Residential Real Estate News

California Statewide Home Sales Down 7.4 Percent in April

Residential News » Los Angeles Edition | By Michael Gerrity | May 26, 2022 8:59 AM ET

Rising interest rates, climbing home prices moderate California home sales

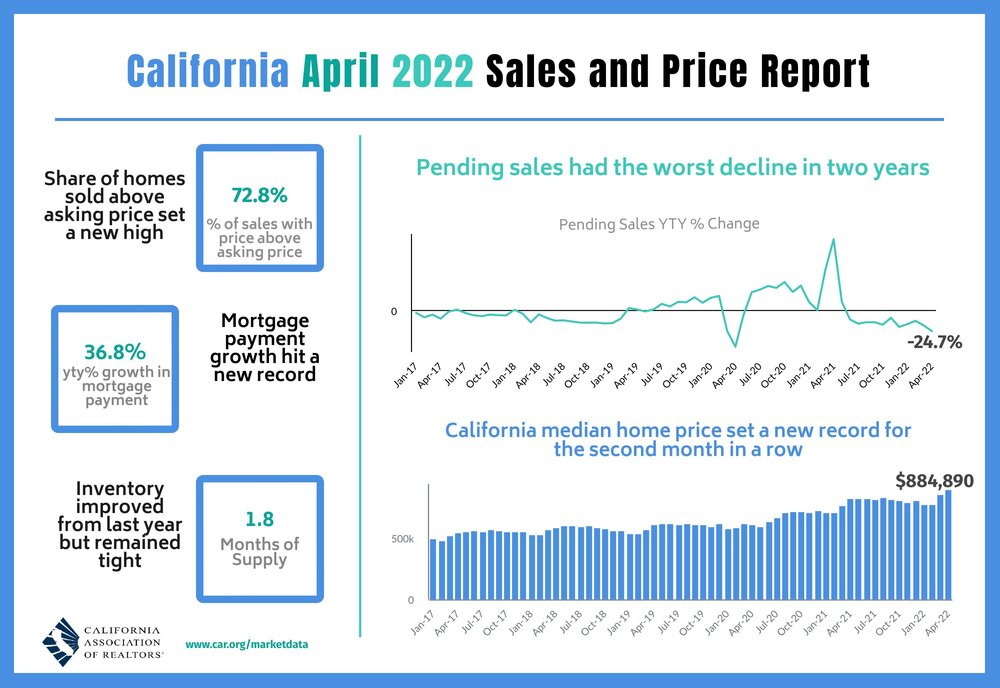

According to the California Association of Realtors, California home sales retreated in April 2022 as rising interest rates and higher home prices depressed housing demand even as the statewide median home price set another record for the second straight month, primarily due to strong sales at the top end of the market.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 419,040 in April, according to information collected by C.A.R. The statewide annualized sales figure represents what would be the total number of homes sold during 2022 if sales maintained the April pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

April's sales pace was down 1.9 percent on a monthly basis from 426,970 in March and down 8.5 percent from a year ago, when 458,170 homes were sold on an annualized basis. The month-to-month April sales decline is in line with the long-run change of -1.6 percent recorded between March and April. The annual sales drop, however, was the biggest decline in the last four months. On a year-to-date basis, sales were down 7.4 percent in April.

"As rates remain on the rise, the sense of urgency to buy is keeping the market highly competitive, especially since housing inventory continues to stay well below pre-pandemic levels," said C.A.R. President Otto Catrina. "While we will likely see more listings come on to the market as we move further into the home-buying season, the housing shortage issue will likely persist throughout the rest of the year in major metropolitan areas, such as the Bay Area and the Southern California region."

California's median home price set another record in April at $884,890 -- surpassing the record of $849,080 set just the previous month. The April price was 4.2 percent higher than the $849,080 recorded in March and 8.7 percent higher than the $814,010 recorded last April. The year-over-year increase was the smallest since June 2020 but was strong enough to establish a new peak price for the state. The month-to-month percent change was higher than the long run average of 2.3 percent recorded between a March and an April in the last 43 years.

A change in the mix of sales continues to play a role in statewide record-setting home prices as sales in high-priced markets remain stronger than their more affordable counterparts. The share of million-dollar home sales increased for the third consecutive month, reaching the highest level on record at 34.7 percent. Home sales priced below $500,000, meanwhile, dipped again in April and hit the lowest level ever. Sales dropped by double-digits for price segments $750,000 and below, while sales above $2 million remained on the rise on a year-over-year basis. The shift in the mix of sales toward high-end homes is expected to persist in the upcoming months.

"California's housing market is moderating from the 12-year-high levels experienced in 2021, as higher mortgage interest rates and soaring home prices are starting to have an adverse impact on housing demand," said C.A.R. Vice President and Chief Economist Jordan Levine. "With April pending home sales recording the worst drop in two years, the affordability challenges that buyers have been encountering are materializing in recent sales trends, and further declines in housing demand could continue in the second half of the year."

Other key points from C.A.R.'s April 2022 resale housing report include:

- At the regional level, home sales in all major California regions declined from a year ago, with three of the five regions falling by double-digits on a year-over-year basis. The Central Coast region continued to have the biggest decline of all regions in April, with sales dropping 21.3 percent from a year ago. Despite being down sharply from last year's unusually high level, April's sales in the Central Coast were only down 2.1 percent from the pre-pandemic average. The San Francisco Bay Area (-18.1 percent) and Southern California (-16.0 percent) were the other two major regions with sales declines exceeding 10 percent from a year ago.

- More than four in five of all counties tracked by C.A.R. experienced a sales decline from a year ago in April 2022, compared to nearly two in three the prior month. Sales in 29 California counties fell more than 10 percent from a year ago, with Mono dropping the most at 70.0 percent, followed by Glenn (-41.7 percent) and Plumas (-29.3 percent). Counties with a sales drop from last year decreased an average of -16.3 percent in April. Only nine counties recorded a sales increase on a year-over-year basis in April, compared to 19 counties in March. Yuba (43.2 percent) had the largest sales growth from last year, followed by Sutter (25.4 percent) and Mariposa (18.2 percent). Through the first four months of 2022, Plumas had the biggest year-to-date sales decline, registering -31.0 percent, while Yuba (+61.3 percent) had the best sales performance of all counties.

- At the regional level, home prices in all major California regions, except the Far North continued to surge from last year by double-digits, with three of them reaching a new record high in April. The San Francisco Bay Area recorded the highest year-over-year price growth with an increase of 15.9 percent, followed by the Central Valley (14.9 percent), the Central Coast (13.4 percent), Southern California (11.7 percent), and the Far North (8.9 percent).The Central Coast and the Far North were the only regions that did not post a new record median price in April.

- At the county level, home prices continued to rise across the state, with 26 counties in California setting new record median highs in April. Forty-five out of 51 counties tracked by C.A.R. recorded a price increase in April, with 33 of them rising 10 percent or more from a year ago. Mono had the biggest year-over-year gain in median price at 142.6 percent, followed by Marin (31.2 percent) and Mariposa (23.3 percent). The median price in six counties dipped from last year, with Plumas dropping the most at -12.5 percent, followed by Glenn (-7.0 percent) and Tehama (-3.3 percent).

- The overall housing supply condition in California improved in April, with the statewide Unsold Inventory Index (UII) inching up slightly from last month and from the same month a year ago. The number of active listings surged more than 20 percent on a year-over-year basis and recorded the highest yearly growth in properties for sale since January 2019. Active listings in April climbed to the highest level in seven months

- Forty of the 51 counties tracked by C.A.R. recorded an increase in active listings on a year-over-year basis in April, compared to 36 counties in March. For the second straight month, Yuba had the biggest increase in homes on the market with a jump of 176.7 percent in growth in active listings from last April. Sutter (108.7 percent) and Glenn (100.0 percent) were the other two counties that also experienced triple-digit annual increases in active listings. On the other hand, eight counties came in short on properties on the market when compared to the same month of last year, with Sonoma dropping the most at -26.2 percent, followed by Mono (-23.3 percent) and Lassen (-21.6 percent).

- The median number of days it took to sell a California single-family home was 8 days in April and 7 days in April 2021.

- C.A.R.'s statewide sales-price-to-list-price ratio* was 104.2 percent in April 2022 and 103.3 percent in April 2021.

- The statewide average price per square foot** for an existing single-family home was $433, up from $383 in April a year ago.

- The 30-year, fixed-mortgage interest rate averaged 4.98 percent in April, up from 3.06 percent in April 2021, according to Freddie Mac. The five-year, adjustable mortgage interest rate averaged 3.70 percent, compared to 2.81 percent in April 2021.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Housing Market Tilts Toward Buyers as Prices Cool

- Ultra-Luxury Home Sales Surge Globally in Late 2025 as 555 Mega-Deals Close

- U.S. Luxury Home Prices Outpaced the Broader Market in 2025

- U.S. Homeowner Equity Growth Cooled in 2025 but Remained Historically Strong

- U.S. Homebuyers Scored Biggest Price Discounts Since 2012 as Market Shifts

- Ten Key Takeaways from the U.S. Housing Market in January

- Hong Kong Stock Market Front-Runs Local Home Prices by Two Months

- Mass Exodus: U.S. Homebuyers Cancel Deals at Record Levels

- U.S. Housing Outlook for 2026 Darkens After Sharp December Pullback in Contract Signings

- America's Housing 'Silver Tsunami' Is Turning Into a Trickle

- Builders Tell Congress Government Rules Are Pricing Americans Out of Housing

- California Housing Market Poised for Balanced Growth in 2026

- U.S. Housing Market Hits Largest Buyer-Seller Imbalance on Record

- Miami Housing Market Ends 2025 on Firmer Ground

- U.S. Homebuilder Confidence Dips at Start of 2026

- Remodeling Outlook Improves as U.S. Homeowners Tap Equity

- U.S. Home Sales Hit Three-Year High in December as Rates Ease

- Las Vegas Area Home Sales Hit 18-Year Low in 2025

- U.S. Mortgage Rates Hit Three-Year Low in January

- U.S. Home Affordability Closed Out 2025 Near Record Lows

- Ireland Home Prices Uptick 5.5 Percent in 2025 Amid Supply Shortages

- One Year After Los Angeles Wildfires, Investors Snap Up Burned Lots

- Greater Palm Beach Area Home Sales Surge in Late 2025

- U.S. Homebuilder Sentiment Ends 2025 in Negative Territory

- America's Single-Family Rent Boom Loses Steam in Late 2025

- Miami Home Price Gains Extend 14-Year Run in 2025

- Why Pre-Biden Mortgages Froze the U.S. Housing Market

- From Bricks to Blockchain: How Digital Dollars Could Soon Rewire Global Real Estate

- U.S. Home Sales Slightly Uptick in November

- Greater Orlando Area Home Sales Dive 22 Percent in November

- World Property Exchange Aims to Make Real Estate Ownership Instantly Tradeable and Democratized on a Planetary Scale

- Falling Home Prices Slash U.S. Homeowner Equity by $13,400 on Average in 2025

- Home Listings in U.S. See Sharpest Drop in Two Years Amid Cooling Buyer Demand

- Dutch Investors Pour Record $4.2 Billion in New Rental Housing in 2025

- U.S. Housing Markets Poised for 2026 Rebound, NAR Says

- Las Vegas Home Prices Hit Record High in November as Inventory Swells, Sales Cool

- Investors Accounted for 30 Percent of All U.S. Home Purchases in 2025

- Canadian Home Sales Recovery Continues in October

- Global Luxury Home Price Growth Cools to 2-Year Low in September

- U.S. Housing Market Recovery to Remain Fragile in 2026