Residential Real Estate News

London Prime Residential Sales Slowly Improve from COVID Pandemic

Residential News » London Edition | By Michael Gerrity | March 9, 2021 8:51 AM ET

According to international property consultant Knight Frank, prices in the prime central and outer London property markets continued to recover from the impact of the pandemic at their own respective pace in the first two months of this year.

There was quarter-on-quarter growth for the seventh consecutive month in prime outer London in February, demonstrating how demand for more space has driven suburban property markets in the capital.

Average prices in Belsize Park, Dulwich and Wimbledon have all grown by 4% since April last year.

In 2021 through February, there were 1.1% more transactions than over the previous 12-month period, which underlines the strength of activity given the UK property market was closed for eight weeks last year.

While there has been a steady pick-up in prime outer London, prime central London is in more of a holding pattern, with prices flat in the three months to February.

The annual price decline was 4.4% in February, a figure that has been relatively consistent for the last six months. Most of this decline was recorded in the early months of the pandemic and average prices have only fallen by only 0.1% since the market re-opened last May.

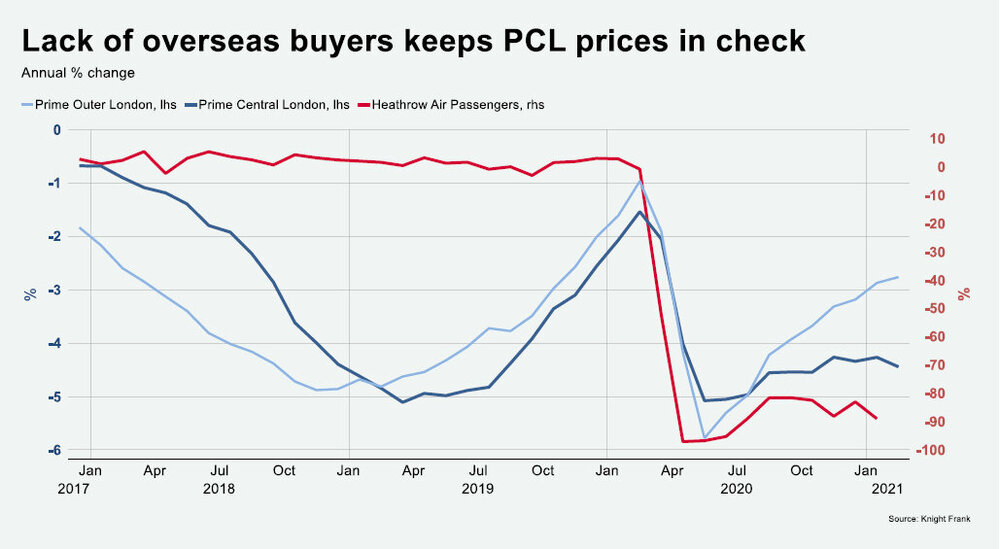

The explanation for this differing rate of recovery is the lack of international travel, an effect that is clearly visible on the chart below.

With passenger numbers through Heathrow down by 80% to 90%, activity in the prime central London property market has been disproportionately impacted.

The number of transactions in PCL in the year to February 2021 was 20% down on the previous 12- month period.

"The prime central London property market has been in a holding pattern since travel restrictions were tightened," said Tom Bill, head of UK residential research at Knight Frank. "A gap is opening up between price growth in central and outer areas of the capital but that will close as international buyers can get back on airplanes."

For overseas buyers, there is a disparity between the desire to transact and the ability to view, an analysis of demand in the £10 million-plus price bracket.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership