The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

U.S. Bank Repossessions Up 66 Percent From One Year Ago

Residential News » United States Edition | By Miho Favela | October 15, 2015 12:45 PM ET

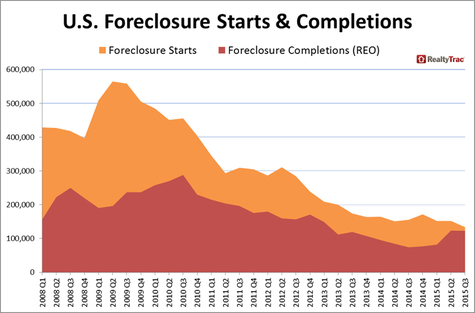

According to RealtyTrac's Q3 and September 2015 U.S. Foreclosure Market Report, a total of 327,258 U.S. properties with foreclosure filings -- default notices, scheduled auctions and bank repossessions -- in the third quarter of 2015 were down 5 percent from the previous quarter, but up 3 percent from the third quarter of 2014.

The annual increase in the third quarter marked the second consecutive quarter where U.S. foreclosure activity increased on a year-over-year basis following 19 consecutive quarters of year-over-year decreases.

A total of 133,811 U.S. properties started the foreclosure process in the third quarter, down 12 percent from the previous quarter and down 14 percent from a year ago to the lowest level since the third quarter of 2005.

There were a total of 123,040 U.S. properties repossessed by the lender (REOs) in the third quarter, down less than 1 percent from the previous quarter but up 66 percent from a year ago, the largest year-over-year increase in bank repossessions since RealtyTrac began tracking quarterly foreclosure activity in the first quarter of 2008.

There were a total of 123,040 U.S. properties repossessed by the lender (REOs) in the third quarter, down less than 1 percent from the previous quarter but up 66 percent from a year ago, the largest year-over-year increase in bank repossessions since RealtyTrac began tracking quarterly foreclosure activity in the first quarter of 2008."The widespread rise in foreclosure activity in the third quarter compared to a year ago is the result of two starkly different trends taking place," said Daren Blomquist, vice president at RealtyTrac. "In states such as New Jersey, Massachusetts, and New York, a flood of deferred distress from the last housing crisis is finally spilling over the legislative and legal dams that have held back some foreclosure activity for years. That deferred distress often represents properties with deferred maintenance that will sell at more deeply discounted prices, creating a drag on overall home values. On the other hand, in states such as Texas, Michigan and Washington, the third quarter increases are a sign that the foreclosure market has settled into a normalized pattern close to or even below pre-crisis levels, and in those states the overall housing market should easily absorb the additional foreclosure activity with little impact on home values."

New Jersey posts top state foreclosure rate, Florida rate drops to second highest

New Jersey foreclosure activity increased 27 percent from a year ago, boosting the state's foreclosure rate to the nation's highest foreclosure rate: one in every 171 housing units with a foreclosure filing during the quarter -- more than twice the national average of one in every 404 U.S. housing units with a foreclosure filing during the quarter. New Jersey foreclosure starts were down 28 percent from a year ago, but scheduled foreclosure auctions increased 61 percent, and bank repossessions jumped 351 percent.

Florida foreclosure activity in the third quarter of 2015 decreased 17 percent from a year ago, but the state still posted the nation's second highest foreclosure rate: one in every 186 housing units with a foreclosure filing. Florida foreclosure starts decreased 28 percent from a year ago, and scheduled foreclosure auctions were down 46 percent year-over-year, but bank repossessions in Florida increased 34 percent from a year ago in the third quarter.

Nevada foreclosure activity in the third quarter of 2015 increased 13 percent from a year ago, with the third highest foreclosure rate in the nation -- one in every 194 housing units with a foreclosure filing. Nevada foreclosure starts decreased 14 percent from a year ago, and scheduled auctions were down 14 percent, but bank repossessions in Nevada increased 255 percent from a year ago in the third quarter.

Maryland's foreclosure rate ranked No. 4 highest among the states despite nearly a 7 percent year-over-year decrease in foreclosure activity in the third quarter, and the Illinois foreclosure rate ranked fifth highest, despite a nearly 5 percent year-over-year decrease in foreclosure activity in the third quarter.

Other states with foreclosure rates ranking among the top 10 highest in the third quarter were South Carolina (one in 311 housing units with a foreclosure filing), New Mexico (one in every 322), Ohio (one in every 334), Georgia (one in every 337) and Indiana (one in every 353).

Atlantic City posts top foreclosure rate among metros

With one in every 97 housing units with a foreclosure filing in the third quarter, Atlantic City, New Jersey, posted the nation's highest foreclosure rate among metropolitan statistical areas with a population of 200,000 or more.

Five Florida cities posted third quarter foreclosure rates among the 10 highest: Jacksonville, Florida at No. 2 (one in every 153 housing units with a foreclosure filing); Deltona Beach, Florida at No. 3 (one in every 155); Tampa, Florida at No. 4 (one in every 162); Miami, Florida at No. 5 (one in every 162); Lakeland, Florida at No. 7 (one in every 176); and Ocala, Florida at No. 8 (one in every 179).

Trenton, New Jersey posted the nation's sixth highest metro foreclosure rate: one in every 172 housing units with a foreclosure filing in the third quarter of 2015. Albuquerque, New Mexico (one in every 181) and Las Vegas, Nevada (one in every 187) take the final two top spots.

11 of nation's 20 largest metro areas post annual increases in foreclosure activity

Eleven of the nation's 20 largest metro areas posted a year-over-year increase in foreclosure activity in the third quarter of 2015 compared to a year ago: St. Louis, Missouri (up 113 percent), Boston, Massachusetts (up 55 percent), Dallas, Texas (up 39 percent), Detroit, Michigan (up 39 percent), New York, New York (up 33 percent), Seattle, Washington (up 14 percent), Houston, Texas (up 12 percent), Minneapolis-St. Paul, Minnesota (up 11 percent), Atlanta, Georgia (up 5 percent), Philadelphia, Pennsylvania (up 1 percent) and Washington D.C. (up 1 percent).

"It's no surprise that foreclosure activity is up from a year ago as banks slowly, but surely, work their way through their pipeline of foreclosed inventory. It's really nothing more than housekeeping on the part of the banks and not a cause for concern," said Matthew Gardner, chief economist at Windermere Real Estate, covering the Seattle market. "In fact, given the dire shortage of homes for sale, I actually see an increase in foreclosures as a positive as it will, in a small way, help with meeting the substantial pent up demand that we have for housing in the Seattle market."

Among the nation's 20 largest metro areas, those posting the biggest decreases in foreclosure activity in the third quarter of 2015 compared to a year ago were Riverside-San Bernardino in Southern California (down 21 percent), Los Angeles, California (down 21 percent), San Diego, California (down 20 percent) and Miami, Florida (down 16 percent).

U.S. foreclosure activity increased slightly in September

A total of 109,130 U.S. properties had foreclosure filings in September 2015, down less than 1 percent from the previous month but up 2 percent from a year ago. U.S. foreclosure activity has increased on a year-over-year basis in six of the last seven months.

43,358 properties started the foreclosure process in September, the lowest level since November 2005.

States bucking the national trend with the biggest increase in foreclosure starts in September compared to a year ago included Louisiana (up 468 percent), Missouri (up 131 percent), Virginia (up 70 percent), Massachusetts (up 60 percent), and Texas (up 21 percent).

Lenders repossessed a total of 40,308 properties in September, up 10 percent from the previous month and up 76 percent from a year ago. Bank repossessions increased year-over-year for the seventh consecutive month in September.

States with the biggest increase in REOs in September compared to a year ago included Nevada (up 844 percent), New York (up 580 percent), New Jersey (up 401 percent), Georgia (up 186 percent), and North Carolina (up 183 percent).

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More