Residential Real Estate News

California Home Sales Begin to Cool in May

Residential News » Los Angeles Edition | By Michael Gerrity | June 24, 2021 8:25 AM ET

Yet California home prices hit another record high in May

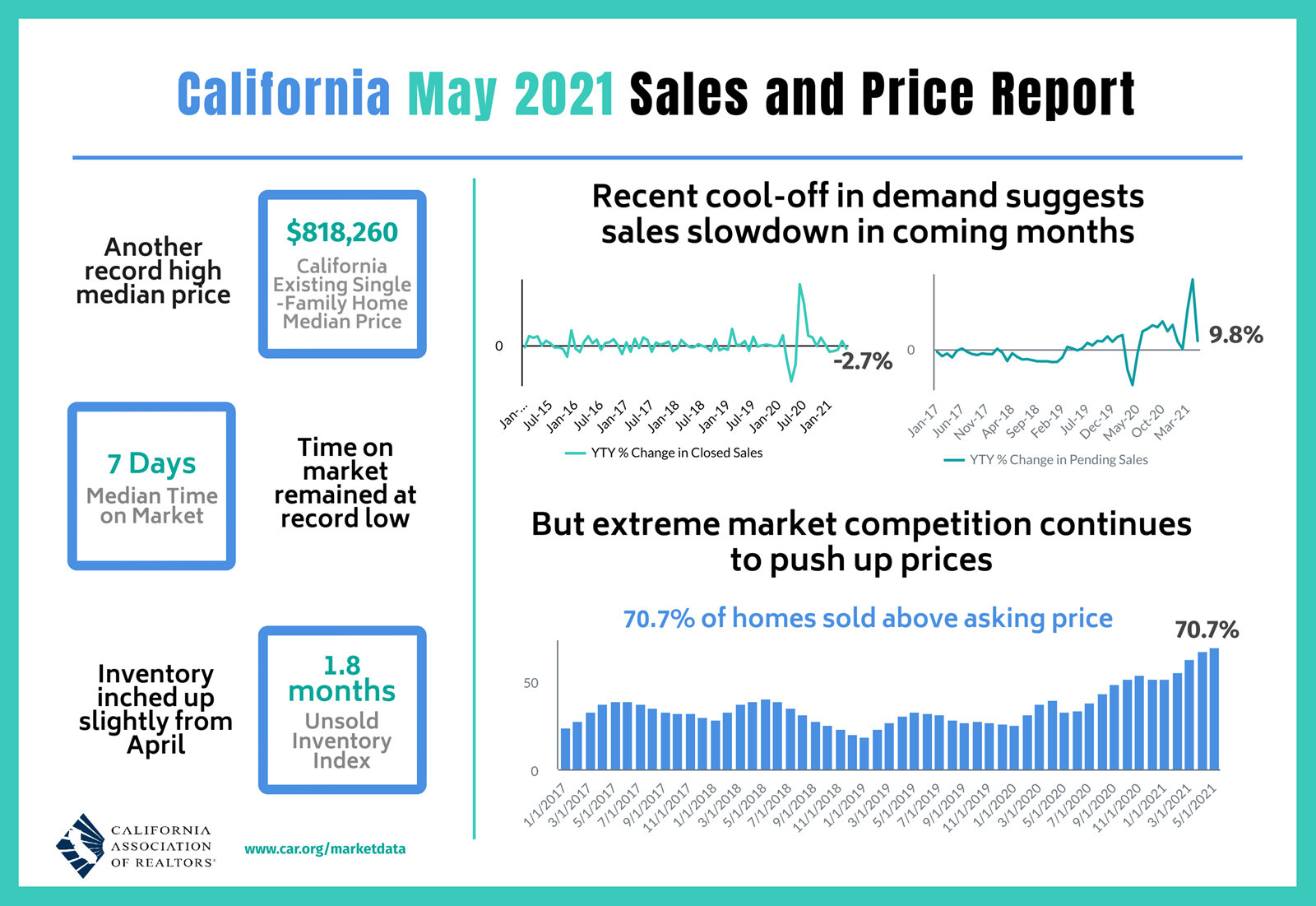

According to the California Association of Realtors, after months of breakneck market competition, California home sales moderated in May 2021 as buyer fatigue set in, while the median home price set another record high.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 445,660 in May 2021. The statewide annualized sales figure represents what would be the total number of homes sold during 2021 if sales maintained the May pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

May home sales dipped 2.7 percent on a monthly basis from 458,170 in April and up 86.7 percent from a year ago, when 238,740 homes were sold on an annualized basis. The sharp yearly sales jump was expected as the housing market was hit hard by the pandemic shutdown last year, when home sales dropped to the lowest level since the Great Recession.

"The overheated housing market is showing signs of a much-needed cooling and could be a sign of waning buyer interest as the torrid pace of home price increases and buyer fatigue adversely affected demand," said C.A.R. President Dave Walsh. "We're seeing many would-be buyers taking a break and hoping to see more listings as the economy reopens and prospective sellers list their homes for sale."

California's median home price set another new record high in May as the statewide median price inched up 0.5 percent on a month-to-month basis to $818,260 in May, up from April's revised $814,010 and up 39.1 percent from the $588,070 recorded last May. The year-over-year price gain was the highest ever recorded, and it was the second straight month that the state recorded an annual increase of over 30 percent.

Robust demand of higher-priced properties contributed to the record-setting statewide median price. With million-dollar home sales surging more than 200 percent from May 2020, its market share is nearly double what it was a year ago when it was at 15.6 percent. More million-dollar properties were sold in the past couple of months than homes priced below $500,000.

"A lack of housing inventory continues to push up prices, and modestly higher interest rates, increased competition, and declining affordability have caused some buyers to become discouraged. Despite strong growth rates, the level of home sales has fallen on a monthly basis in four of the last five months," said C.A.R. Vice President and Chief Economist Jordan Levine. "Additionally, pending sales data for May, which was virtually unchanged from April, suggests further slowing in coming months. Fortunately, new listings have finally started to rise, which could help to sustain a higher level of home sales deeper into summer by providing much-needed supply."

Other key points from C.A.R.'s May 2021 resale housing report include:

- At the regional level, all major regions had at least 44 percent year-over-year growth in sales from last May when the market hit its lowest point in 2020. Among all regions, the Central Coast had the biggest jump of 111.8 percent from a year ago, with sales in all four counties in the region surging by more than 99 percent.

- The San Francisco Bay Area also increased in sales by triple-digits (104.6 percent) from last year, followed by Southern California (80 percent), the Far North (58.6 percent), and the Central Valley (44 percent).

- Nearly all counties -- 49 of 51 -- tracked by C.A.R. recorded a year-over-year sales increase in May, with 17 counties more than doubling the sales level reached a year ago. Six of the counties with more than 100 percent growth rate had a median price above $1 million in May 2021. Mono had the strongest sales growth from last year at 400 percent, followed by Plumas (260 percent), and San Benito (195 percent). Counties with an increase from last year had an averaged gain of 89.2 percent in May, compared to 70.7 percent in April. Del Norte (-59.1 percent) and Glenn (-4.3 percent) were the only counties with a sales decline from last year.

- Sales growth remained concentrated in higher-priced markets, while home sales in the lower-end continued to be lackluster. Demand in the million-dollar segment increased by more than 200 percent year-over-year, with sales of homes priced $2 million and higher surging over 300 percent from a year ago. Sales of properties priced below $300k, on the other hand, continued to fall precipitously, with the year-over-year sales dropping 34 percent in May. Tight housing supply continues to be the primary factor constraining sales in the lower price segment.

- Three out of five major regions reached new record high median prices in May, with each region growing more than 20 percent from a year ago. The San Francisco Bay Area had the highest year-over-year gain of 38.9 percent, followed by Southern California (33.1 percent), the Central Coast (32.6 percent), the Central Valley (27.1 percent), and the Far North (22.1 percent).

- All 51 counties tracked by C.A.R. notched a gain in their median price on a year-over-year basis, with 50 of them reporting at least a double-digit growth rate from last May. Mono had the largest price growth of 119.2 percent in May, followed by Santa Barbara (103.8 percent) and Plumas (57.2 percent). Thirty-two counties set new record high median prices in May. Marin had the smallest price growth of all counties with an 8.8 percent increase from May 2020. It was also the only county with a single-digit price gain from a year ago.

- The Unsold Inventory Index (UII) improved slightly from 1.6 months in April to 1.8 months in May but remained sharply below last year's level. The month-over-month rise in inventory is partly due to a slight increase in housing supply, but a slowdown in housing demand in May also contributed to a bump in the index. The index indicates the number of months it would take to sell the supply of homes on the market at the current rate of sales.

- Active listings reached the highest level in six months after a 6.6 percent monthly increase in May and continued to inch up, following the seasonal pattern. Housing supply typically climbs during this time of the year and usually remains on an upward trend until late July/early August. The pace of growth on a month-to-month basis is on par with the average growth rate of 6.7 percent from April to May recorded between 2015 to 2019.

- All counties reported by C.A.R. saw a decline in active listings from last May, and nearly all counties -- 49 out of 51 -- dipped more than 20 percent from year-ago levels. Ventura had the largest decline in housing supply, dropping 63.5 percent year-over-year, while Amador followed closely with a 62.5 percent slide from a year ago. Lassen (-1.8 percent) and San Francisco were the only two counties in the state with a single-digit decline in active listings from the prior year.

- The median number of days it took to sell a California single-family home remained unchanged at the record low of 7 days in May, down from 17 days in May 2020.

C.A.R.'s statewide sales-price-to-list-price ratio* posted a record high in May at 103.8 percent and was 99.7 percent in May 2020. - The statewide average price per square foot** for an existing single-family home remained elevated. At $387, May's price per square foot was an all-time high. The price per square foot was $281 in May a year ago.

- The 30-year, fixed-mortgage interest rate averaged 2.96 percent in May, down from 3.23 percent in May 2020, according to Freddie Mac. The five-year, adjustable mortgage interest rate was an average of 2.62 percent, compared to 3.16 percent in May 2020.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership