The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

London Office Market Performs, Despite Global Financial Market Volatility

Commercial News » London Edition | By Michael Gerrity | July 30, 2015 8:40 AM ET

No cycle lasts forever, and a choppy July in the global financial markets reminds us that historically UK real estate has usually gone into a downturn due to an external shock in the macro-economic environment, says global real estate advisor Knight Frank.

In 1990 it was Iraq invading Kuwait, causing an oil price spike, which in turn hit growth and burst a house price bubble. In 2007, it was credit markets drying up which again caused house prices to crash. In both cases commercial real estate was dragged under by the wider economic turmoil.

London Office Market Fast Facts:

- All property capital growth index rose by 0.9% in June m-on-m, which is up on the 0.8% reported for May.

- Offices saw the highest capital growth (1.4%), and retail the lowest (0.3%).

- 12 month total return stood at 16.7%.

- Investment volume from January to June was £34.5 bn, up from £24.8 bn for the same period of 2014.

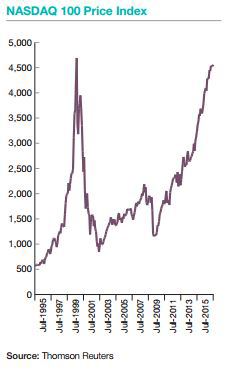

Fortunately, Knight Frank reports, the causes of the rollercoaster financial markets in July - Greece, the China stock market crashes, and a tumble for tech stocks - does not look set to destabilize the global economy, at least this time around. The Euro group remains determined to hold the currency zone together. China's equity markets probably have not yet attracted enough international money to create a systemic threat beyond its shores. The Economist journal argues that the US tech share values are more justifiable this time around than in 2001, when so few were making profits.

Fortunately, Knight Frank reports, the causes of the rollercoaster financial markets in July - Greece, the China stock market crashes, and a tumble for tech stocks - does not look set to destabilize the global economy, at least this time around. The Euro group remains determined to hold the currency zone together. China's equity markets probably have not yet attracted enough international money to create a systemic threat beyond its shores. The Economist journal argues that the US tech share values are more justifiable this time around than in 2001, when so few were making profits.However, the start of the next cyclical downturn will probably resemble this July; i.e. a panic begins in the financial markets which sends aftershocks through the global economy, until eventually it reaches UK commercial property. Even if this is not the occasion that the cycle ends, there remains the question of whether that turning point is going to be sooner rather than later?

The darkest hour for the UK commercial property market during the downturn came in mid-2009, as the IPD capital growth index hit its lowest point in July of that year. While some sub-markets have only meaningfully shown signs of recovery in the last two years, it is tempting to view 2009 as the start of the present cycle. The IPD capital growth index has risen 37% since July 2009, demonstrating growth over several years, albeit with a weak patch in 2011-2012.

Certainly for the UK economy and real estate market the word 'recovery' is no longer appropriate, as the situation has moved well beyond the recovery stage. GDP expanded by a heady 3.0% last year, and the 2.5% consensus forecast for 2015 if achieved would still be impressive, even if it is less than 2014. For commercial real estate, total returns stand at 16.7% on an annual basis according to IPD, and we are seeing signs in the office market of rental growth spreading from London to the regions.

Knight Frank's chief economist James Roberts says, "No market cycle lasts forever, and a choppy July in the global financial markets reminds us that historically UK real estate has usually gone into a downturn due to an external shock in the macro-economic environment."

Knight Frank's chief economist James Roberts says, "No market cycle lasts forever, and a choppy July in the global financial markets reminds us that historically UK real estate has usually gone into a downturn due to an external shock in the macro-economic environment."In January, IPD capital growth (month-on-month) hit a low point of 0.4%, but this accelerated to 0.8% in May and 0.9% in June. So rather than showing any sign of losing momentum, the market could be viewed as mid-cycle and with potential to improve further. This could be driven by the growing volume of money that is targeting the UK regions this year, and a robust performance for the economy.

However, as stated above eventually a turning point will come, and past historic experience is that the downturn starts beyond property. What could bring this turning point about?

The candidate we view as most likely to cause the next downturn is ironically a rising star in the global economy - the tech sector. Even if The Economist is correct in predicting now is not the time we see a tech driven stock market crash, we cannot rule one out at some later date. The railway share booms and busts in the Victorian era demonstrate that it is difficult (if not impossible) to accurately value future growth potential, particularly when so much speculative money is clouding the picture.

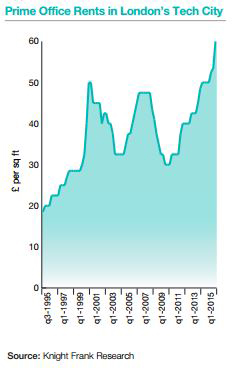

The unfolding tech revolution has had a considerable impact on UK commercial property, boosting occupier demand for offices in districts favored by tech firms (like London's Shoreditch). Sheds are popular with investors eager to get exposure to the rise of online shopping. A future crash for the tech sector will have far reaching implications for property, and in our view this should sit high on the list of potential future threats.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More