The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Russia Overtakes France as Europe's Largest Shopping Mall Market

Commercial News » Moscow Edition | By Michael Gerrity | April 21, 2015 9:50 AM ET

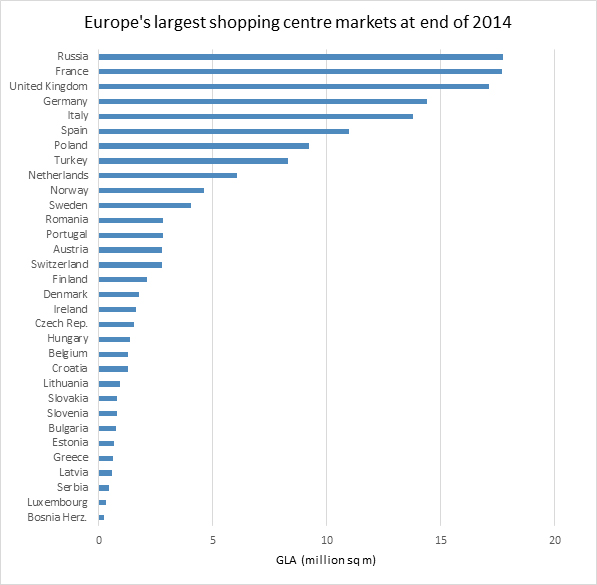

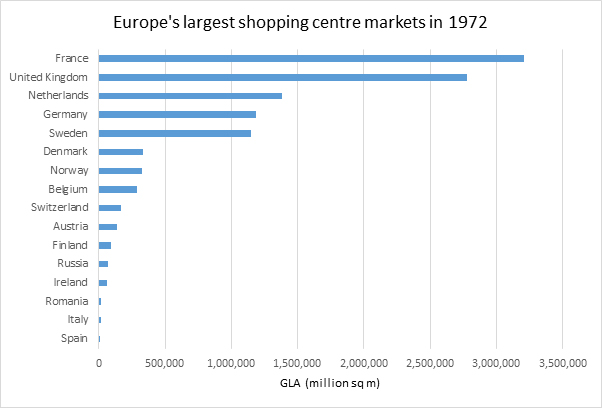

According to new research from Cushman & Wakefield, after a number of large-scale malls were delivered to the European market in H2 2014, Russia has now broken France's 43-year reign as Europe's largest shopping centre market.

Accounting for more than half of all shopping centre space added to the market in H2 2014, Russia's total shopping centre stock climbed to more than 17.7 million sq m as at the end of last year, overtaking France's 17.66 million sq m GLA. The UK follows behind as Europe's third largest market with 17.1 million sq m.

According to Cushman & Wakefield's latest European Shopping Centre Development report, total shopping centre floor space across Europe totaled 152.3 million sq m at 1 January 2015, recording a 3.3% year-on-year increase. While Western Europe currently accounts for 69% of total built space, development activity in Central and Eastern Europe (CEE) surged ahead in H2 2014, with 2.2 million sq m of space delivered to the market compared to 981,000 in Western Europe over the same period.

Development activity throughout Europe has been motivated by the need to meet consumer demand for larger centres which offer a greater diversity of retailers, an array of leisure activities and a wider choice of food and drink offerings.

Western Europe's biggest markets have seen an increasing number of extensions and refurbishments as developers seek to 'future-proof' small or outdated centres, whilst CEE is still dominated by the creation of new, dominant regional centres that serve a wide catchment area. These trends will continue into 2015 and 2016, with Russia and Turkey continuing to dominate the development pipeline as overall density remains at a low level, albeit the completion of projects of Russia will be subject to financing conditions and the wider geopolitical environment. In Western Europe, development activity in markets with lower densities such as Italy and Spain are also gaining momentum, with Italy's pipeline over the next two years more than doubling that of the UK.

Cushman & Wakefield's head of retail services in Russia, Maxim Karbasnikoff commented, "The Russian retail market has been under unprecedented pressure since March 2014. In addition to the Ukrainian crisis and following sanctions, rouble and oil depreciation especially in the second half of last year has placed occupiers into a near panic situation. Unsurprisingly, the exceptional volume of new supply delivered remains partially vacant, with occupiers being more focused on the optimization of the existing network, rather than opening stores without economic visibility. Nevertheless, stable retailer sales in Q1 2015, recent rouble appreciation, low vacancy in existing malls and a somewhat more limited pipeline of new projects, makes us think the market is showing signs of resilience and has now entered into a consolidation phase."

Investment demand has been exceptionally strong over the past year and with the ownership of a number of top tier centres changing hands, prime yields have compressed to near pre-crisis levels in many markets. A lack of modern supply is frustrating investors however, leading to a further spreading in demand towards new target markets such as Spain but also encouraging more interest in second tier markets and assets to find opportunities. Portfolio restructuring by funds and in particular leading REITS has created new supply in some markets but an increase in development will be yet more crucial to feeding investor as well as retailer demand in the future.

"With the rise of online sales, the ability for customers to be able to interact with their favorite brands in a well-designed, exciting and culturally-rich environment has never been so important. Throughout Europe, many developers have opted to build increasingly large-scale schemes with significant leisure offerings and an increasing share of food and beverage operators in order to give centres a unique identification", adds Justin Taylor, Cushman & Wakefield's head of EMEA retail.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More