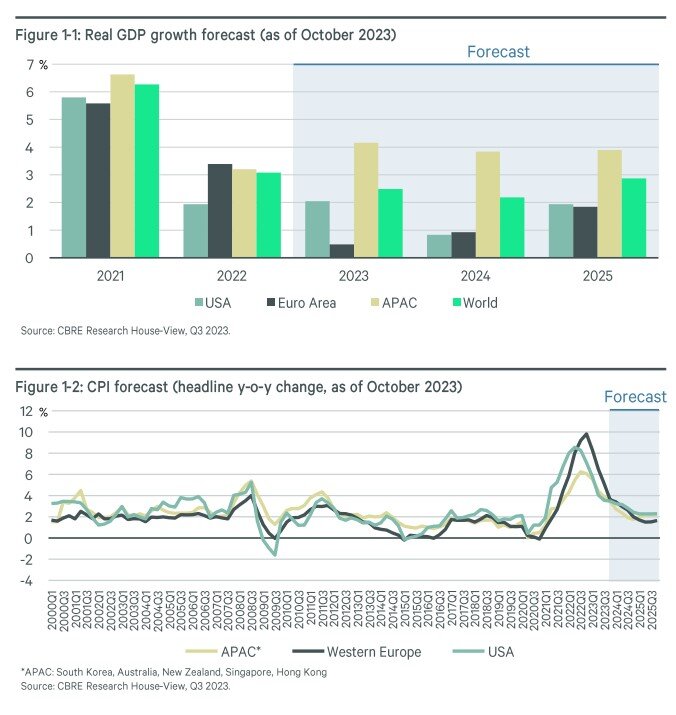

According to new data from CBRE, consensus forecasts expect the Japanese economy to continue to see moderate growth of around 1% per annum in 2024 and beyond. Capital expenditure is projected to increase on the back of generally strong corporate earnings. The semiconductor and automotive industries are expected to underpin exports, while inbound tourist spending is set to grow further, propelled by the return of Chinese visitors. However, domestic consumption may shrink as consumers tighten purse strings in response to falling real wages.

The Bank of Japan has indicated that it will closely monitor wage growth to see whether it will keep pace with inflation, with the results of the spring labor negotiations ("Shunto") set to inform the BoJ's policy decisions in 2024.

Commercial Property Investment

Thanks to robust spending by domestic investors, Japan commercial real estate investment volume in 2023 is projected to exceed that of the previous year. However, investment is likely to weaken in 2024 as investors adopt a more selective approach in response to the changing supply-demand balance in the rental market. Other headwinds include a possible shift in the BoJ's monetary policy leading to further increase in long-term interest rates, which may push up investors' targeted cap rates, potentially inhibiting the flow of transactions and further weighing on investment volume.

Office Market

CBRE says that in a continuation of the trend that emerged in the previous year, 2023 saw vacancies filled by companies moving to new premises in superior locations or higher-grade buildings. Most cities where the vacancy rate rose saw significant new supply come on stream at less than full occupancy. Amid the ongoing drive among companies to improve their working environment, demand for office space should continue to recover in 2024. In cities where new supply will exceed what the market can absorb, however, rents are likely to continue to fall as the vacancy rate rises.

Logistics

Total net absorption across Japan's four major metropolitan areas in 2023 is set to top 1 million tsubo for the first time since records began. Demand for logistics facilities continues to grow on the back of concerns over the "2024 problem" and a strengthening of manufacturing supply chains. Even though new supply is slated to remain abundant, vacancy rates should remain stable or even fall slightly in all major cities, according to CBRE.

Retail

While strong demand for store space on the Ginza high street is still seen from a wide variety of retailers, available properties in the prime locations are becoming scarce. On the back of such a tight supply-demand balance, Ginza high street rents recorded a 7.9% year-over-year rise in Q3 2023, returning to pre-pandemic levels. CBRE projects rents will continue to climb steadily going forward, says CBRE.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Commercial Property Investors Poised to Increase Allocations in 2026

- U.S. Commercial Mortgage Debt Climbs Toward $5 Trillion

- AI Sparks a Global $3 Trillion Data Center Supercycle

- AI Rewrites Playbook for Global Property Dealmakers, Says PwC

- Hong Kong's Central Office Market Enjoys First Rent Increase Since 2022

- U.S. Commercial Real Estate Lending Spikes in Q3

- Commercial Lending Surges in America

- North America Real Estate Enters a Tech-Driven, Boomers-Fueled Era in 2026

- U.S. Commercial Mortgage Delinquencies Ease in Q3

- Rents Hit 18-Year High in Tokyo as Japan's Office Market Defies Gravity

- Hong Kong Office Market Rebounds, IPO Activity Spurs Leasing Demand

- Poland's Commercial Markets Enjoy Rising Property Investment Activity

- Asia-Pacific Property Markets Show Signs of Revival as Investment Rises

- World Property Ventures Raising Capital to Digitize the Global Real Estate Economy

- U.S. Data Center Boom Tests Power Grid as AI Demand Outpaces Supply

- Commercial, Multifamily Mortgage Debt Climbs to Record $4.88 Trillion in U.S.

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs