Commercial Real Estate News

Asia Pacific Commercial Investment Dives 37 Percent in Q2

Commercial News » Seoul Edition | By Michael Gerrity | August 4, 2022 8:58 AM ET

Declines driven by slowing China, Japan, and Australia deal activity

According to global property consultant JLL, tightening rate cycles and inflationary concerns led to a slowdown of direct real estate investment activity across the Asia Pacific region, which fell 37% year-on-year to $32.3 billion in Q2.

Among the hardest-hit was China, where investment volumes contracted by 61% year-on-year to $5.8 billion on the back of pandemic lockdowns.

Japan's lack of logistics transactions saw deal activity dip 8% year-on-year to a historic low of US$5.3 billion, while activity in Australia moderated by 52% year-on-year to end the quarter at $4.9 billion.

"Investment volumes in the first half declined moderately from the high base set in 2021 as external factors emerged, resulting in investors adjusting capital deployment strategies to align with a more aggressive rate tightening cycle. Encouragingly, dry powder levels remain high and we are seeing that the appetite for real assets remains strong. Clear opportunities exist and we're advising clients to expect a new price discovery phase to remain a dominant theme for the remainder of 2022, as macroeconomic headwinds and ongoing inflationary pressures influence decisions," says Stuart Crow, CEO, Capital Markets, Asia Pacific, JLL.

The Asia Pacific office sector remained the region's most liquid asset class, drawing $30.6 billion in investments in the first half, declining a modest 8% year-on-year from last year's high base. Industrial and logistics investments ($14.6 billion) tapered off by 37% from record volumes in 2021, while deployments into retail assets ($14.0 billion) declined by 31% year-on-year. Investments into alternative assets ($1.4 billion), such as data centres declined modestly, dropping by 12% year-on-year.

Asia Pacific-dedicated fundraising continued its momentum despite falls in global activity. In a sign of the longer-term positivity in the Asia Pacific real estate sector, development focused funds in logistics, living, data centres, India, and Southeast Asia continue to secure financial commitments from global and regional institutional investors.

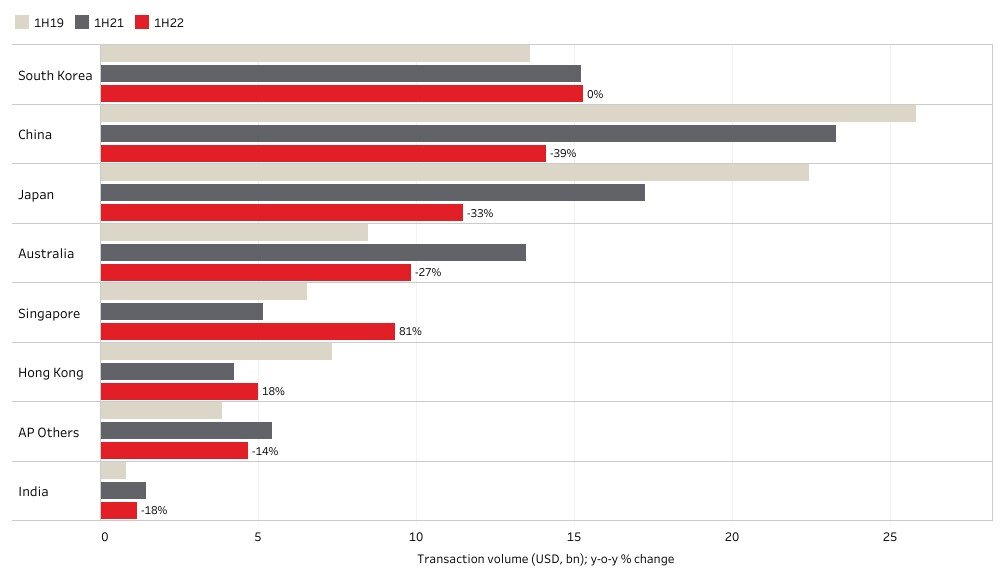

The impact of the pandemic-influenced lockdowns weighed on China in the first half with investment volumes of $14.1 billion representing a year-on-year contraction of 39%. Japan volumes ($11.5 billion) decreased by 33% in the first half due to a lack of logistics transactions. Activity in Australia declined by 27% year-on-year to end the half at $9.8 billion.

South Korea ($15.3 billion) emerged as the region's largest market by volume in the first half, remaining flat year-on-year, buoyed by office transactions including SK U-Tower and A+ Asset Tower in Seoul. Gains were registered in Singapore ($9.3 billion), with 81% year-on-year growth supported by large ticket office and mixed-use transactions including Income@Raffles and in Hong Kong ($5.0 billion), up 18% driven by a number of en-bloc industrial sales.

Additionally, sustainability frameworks emerged as high on the agenda for investment committees, influencing acquisition decisions. JLL expects investors to deploy more capital into value-add strategies by refurbishing old offices into green buildings as occupiers increasingly choose higher quality space post-pandemic.

"The market adjusted to new realities over the first half, which was reflected in more muted investment activity. Capital remains committed to the Asia Pacific real estate market but deployments will be more selective as investors play the long game and price in financial market tightening to any investments for the foreseeable future," says Pamela Ambler, Head of Investor Intelligence & Strategy, Capital Markets, Asia Pacific, JLL.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Commercial Property Investors Poised to Increase Allocations in 2026

- U.S. Commercial Mortgage Debt Climbs Toward $5 Trillion

- AI Sparks a Global $3 Trillion Data Center Supercycle

- AI Rewrites Playbook for Global Property Dealmakers, Says PwC

- Hong Kong's Central Office Market Enjoys First Rent Increase Since 2022

- U.S. Commercial Real Estate Lending Spikes in Q3

- Commercial Lending Surges in America

- North America Real Estate Enters a Tech-Driven, Boomers-Fueled Era in 2026

- U.S. Commercial Mortgage Delinquencies Ease in Q3

- Rents Hit 18-Year High in Tokyo as Japan's Office Market Defies Gravity

- Hong Kong Office Market Rebounds, IPO Activity Spurs Leasing Demand

- Poland's Commercial Markets Enjoy Rising Property Investment Activity

- Asia-Pacific Property Markets Show Signs of Revival as Investment Rises

- World Property Ventures Raising Capital to Digitize the Global Real Estate Economy

- U.S. Data Center Boom Tests Power Grid as AI Demand Outpaces Supply

- Commercial, Multifamily Mortgage Debt Climbs to Record $4.88 Trillion in U.S.

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs