Residential Real Estate News

Prime Central London Home Prices Uptick in May

Residential News » London Edition | By Michael Gerrity | June 11, 2021 8:45 AM ET

First time in 4 years on an annualized basis

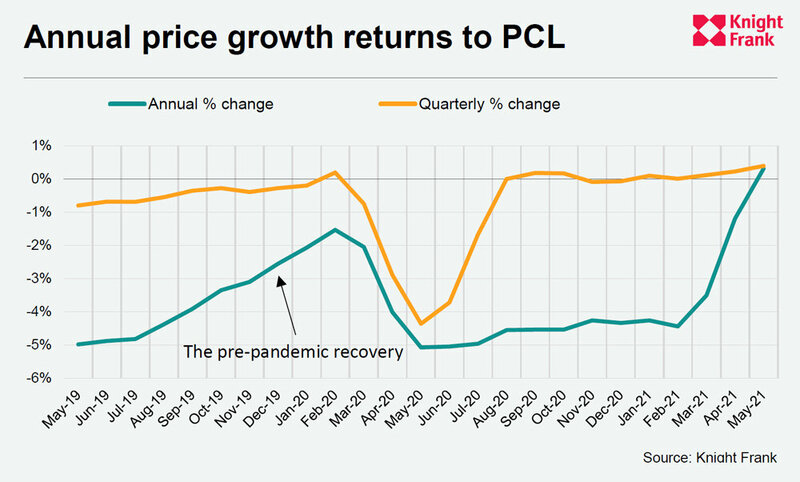

International property consultant Knight Frank is reporting prices in prime central London grew by 0.3% in the year to May 2021.

While it wasn't a large increase, it was the first rise in five years and underlines how the recovery of the property market in PCL is not reliant on the re-opening of international travel.

Knight Frank says the last time prices increased on an annual basis was in May 2016, the month before the EU referendum. Subsequent political uncertainty, combined with a growing number of taxes on high-value property, meant average prices fell 17% in the intervening period.

A period of house price inflation in PCL has therefore been overdue and was on the horizon when the pandemic struck.

"The relaxation of international travel rules will provide a boost for the prime central London property market but prices are on the up anyway," said Tom Bill, head of UK residential research at Knight Frank. "Things are picking up where they left off after the general election in December 2019 and buyers can recognize good value after five or six years of falling prices."

The relaxing of international travel rules will, however, provide a more noticeable boost in locations such as Mayfair and Knightsbridge.

Low numbers of overseas buyers have come to the UK in recent months but the ending of quarantine rules will lift demand. Although travellers may still need to quarantine when they return home, any relaxation of the rules means visiting London will become more tenable.

The other impact of rising prices will be a further erosion of the discount for buyers denominated in overseas currencies.

The effect will be exaggerated as the pound gets stronger, which in part has been driven by the country's vaccine-fuelled economic recovery.

The effective discount based on price and currency movements in PCL compared to the period before the EU referendum for a buyer denominated in US dollars was 19.2% at the end of May. That compares to 24.3% in December last year.

Meanwhile, annual price growth in prime outer London increased to 3.1% in May, which was the strongest rate of growth since before the EU referendum in March 2016.

Growing demand for space and greenery after three national lockdowns has led to annual price growth in excess of 6% in markets like Richmond, Dulwich, Wandsworth and Belsize Park. Wimbledon experienced price growth of 9.4% in the year to May, which was the strongest of all London markets, concludes Knight Frank.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership