The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Poland's Industrial Market Saw Record Demand in 2014

Commercial News » Warsaw Edition | By WPJ Staff | February 5, 2015 8:05 AM ET

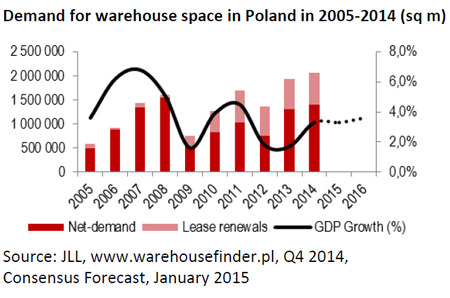

According to JLL, Poland saw record total demand of over 2 million sq m, with 1.4 million sq m attributable to net take-up. Developers were quick to react - 1 million sq m of new stock was delivered to the market last year.

Tomasz Olszewski, Head of Industrial CEE, JLL, said, "2014 was a very intensive year for both tenants and developers on Poland's industrial market. Despite the lack of spectacular new entries in 2014 and lease agreements, such as Amazon's in 2013, demand for industrial space in Poland peaked for the second consecutive year. Total demand reached 2.06 million sq m, which is the best ever result for the Polish industrial market and is 6% higher than 2013. Furthermore, net take-up accounted for 1.4 million sq m, which means a 7.5% increase y-o-y. The confident mood in the market can be credited to a number of factors, such as the general economic improvement, development of road infrastructure, as well as the expansion of e-commerce, retail chains, production and manufacturing firms."

Tomasz Olszewski, Head of Industrial CEE, JLL, said, "2014 was a very intensive year for both tenants and developers on Poland's industrial market. Despite the lack of spectacular new entries in 2014 and lease agreements, such as Amazon's in 2013, demand for industrial space in Poland peaked for the second consecutive year. Total demand reached 2.06 million sq m, which is the best ever result for the Polish industrial market and is 6% higher than 2013. Furthermore, net take-up accounted for 1.4 million sq m, which means a 7.5% increase y-o-y. The confident mood in the market can be credited to a number of factors, such as the general economic improvement, development of road infrastructure, as well as the expansion of e-commerce, retail chains, production and manufacturing firms."What is interesting is the fact that the distribution pattern of demand has slightly altered when compared to 2013, with the Warsaw Suburbs regaining their position as the most sought-after region.

The largest new lease agreements in 2014 were signed by Czerwona Torebka (54,000 sq m in MLP PoznaÅ Zachód), ID Logistics (46,000 sq m in Point Park Mszczonów) and GE (45,000 sq m in Panattoni's BTS scheme in Bielsko-BiaÅa). The most significant renegotiation involved Carrefour, who renewed their 46,000 sq m lease in Distribution Park BÄdzin, and P&G, who renegotiated their lease of 38,000 sq m in Prologis Park Sochaczew.

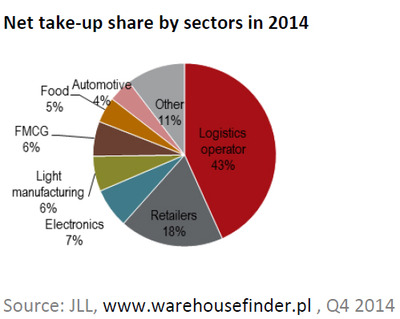

The largest new lease agreements in 2014 were signed by Czerwona Torebka (54,000 sq m in MLP PoznaÅ Zachód), ID Logistics (46,000 sq m in Point Park Mszczonów) and GE (45,000 sq m in Panattoni's BTS scheme in Bielsko-BiaÅa). The most significant renegotiation involved Carrefour, who renewed their 46,000 sq m lease in Distribution Park BÄdzin, and P&G, who renegotiated their lease of 38,000 sq m in Prologis Park Sochaczew.The volume leased by logistics operators doubled 2013's total, with nearly 607,000 sq m leased over 2014, accounting for 43% of net take-up.

Vacancy rate down

According to warehousefinder.pl, at the end of 2014, a total of 834,000 sq m was immediately available to tenants. This figure translated into a vacancy rate of 9.8%, down by 1.6 p.p. on Q4 2013. Among the major markets, the largest share of unleased space was found in Central Poland - 15.8%, Warsaw - 11.2% and Upper Silesia - 11.1%. A high vacancy rate (14.3%) was also registered in the Tri-City, though it should be noted that it refers to a modest 35,000 sq m.

The lowest availability of warehouse space is to be found in Western Poland. The current availability in PoznaÅ totals a mere 32,000 sq m (2.6% of existing stock). The WrocÅaw region has a vacancy rate of 5.7% as of Q4 2014. This translates into 66,700 sq m of available floor space.

The Warsaw Inner City area has seen a significant depletion of available floor space - from 22.3% in Q4 2013 to 14.6% by the end of 2014.

Supply - million sq m of new industrial space in 2014

At the end of 2014, warehouse stock on the Polish market reached a level of 8.54 million sq m and remained the largest in the Central and Eastern European region. 92% of this stock is concentrated in the five main regions, namely Warsaw, Upper Silesia, PoznaÅ, Central Poland and WrocÅaw. What is interesting is the fact that other locations, acting mainly as local support, have the chance to witness the development of new schemes over the next months.

"In 2014 developers completed 1.02 million sq m of space - the third highest volume in the history of the Polish industrial market. This was also much higher compared to the previous year's total of 305,000 sq m. The largest volume of new space - 355,000 sq m - was delivered in WrocÅaw, and as a result this region hit the 1 million sq m of total industrial stock last year", Tomasz Olszewski explained.

The pace of expansion was fastest in WrocÅaw and PoznaÅ, with the two cities registering new supply of 355,000 sq m and 268,000 sq m respectively. These were followed by Central Poland, where 138,000 sq m was delivered. A large portion of new supply was attributable to Amazon, for whom Panattoni and Goodman delivered three buildings with a total floor space of nearly 370,000 sq m (in WrocÅaw and PoznaÅ).

Among the major industrial regions, the lowest developer activity was registered in Warsaw. But this does not alter the fact that Warsaw remains the largest market in terms of stock (over 2,67 million sq m distributed over two zones - the Warsaw Suburbs and the Warsaw Inner City).

With over 462,000 sq m of completed space, Panattoni was again the most active developer. Goodman has been the second most active, having completed 215,000 sq m, followed by Prologis with 85,000 sq m.

"Developer activity has not shown any signs of slowing down. On the contrary, 687,000 sq m is currently in the pipeline as part of 30 construction projects across Poland. Importantly, speculative projects are becoming more popular. Over 184,000 sq m of industrial space not secured by lease agreements is under construction. This is a clear response from developers to both decreasing level of space available to hand and increasing demand," Tomasz Olszewski added.

The largest volume under construction is in PoznaÅ.

Again, it is Panattoni who leads in terms of the current development activity with nearly 252,000 sq m in the construction stage, followed by Goodman who is delivering 212,000 sq m. Unsurprisingly, these two companies are also the largest speculative developers.

Rents

Owing to their urban location and smaller size, Small Business Units (SBU) typically feature higher rents than the larger distribution parks. During 2014 the headline rents in such facilities were stable in Warsaw and Åódź, with WrocÅaw recording only a minor drop from â¬3.7-4.0/ sq m / month to â¬3.5-4.0/ sq m / month.

Large distribution parks are predominantly located outside cities and feature considerably lower rents. During 2014, headline rents remained stable in the Warsaw Suburbs (â¬2.7-3.6/ sq m /month), Upper Silesia (â¬3.0-3.7/ sq m / month) and Central Poland (â¬2.6-3.3/ sq m / month). Minor downward pressure was registered in WrocÅaw, where the rental band dropped from â¬3.0-3.8 q m / month to â¬3.0-3.6/ sq m / month. A more significant rental decrease applied in the case for PoznaÅ. Over the course of the year, the rental band dropped from â¬3.3-3.8/ sq m /month to â¬2.9-3.5/ sq m /month. This can be put down to the acute competition between developers seeking to secure large new construction projects or replenish occupancy in existing buildings. Effective rents were stable in the Warsaw Suburbs (â¬2.1-â¬2.8 / sq m /month), Upper Silesia (â¬2.4 - â¬3.3 / sq m /month) and Central Poland (â¬2.1 - â¬2.8 / sq m/month). In PoznaÅ and WrocÅaw effective rents decreased and, by the end of 2014, stood at â¬2.15 - â¬3/ sq m /month and â¬2.5 - â¬3.1/ sq m /month respectively.

Industrial land - return of speculative purchases

Agata ZajÄ c, Land Transactions Coordinator, JLL, commented, "A notable change in the approach of developers was witnessed in 2014. With increasing industrial demand anticipated in the coming years they no longer feel restrained when it comes to speculative land acquisitions. Such activity has not been seen since 2007. Companies were interested not only in the major established industrial regions, but also some less obvious locations such as Lublin, Rzeszów, Bydgoszcz, ToruÅ and BiaÅystok. An additional factor shaping the industrial land market in 2014 and generating interest in plots, especially within Special Economic Zones, concerned a change in the rules relating to regional aid. New rules, effective from July 2014, increased the interest in plots of land in H1. The most sought-after regions in 2014 included the PoznaÅ and Lower and Upper Silesia regions. In 2015, we expect the Warsaw Suburbs to also gain momentum".

Investment market

The Investment market showed further buoyancy in 2014 with the transacted volume reaching an historic peak of â¬744 million. The largest deal was the acquisition of logistics parks by PZU FIZ Sektora NieruchomoÅci 2 for ca â¬140 million.

Ownership became more concentrated with four players together controlling 54% of the stock: Prologis (26%), SEGRO (11%), Blackstone/Logicor (11%) and Goodman (6%).

2015 Outlook

"Considering the positive economic forecasts, we expect that demand for industrial space will be similar to results registered in the past two years, however, achieving new peaks may prove to be difficult. Developer activity is likely to remain high as well and even one million sq m of new industrial space can be completed in 2015. We expect an increase in both developer and tenant interest in industrial markets in Eastern Poland - Lublin, Rzeszów and other locations, such as Szczecin or ToruÅ. Rents will mostly remain stable, with an eventual upward pressure in the regions with a low amount of available space", Tomasz Olszewski summarized.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More