Residential Real Estate News

California Home Sales Dip 34 Percent Annually in March

Residential News » Los Angeles Edition | By Michael Gerrity | April 25, 2023 8:34 AM ET

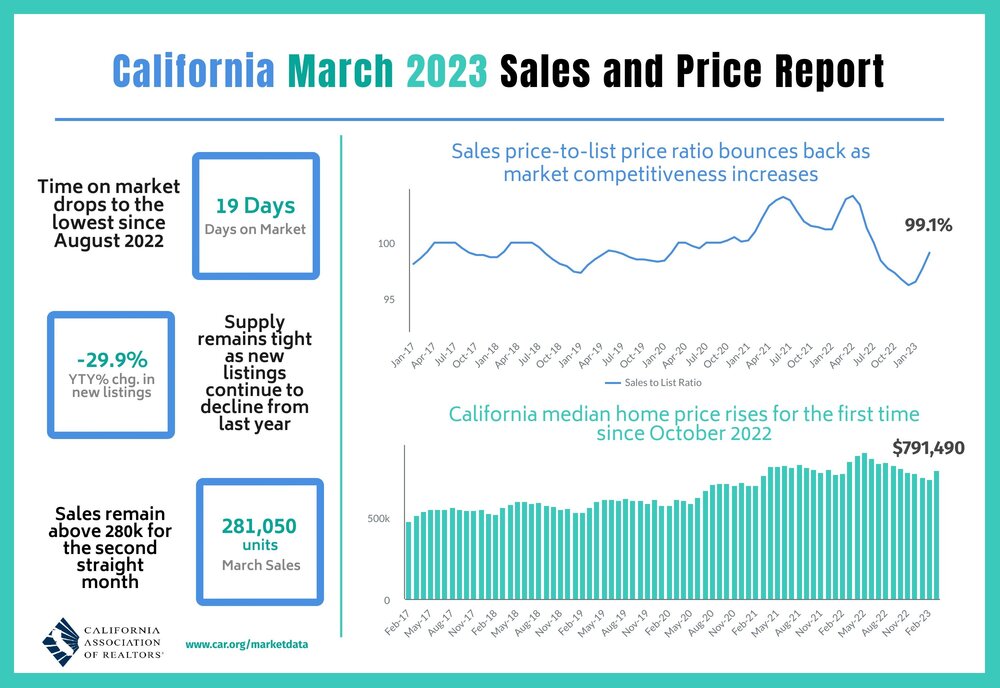

According to the California Association of Realtors, California's March 2023 home sales pace was down 1.0 percent on a monthly basis from 284,010 in February 2023, but down 34.2 percent from a year ago, when a revised 427,040 homes were sold on an annualized basis. Sales of existing single-family homes in California remained below the 300,000-unit pace for the sixth consecutive month.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 281,050 in March 2023. The statewide annualized sales figure represents what would be the total number of homes sold during 2023 if sales maintained the March pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

"Despite a dip in March home sales, the competitiveness in the housing market continues to heat up, as homes are selling faster, and the sales-to-list-price ratio is improving, all the while when the number of homes available for sale continues to tighten," said C.A.R. President Jennifer Branchini. "All signs point to a market with solid demand, which should help bolster sales through the homebuying season."

California's median home price grew for the first time in seven months in March, increasing 7.6 percent from February's $735,480 to $791,490. March's price also was lower on a year-over-year basis for the fifth consecutive month, declining 7.0 percent from the revised $851,130 recorded last March. With home prices rising more sharply than the normal seasonal pattern last year, the market could see larger year-over-year price drops as it moves through the spring home-buying season.

"While home sales continue to hover below the 300,000-unit annualized pace, the market seems to have weathered more aggressive rate hikes and banking failures quite well in the last few weeks," said C.A.R. Vice President and Chief Economist Jordan Levine. "If interest rates stabilize or even improve in the next couple of months, home sales should rise during the spring home-buying season, but tight inventory will prevent a rapid rebound."

C.A.R. March 2023 Housing Data Key Points

- At the regional level, all regions except the Central Valley (-27.7 percent) continued to record annual sales declines of more than 30 percent, with the Far North dropping the most at -38.9 percent. Sales in four of the six counties in the region dipped more than 40 percent from a year ago. The San Francisco Bay Area followed closely behind with a sales decrease of 35.5 percent from a year ago, while Southern California (-33.8 percent) and Central Coast (-31.2 percent) both declined sharply from last March

- All but one of the 51 counties tracked by C.A.R. experienced a sales drop from a year ago in March, with 35 counties dropping more than 30 percent year-over-year and five counties plummeting more than 50 percent from last March. Extreme weather conditions throughout the state in the past few weeks had a negative impact on the housing market, which contributed to sharp sales declines in some of these counties. Plumas (-77.3 percent) had the largest sales drop in March, followed by Mono (-70.6 percent) and Glenn (-52.9 percent). Amador was the only county with an annual sales increase, with a year-over-year gain of 6.4 percent. The market is gaining momentum, however, as it enters the spring homebuying season. All but one county tracked by C.A.R. posted a sales gain on a month-over-month basis, while sales in 23 counties grew more than 50 percent from February.

- At the regional level, median home prices dropped from a year ago in all major regions, with prices in three of the five regions declining more than 10 percent year-over-year in March. Home prices in the San Francisco Bay Area continued to drop the most of all regions, even though it was no longer the only region with a double-digit decline. With prices in five counties falling over 10 percent year-over-year, the median price for the Bay Area region was down 12.8 percent from March 2022. The sharp decline is attributable partly to the base effect, as prices surged a year ago when many homebuyers tried to close transactions before rates climbed further. Central Coast (-12.1 percent) and the Far North (-10.1 percent) were the other two regions with a double-digit loss from a year ago, followed by Central Valley (-8.4 percent) and Southern California (-4.0 percent).

- More than four out of five counties experienced year-over-year price declines in March, with 18 counties falling more than 10 percent on a year-over-year basis. Santa Barbara (-40.8 percent) had the biggest drop of all counties, followed by Mono (-31.8 percent), and Tehama (-29.5 percent). Six counties registered an increase in their median prices from last March, with all but one county growing less than 10 percent. Glenn had the biggest gain in price of all counties with an increase of 15.6 percent, followed by Kings (9.2 percent) and Humboldt (4.7 percent).

- Following its typical seasonal pattern, housing inventory in California dipped on a monthly basis for the second straight month from 3.2 months in February to 2.2 months in March, the lowest level since May 2022. The statewide unsold inventory index (UII) in March 2023, nevertheless, continued to increase from a year ago, jumping 37.5 percent on a year-over-year basis. The surge in UII was due primarily to low housing demand as existing home sales remained below the annualized 300,000 benchmark level.

- All price ranges posted an increase in UII from a year ago by 28 percent or more, with the $1 million and up gaining the most (50 percent), followed by the $500,000 - $749,000 price range (25.0 percent), the $750,000 - $999,000 (23.5 percent) and the sub $500,000 (16.7 percent).

- With sales remaining 30 percent or more below last year's level for more than half of the counties in California, active listings continued to surge year-over-year in March. Twenty-one counties recorded a double-digit, year-over-year gain in March as compared to 43 counties in February. Marin registered the largest yearly growth of 52.5 percent, followed by Kings (50.7 percent) and Riverside (46.3 percent). Meanwhile, 20 counties recorded a decline in active listings from a year ago as sales growth outpaced the gain in new active listings in some of these counties. Mono (52.9 percent) had the biggest year-over-year decline in March, followed by Alameda (-45.3 percent) and Contra Costa (-43.2 percent).

- Despite the increase in overall active listings in March, housing inventory is much tighter than what the yearly growth suggests. While new active listings added in March improved 27.9 percent on a month-to-month basis from the prior month, the figure also declined 30 percent year-over-year from the same month in 2022. The drop in new active listings, in fact, was the largest dip since May 2020 when the pandemic shutdown took place.

- The median number of days it took to sell a California single-family home was 19 days in March and 8 days in March 2022.

- C.A.R.'s statewide sales-price-to-list-price ratio was 99.1 percent in March 2023 and 103.9 percent in March 2022.

- The statewide average price per square foot for an existing single-family home was $388, down from $418 in March a year ago.

- The 30-year, fixed-mortgage interest rate averaged 6.54 percent in March, up from 4.17 percent in March 2022, according to Freddie Mac.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Housing Market Tilts Toward Buyers as Prices Cool

- Ultra-Luxury Home Sales Surge Globally in Late 2025 as 555 Mega-Deals Close

- U.S. Luxury Home Prices Outpaced the Broader Market in 2025

- U.S. Homeowner Equity Growth Cooled in 2025 but Remained Historically Strong

- U.S. Homebuyers Scored Biggest Price Discounts Since 2012 as Market Shifts

- Ten Key Takeaways from the U.S. Housing Market in January

- Hong Kong Stock Market Front-Runs Local Home Prices by Two Months

- Mass Exodus: U.S. Homebuyers Cancel Deals at Record Levels

- U.S. Housing Outlook for 2026 Darkens After Sharp December Pullback in Contract Signings

- America's Housing 'Silver Tsunami' Is Turning Into a Trickle

- Builders Tell Congress Government Rules Are Pricing Americans Out of Housing

- California Housing Market Poised for Balanced Growth in 2026

- U.S. Housing Market Hits Largest Buyer-Seller Imbalance on Record

- Miami Housing Market Ends 2025 on Firmer Ground

- U.S. Homebuilder Confidence Dips at Start of 2026

- Remodeling Outlook Improves as U.S. Homeowners Tap Equity

- U.S. Home Sales Hit Three-Year High in December as Rates Ease

- Las Vegas Area Home Sales Hit 18-Year Low in 2025

- U.S. Mortgage Rates Hit Three-Year Low in January

- U.S. Home Affordability Closed Out 2025 Near Record Lows

- Ireland Home Prices Uptick 5.5 Percent in 2025 Amid Supply Shortages

- One Year After Los Angeles Wildfires, Investors Snap Up Burned Lots

- Greater Palm Beach Area Home Sales Surge in Late 2025

- U.S. Homebuilder Sentiment Ends 2025 in Negative Territory

- America's Single-Family Rent Boom Loses Steam in Late 2025

- Miami Home Price Gains Extend 14-Year Run in 2025

- Why Pre-Biden Mortgages Froze the U.S. Housing Market

- From Bricks to Blockchain: How Digital Dollars Could Soon Rewire Global Real Estate

- U.S. Home Sales Slightly Uptick in November

- Greater Orlando Area Home Sales Dive 22 Percent in November

- World Property Exchange Aims to Make Real Estate Ownership Instantly Tradeable and Democratized on a Planetary Scale

- Falling Home Prices Slash U.S. Homeowner Equity by $13,400 on Average in 2025

- Home Listings in U.S. See Sharpest Drop in Two Years Amid Cooling Buyer Demand

- Dutch Investors Pour Record $4.2 Billion in New Rental Housing in 2025

- U.S. Housing Markets Poised for 2026 Rebound, NAR Says

- Las Vegas Home Prices Hit Record High in November as Inventory Swells, Sales Cool

- Investors Accounted for 30 Percent of All U.S. Home Purchases in 2025

- Canadian Home Sales Recovery Continues in October

- Global Luxury Home Price Growth Cools to 2-Year Low in September

- U.S. Housing Market Recovery to Remain Fragile in 2026