Residential Real Estate News

California Home Sales Start 2021 with 22 Percent Spike Over Last Year

Residential News » Laguna Beach Edition | By Michael Gerrity | February 23, 2021 9:42 AM ET

The California Association of Realtors reported this week that the State's housing market kicked off the year on a positive note, following up on December's strong showing with double-digit price and sales growth on a yearly basis in January 2021.

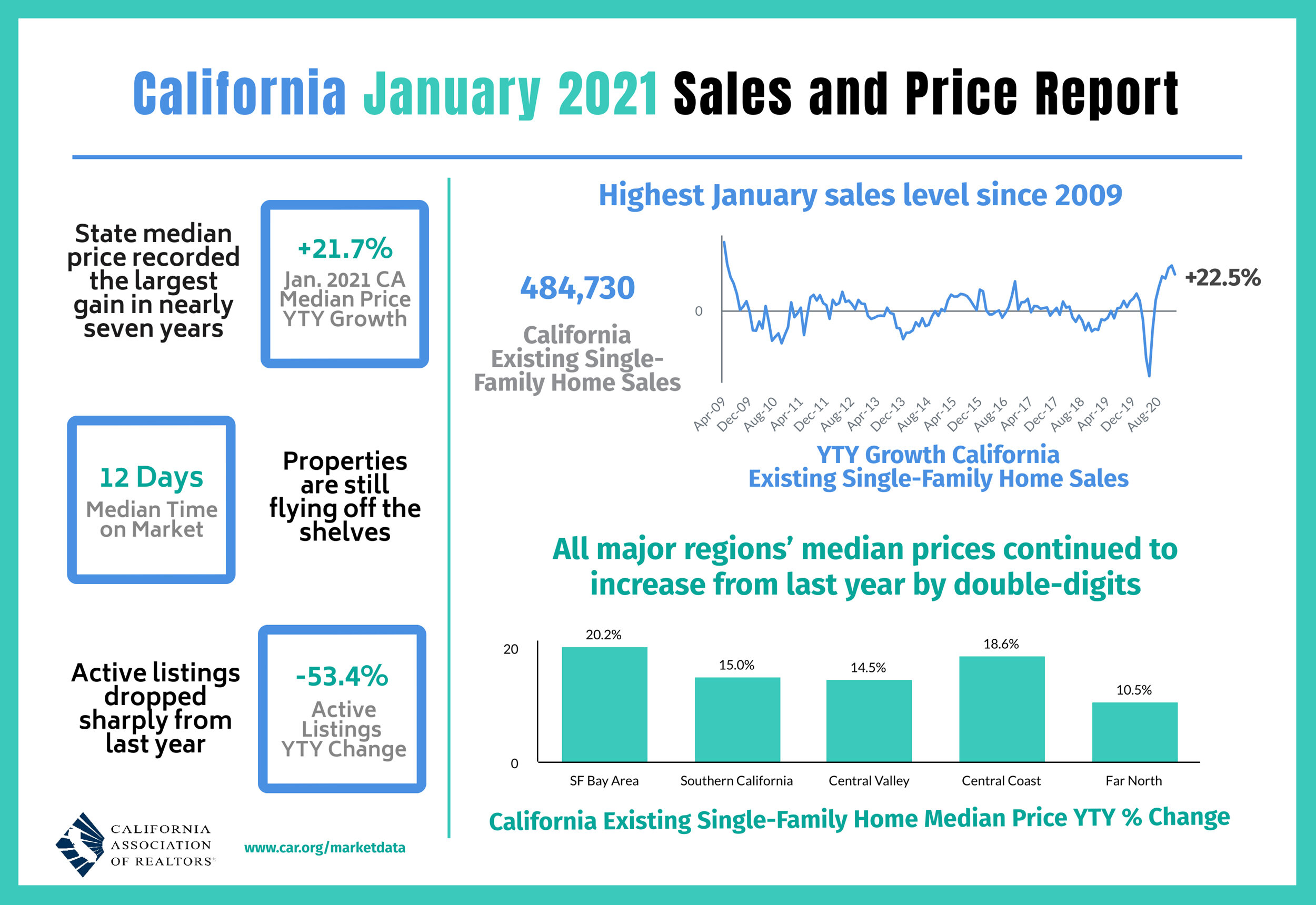

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 484,730 in January 2021, according to information collected by C.A.R. The statewide annualized sales figure represents what would be the total number of homes sold during 2021 if sales maintained the January pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

January 2021 home sales decreased 4.9 percent from 509,750 in December and were up 22.5 percent from a year ago, when 395,700 homes were sold on an annualized basis. The year-over-year, double-digit sales gain was the sixth consecutive and the third straight month that sales increased more than 20 percent from a year ago.

"Despite an economy that's slow to recover, the momentum from late last year continued into January, driven by strong growth in California's core housing markets, especially in the San Francisco Bay Area, where the higher cost areas experienced the most sales growth," said C.A.R. President Dave Walsh, vice president and manager of the Compass San Jose office. "Home prices continued to power through the traditional slow season in January with the largest annual price gain in nearly seven years."

After hitting a record high price the previous month, California's median home price dipped below the $700,000 benchmark in January. The statewide median home price declined 2.5 percent on a month-to-month basis to $699,890 in January, down from December's $717,930. Low rates and tight supply continued to push up home prices on a year-over-year basis, gaining 21.7 percent from the $575,160 recorded last January. The double-digit increase from last year was the sixth in a row and the largest since February 2014.

"With the COVID-19 vaccine continuing to roll out, another fiscal stimulus relief package likely on the way and historically low interest rates, the housing market will continue to thrive," said C.A.R. Vice President and Chief Economist Jordan Levine. "The market outlook is stronger than previously projected as buyer demand continues to outstrip supply, but we do expect the current robust market growth to decelerate later this year as the housing shortage intensifies."

Other key points from C.A.R.'s January 2021 resale housing report include:

- At the regional level, sales continued to record healthy year-over-year gains in all major regions, except in the Far North, which was the only region that posted an annual sales decline. The San Francisco Bay Area had the highest year-over-year growth rate at a gain of 31.8 percent over last January. The Central Coast (19.9 percent) and Southern California (13.5 percent) regions also remained strong and experienced double-digit, year-over-year sales increases. Sales in the Central Valley region moderated slightly (6.9 percent) but continued to grow on a year-over-year basis. The Far North had a slow start for the year with a modest sales decline of 5.3 percent.

- Resort communities sustained their momentum going into 2021, as sales continue to outpace the rest of the state. Big Bear and Mammoth Lakes experienced year-over-year, triple-digit gain of 176.2 percent and 150 percent, respectively, while South Lake Tahoe and Mammoth Lake both had a sales growth rate of more than 30 percent.

- More than 80 percent of all counties - 42 of 51 - tracked by C.A.R. recorded a year-over-year increase in closed sales, with both Calaveras and Mariposa gaining the most from last year at 69.2 percent, followed by Alameda (53.6 percent), and San Benito (50 percent). Counties with an increase from last year averaged a gain of 22.7 percent in January, compared to 36.1 percent in December. Nine counties experienced a sales decline at the beginning of 2021, with Yuba dropping the most from last year at 25.4 percent, followed by Glenn (-25 percent) and Merced (-22 percent).

- All major regions' median prices continued to increase by double digits on a yearly basis, with the San Francisco Bay Area growing the fastest at 20.2 percent. The Central Coast region had another strong month, increasing 18.6 percent from January 2020, followed by Southern California (15.0 percent), the Central Valley (14.5 percent), and the Far North (10.5 percent). Three of four Central Coast region counties continued to surge by more than 25 percent from a year ago.

- Forty-seven of the 51 counties tracked by C.A.R. reported a gain in price on a year-over-year basis, with 40 of them increasing more than 10 percent. Del Norte had the largest price growth of 75.8 percent in January, followed by Mariposa (50.4 percent) and Nevada (48.4 percent). Glenn was one of four counties with an annual drop in price, dipping 21.4 percent from a year ago. Madera, Plumas and Tehama also experienced price declines in the first month of 2021, but their losses were all less than five percent.

- Homeowners reluctant to list their homes for sale during the pandemic is contributing to a shortage of active listings. As a result, C.A.R.'s Unsold Inventory Index (UII) remains extremely low at 1.5 months in January and was down sharply from 3.4 months in January 2020. The index indicates the number of months it would take to sell the supply of homes on the market at the current rate of sales.

- Active listings fell 53.4 percent from last year and continued to drop more than 40 percent on a year-over-year basis for the eighth straight month. On a month-to-month basis, for-sale properties dropped 10.7 percent in January.

- Except for the Bay Area, housing inventory continued to tighten up across the state in all major regions, declining more than 45 percent in January. Southern California had the biggest year-over-year supply drop of 56 percent in January, followed by the Central Coast (52.1 percent), the Central Valley (-48.6 percent), the Far North (-46.5 percent), and the San Francisco Bay Area (-30.9 percent).

- All 51 counties reported by C.A.R. experienced a year-over-year decline in active listings in January. Merced had the biggest drop from last year, with a decline of 72.8 percent, followed by Madera (-71.9 percent) and San Bernardino (-70.8 percent). Thirty-two counties had less than half the active listings they had in January 2020. San Mateo (-0.3 percent) and San Francisco (-5.6 percent) were the only counties in California with less than a 10 percent decline in active listings from the prior year.

- The 30-year, fixed-mortgage interest rate averaged 2.74 percent in January, down from 3.62 percent in January 2020, according to Freddie Mac. The five-year, adjustable mortgage interest rate was an average of 2.87 percent, compared to 3.33 percent in January 2020.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership