Residential Real Estate News

Rising Mortgage Rates Continue to Slow U.S. Home Sales in September

Residential News » Los Angeles Edition | By David Barley | October 20, 2022 8:45 AM ET

Based on a new report by Zillow, the U.S. housing market continued to drastically cool in September 2022, though rebalancing from monumental appreciation is producing vastly different conditions depending on region and metro.

Affordability issues are driving the pullback in activity; steep prices mixed with high and volatile mortgage rates have stunted sales and frozen current owners in their homes, reducing the flow of new inventory.

Current homeowners are looking at home prices and the mortgage market and deciding to stay put. Among home sellers, 71% are also buyers. Homeowners who either bought or refinanced at record-low rates over the past two years understand that current rates are going to yield a lot less home than they're currently in unless they seek out a much more affordable area.

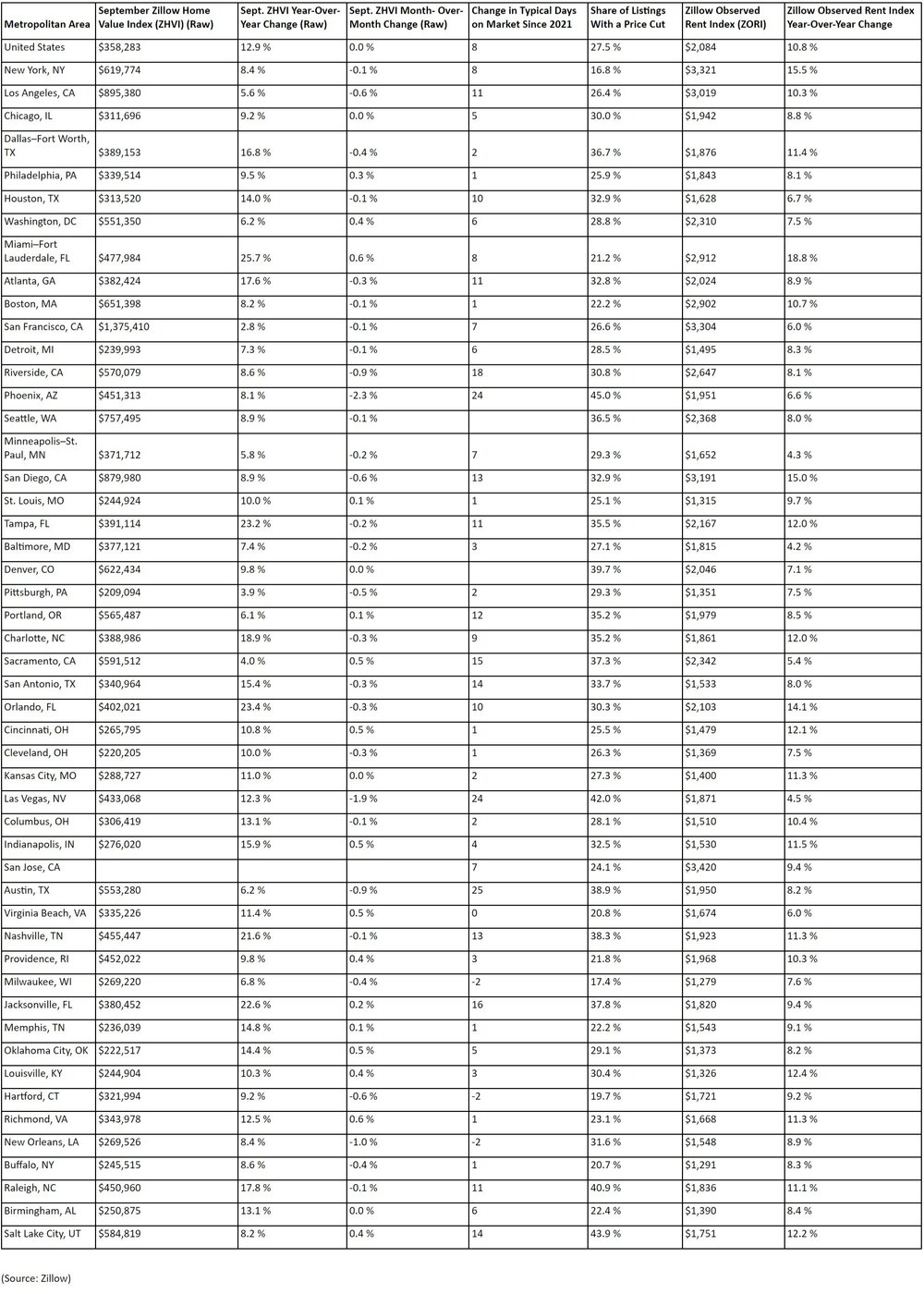

At the national level, home values stayed roughly steady from August to September after dropping in the previous two months. The typical U.S. home value is $358,283, up 12.9% from last year and nearly $110,000 (43.5%) above 2019. Of the 100 largest metros, exactly half saw home values rise from August to September 2022.

"The late-summer mortgage rate reprieve brought a short-lived surge of buyers back into the market, proving that many priced-out home shoppers are poised to buy when homeownership becomes more affordable," said Jeff Tucker, senior economist at Zillow. "Unfortunately, shoppers this winter are more likely to contend with mortgage rates in the ballpark of 7%, making even this summer's rising rates look modest by comparison. Still, as many rate-sensitive shoppers stay sidelined, those who forge ahead now will find more options and more eager sellers than anytime since the pandemic began."

Home values have fallen the furthest from peak levels in expensive and high-growth metros in the Mountain states and on the West Coast; the largest drops are in Austin (-8.2%), San Francisco (-7.9%) and Salt Lake City (-6.8%). Among the 100 largest U.S. metros, the 17 with the largest home value declines from peak levels are in the West. However, owners in these areas should still have significant equity in their homes; home value appreciation since 2019 ranges from 26% in San Francisco to 65% in Austin.

Sales slowed significantly in September. The number of newly pending listings fell 18% month over month and are down 29.3% compared to last year, in part because of a sharp deceleration in activity at the end of the month, when rates were highest. Sales are down more than 6% from September 2019. Mortgage rates -- the largest driver of monthly payments -- rose through September and are so volatile, they are hurting buyers' ability to plan for the future.

The flow of new for-sale listings to the market remained anemic; an 11.4% drop from August was the third straight month of double-digit declines. Although the flow of new listings typically slows down at this time of year, the decline from this year's spring peak is larger than in 2019. But even as demand has fallen off, tight supply could insulate the market from a significant price correction.

Total inventory is now 3% above levels a year ago, but remains 38% below that of 2019. Considering the drastic decline in new additions to the market, the rise in total inventory is due to listings staying on the market longer. Listings' median time on the market rose from August and now stands at 19 days. That's a more leisurely pace than last year's 11 days on market, but much faster than in September 2019, when listings typically waited a month before the seller accepted an offer.

Buyers still in the market are seeing far less competitive conditions than in months past, giving them more time to decide on a home, less chance of a bidding war and greater leverage in negotiations.

Now at 27.5% nationwide, the share of listings with a price cut is also rising -- up from 18.3% in 2021 and September 2019's rate of 22.3%. Among the top-100 largest metro areas, those with the largest share of price cuts are Boise (47.8%), Phoenix (45%), Ogden, Utah (44.4%), and Salt Lake City (43.9%).

Although rent growth is moderating, rapid increases throughout the pandemic have drastically reduced rental affordability. Zillow's rent index pegs typical U.S. rent at $2,084, with 10.8% annual growth in September, down from a record-breaking peak of 17.2% in February. Month-over-month growth has declined to a more normal rate of 0.3% -- far from the peak of 2.2% seen in July 2021.

But the share of renters' income that goes toward housing has marched up, from 29% in September 2019 to 35% now. When housing costs require more than 30% of a household's income, it becomes a financial burden, leaving less to spend on other essentials, like groceries. And a typical renter spending more than 32% of their income on rent has been tied to a more rapid increase in homelessness. Since 2019, rents have risen the most in Miami (51.5%), Tampa (49.1%) and Phoenix (43.8%).

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Housing Market Tilts Toward Buyers as Prices Cool

- Ultra-Luxury Home Sales Surge Globally in Late 2025 as 555 Mega-Deals Close

- U.S. Luxury Home Prices Outpaced the Broader Market in 2025

- U.S. Homeowner Equity Growth Cooled in 2025 but Remained Historically Strong

- U.S. Homebuyers Scored Biggest Price Discounts Since 2012 as Market Shifts

- Ten Key Takeaways from the U.S. Housing Market in January

- Hong Kong Stock Market Front-Runs Local Home Prices by Two Months

- Mass Exodus: U.S. Homebuyers Cancel Deals at Record Levels

- U.S. Housing Outlook for 2026 Darkens After Sharp December Pullback in Contract Signings

- America's Housing 'Silver Tsunami' Is Turning Into a Trickle

- Builders Tell Congress Government Rules Are Pricing Americans Out of Housing

- California Housing Market Poised for Balanced Growth in 2026

- U.S. Housing Market Hits Largest Buyer-Seller Imbalance on Record

- Miami Housing Market Ends 2025 on Firmer Ground

- U.S. Homebuilder Confidence Dips at Start of 2026

- Remodeling Outlook Improves as U.S. Homeowners Tap Equity

- U.S. Home Sales Hit Three-Year High in December as Rates Ease

- Las Vegas Area Home Sales Hit 18-Year Low in 2025

- U.S. Mortgage Rates Hit Three-Year Low in January

- U.S. Home Affordability Closed Out 2025 Near Record Lows

- Ireland Home Prices Uptick 5.5 Percent in 2025 Amid Supply Shortages

- One Year After Los Angeles Wildfires, Investors Snap Up Burned Lots

- Greater Palm Beach Area Home Sales Surge in Late 2025

- U.S. Homebuilder Sentiment Ends 2025 in Negative Territory

- America's Single-Family Rent Boom Loses Steam in Late 2025

- Miami Home Price Gains Extend 14-Year Run in 2025

- Why Pre-Biden Mortgages Froze the U.S. Housing Market

- From Bricks to Blockchain: How Digital Dollars Could Soon Rewire Global Real Estate

- U.S. Home Sales Slightly Uptick in November

- Greater Orlando Area Home Sales Dive 22 Percent in November

- World Property Exchange Aims to Make Real Estate Ownership Instantly Tradeable and Democratized on a Planetary Scale

- Falling Home Prices Slash U.S. Homeowner Equity by $13,400 on Average in 2025

- Home Listings in U.S. See Sharpest Drop in Two Years Amid Cooling Buyer Demand

- Dutch Investors Pour Record $4.2 Billion in New Rental Housing in 2025

- U.S. Housing Markets Poised for 2026 Rebound, NAR Says

- Las Vegas Home Prices Hit Record High in November as Inventory Swells, Sales Cool

- Investors Accounted for 30 Percent of All U.S. Home Purchases in 2025

- Canadian Home Sales Recovery Continues in October

- Global Luxury Home Price Growth Cools to 2-Year Low in September

- U.S. Housing Market Recovery to Remain Fragile in 2026