Commercial Real Estate News

U.S. Office Sales Total $15 Billion Halfway Through 2023

Commercial News » Los Angeles Edition | By Michael Gerrity | July 24, 2023 8:09 AM ET

According to new data by CommerialEdge, wider economic shifts fueled by multiple interest rate hikes, the growing prevalence of work from home and the increasing office footprint reductions by companies continued to pressure the U.S. office sector throughout the first half of 2023.

The national U.S. office vacancy rate reached 17.1%, rising 180 basis points over year-ago figures. At the same time, rent growth remained patchy across the country, with listing rates falling even in some of the priciest markets, such as Manhattan (down 2.8% year-over-year) and the Bay Area (down 5.57%).

Halfway through 2023, office sales totaled $14.8 billion, significantly below the $43.7 billion recorded during the same period in 2022. Overall, markets with a larger life science supply, such as Boston and New Jersey, remained attractive to investors. Besides life sciences, medical office buildings are also expected to stay a favorable property type for investors, our office market outlook shows.

The national average full-service equivalent listing in June was $37.82, an increase of 0.6% over the last year, according to the latest U.S. office market report. The average rates for A and A+ office spaces have decreased by 1.4% from last year, currently standing at $45.41 per square foot. Class B office rates have inched up by 0.3%, to $30.37 per square foot, and Class C properties also saw a slight increase of 0.3%, to $23.04 year-over-year in June.

Rents for suburban properties have increased the most, going up by 3.3% to $30.76 per square foot compared to the previous year. On the other hand, CBD office spaces have seen a decrease of 1.7% to $49.02 per square foot, while urban office spaces have gone down by 1.4% to $44.80 per square foot year-over-year in June.

While the national office vacancy rate stood at 17.1%, more than half of the top 25 markets recorded vacancies above the national average. Vacancy rates in Denver have increased 310 basis points in the last 12 months and currently sit at 20.1%, one of the highest figures among the top 25 markets. Denver also has one of the highest rates of remote work, according to data from the Census Bureau's American Community Survey.

Recently, the city government has joined other cities in paying an outside consulting firm to study the feasibility of converting largely vacant towers in the CBD into housing. In the metro's CBD, the vacancy rate stood at 31.7%, more than double compared to more in-demand submarkets such as Lower Downtown and Cherry Creek.

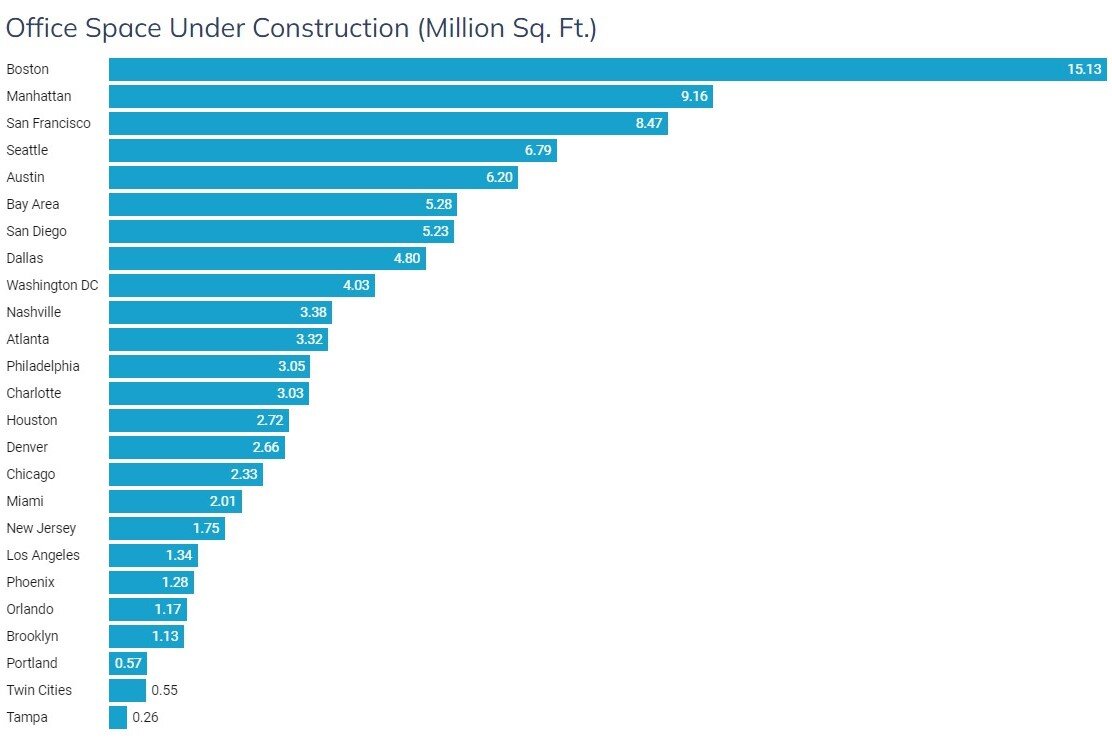

Nationally, 115.8 million square feet of office stock was under construction at the end of the second quarter of the year, accounting for 1.7% of the existing stock. Nonetheless, the under-construction pipeline continued to shrink steadily this year as projects are delivering faster than new ones are starting.

CommercialEdge reports only 15.7 million square feet of office space has started through the first two quarters, half of what had started during the same period last year. What is more, nearly two-thirds of all starts in 2023 have been in just 10 markets, primarily in those located in the Sunbelt or life science hubs.

Construction of more than 1.5 million square feet started in Austin this year, the most of any market in the country. Much of that is due to The Republic, a 48-story tower with more than 800,000 square feet of office space along 4th St. While the market has added office jobs at a faster rate than any other market in the country and has the highest office utilization in Kastle's Back to Work Barometer, there are still risks of oversupply, especially as the vacancy rate continues to rise.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Commercial Property Investors Poised to Increase Allocations in 2026

- U.S. Commercial Mortgage Debt Climbs Toward $5 Trillion

- AI Sparks a Global $3 Trillion Data Center Supercycle

- AI Rewrites Playbook for Global Property Dealmakers, Says PwC

- Hong Kong's Central Office Market Enjoys First Rent Increase Since 2022

- U.S. Commercial Real Estate Lending Spikes in Q3

- Commercial Lending Surges in America

- North America Real Estate Enters a Tech-Driven, Boomers-Fueled Era in 2026

- U.S. Commercial Mortgage Delinquencies Ease in Q3

- Rents Hit 18-Year High in Tokyo as Japan's Office Market Defies Gravity

- Hong Kong Office Market Rebounds, IPO Activity Spurs Leasing Demand

- Poland's Commercial Markets Enjoy Rising Property Investment Activity

- Asia-Pacific Property Markets Show Signs of Revival as Investment Rises

- World Property Ventures Raising Capital to Digitize the Global Real Estate Economy

- U.S. Data Center Boom Tests Power Grid as AI Demand Outpaces Supply

- Commercial, Multifamily Mortgage Debt Climbs to Record $4.88 Trillion in U.S.

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs