Residential Real Estate News

Macau's Property Market Recovery Dampened by Interest Rate Hikes in 2023

Residential News » Macau Edition | By Michael Gerrity | July 28, 2023 7:27 AM ET

According to JLL's Macau mid-year 2023 property market review, the reopening of borders in the early part of this year buoyed the retail leasing market significantly in Macau. However, the weakening global economy and mainland China's slowdown coupled with the interest rate hikes has affected the recovery of the local real estate market.

Figures from DICJ show Macau's gross gaming revenue surged 205.0% year-over-year to MOP 80.14 billion, representing about 55% of pre-pandemic levels. In the first quarter of 2023, the gross revenue generated from VIP junkets soared 77.0% y-o-y to MOP 8.57 billion, which represents 24.7% of the city's total gaming revenue.

Macau's GDP totalled MOP 74.13 billion in the first quarter of 2023, up by 38.8% y-o-y. The figures for expenditure-based GDP reflected the growth is mainly driven by the exports of goods and government final consumption expenditure, which increased 38.3% and 30.1%, respectively. Private consumption expenditure, fixed capital formation and imports of goods dropped 7.5%, 1.1% and 0.7%, respectively, a sign that individual consumption and investment remained weak.

According to the DSEC statistics, Macau's total inbound tourism surged 236.1% y-o-y to 11.645 million in the first half of this year, with the combination of inbound visitors changing slightly. Visitors from Hong Kong grew significantly to 3.451 million, accounting for 29.6% of Macau's total visitor arrivals. About 59.8% of visitors came from mainland China. Macau had a total of 42,061 hotel rooms as at the end of May, up 13.9% or 5,149 rooms from the end of 2022. The cumulative occupancy rate of hotel rooms reached 76.8%, while the average length of stay of guests slightly increased to about 1.7 nights.

The industries in Macau began to recruit additional manpower, while the expatriate employees have returned to the city's labour market. Figures from the DSEC show that the number of imported labour reached 161,508 by the end of May, 6,596 people or 4.3% more than the level at the end of 2022. The overall unemployment rate and underemployment rate dropped to 2.8% and 1.8%, respectively. The overall median monthly income grew 13.3% from the end of last year to MOP 17,000, while the total resident deposit fell 0.6% from 2022 to MOP 692.92 billion.

Mark Wong, Director of Value and Risk Advisory at JLL Macau said, "Although Macau's economic recovery has stabilised, the interest rate hikes, global economic slowdown and slowing economic recovery in mainland China weigh on Macau's property market. Investors continue to adopt a wait-and-see attitude toward the real estate market. The government recently increased the rates of land premiums could sharply reduce the profit of developers, which would affect the land market as a result. As such, we forecast that the investment property market will remain subdued in the second half of 2023, and with the heightened interest rates, distressed investors will continue to release their properties for sale."

Residential transaction volume climbed 9.9% y-o-y to 1,793 as of June 2023, according to the data from DSEC. Only 36 pre-sale transactions were recorded in the first half due to the absence of major residential projects, and the transaction of pre-sale projects accounted for only 2.0% of the overall residential transaction volume.

In the first half of 2023, a total of nine projects with 302 flats received pre-sale permits. All of the projects are located on the Macau Peninsula and provide a total of gross floor area of 22,405.6 sqm. Macau New Neighbourhood (MNN) project in Hengqin is expected to be launched in September. It provides about 4,000 units and will absorb some of the housing demand in Macau.

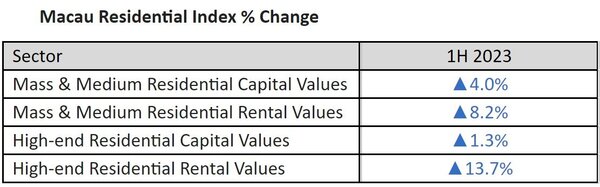

Benefiting from the increasing expatriate employees, the residential rents have remained strong. Rents of luxury flats surged 13.7% in the first half of 2023, while the rents of mass residential flats grew 8.2%. Capital values of luxury residential climbed 1.3% during the same period, while capital values of mass residential rebounded 4.0%. The investment yields of luxury and mass residential are 1.7% and 1.5%, respectively.

Oliver Tong, General Manager at JLL Macau and Zhuhai also commented, "The residential leasing market benefited from the return of expatriate employees after the reopening of borders early this year. However, it failed to revive Macau's property market with home sales remaining at a historic low level. Although home prices recorded moderate growth in the first half of 2023, the current market indicators are not favourable to the housing market and the housing price has dropped over 10% from the levels prior to the pandemic. Even though the market has suggested the government remove the cooling measures in the housing market many times, the government believes the housing prices will rise after the removal. But in Hong Kong, it failed to stimulate market activities after the government relaxed the cooling measures recently. As such, we believe it could help to stabilise the economy and develop a healthier market if the Macau government withdrew the restrictions to a certain extent. Under the current market condition, housing prices will be under pressure due to the interest rate hikes, fluctuating stock market, weak global economy and lower-than-expected economic recovery of mainland China, which will affect the economic recovery of Macau as a result."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Housing Market Tilts Toward Buyers as Prices Cool

- Ultra-Luxury Home Sales Surge Globally in Late 2025 as 555 Mega-Deals Close

- U.S. Luxury Home Prices Outpaced the Broader Market in 2025

- U.S. Homeowner Equity Growth Cooled in 2025 but Remained Historically Strong

- U.S. Homebuyers Scored Biggest Price Discounts Since 2012 as Market Shifts

- Ten Key Takeaways from the U.S. Housing Market in January

- Hong Kong Stock Market Front-Runs Local Home Prices by Two Months

- Mass Exodus: U.S. Homebuyers Cancel Deals at Record Levels

- U.S. Housing Outlook for 2026 Darkens After Sharp December Pullback in Contract Signings

- America's Housing 'Silver Tsunami' Is Turning Into a Trickle

- Builders Tell Congress Government Rules Are Pricing Americans Out of Housing

- California Housing Market Poised for Balanced Growth in 2026

- U.S. Housing Market Hits Largest Buyer-Seller Imbalance on Record

- Miami Housing Market Ends 2025 on Firmer Ground

- U.S. Homebuilder Confidence Dips at Start of 2026

- Remodeling Outlook Improves as U.S. Homeowners Tap Equity

- U.S. Home Sales Hit Three-Year High in December as Rates Ease

- Las Vegas Area Home Sales Hit 18-Year Low in 2025

- U.S. Mortgage Rates Hit Three-Year Low in January

- U.S. Home Affordability Closed Out 2025 Near Record Lows

- Ireland Home Prices Uptick 5.5 Percent in 2025 Amid Supply Shortages

- One Year After Los Angeles Wildfires, Investors Snap Up Burned Lots

- Greater Palm Beach Area Home Sales Surge in Late 2025

- U.S. Homebuilder Sentiment Ends 2025 in Negative Territory

- America's Single-Family Rent Boom Loses Steam in Late 2025

- Miami Home Price Gains Extend 14-Year Run in 2025

- Why Pre-Biden Mortgages Froze the U.S. Housing Market

- From Bricks to Blockchain: How Digital Dollars Could Soon Rewire Global Real Estate

- U.S. Home Sales Slightly Uptick in November

- Greater Orlando Area Home Sales Dive 22 Percent in November

- World Property Exchange Aims to Make Real Estate Ownership Instantly Tradeable and Democratized on a Planetary Scale

- Falling Home Prices Slash U.S. Homeowner Equity by $13,400 on Average in 2025

- Home Listings in U.S. See Sharpest Drop in Two Years Amid Cooling Buyer Demand

- Dutch Investors Pour Record $4.2 Billion in New Rental Housing in 2025

- U.S. Housing Markets Poised for 2026 Rebound, NAR Says

- Las Vegas Home Prices Hit Record High in November as Inventory Swells, Sales Cool

- Investors Accounted for 30 Percent of All U.S. Home Purchases in 2025

- Canadian Home Sales Recovery Continues in October

- Global Luxury Home Price Growth Cools to 2-Year Low in September

- U.S. Housing Market Recovery to Remain Fragile in 2026