Commercial Real Estate News

Commercial Real Estate Lending in U.S. Show Resilience in Q1

Commercial News » New York City Edition | By Michael Gerrity | May 19, 2021 8:00 AM ET

According to CBRE research, the improving U.S. economy created a favorable capital markets environment for commercial real estate lending in Q1 2021, despite continuing challenges in office and retail loan underwriting.

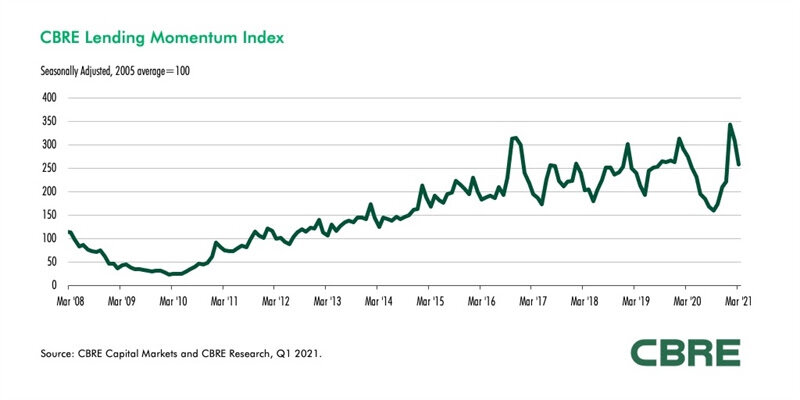

The CBRE Lending Momentum Index, which tracks the pace of CBRE-originated commercial loan closings in the U.S., continued to recover and finished Q1 2021 at a value of 258 (up 16.7% from the December 2020 reading) after rising to a cycle high of 342 in January. With the recovery of commercial mortgage capital markets beginning last summer, the index is now just 6% below its year-ago level. Lending activity hit its most recent low in September 2020, when the index value was 160.

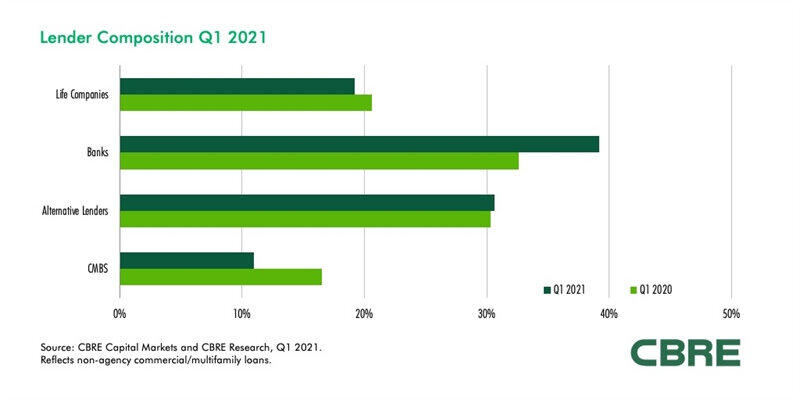

Banks and alternative lenders, such as credit companies and debt and pension funds, were most active in the first quarter, while credit spreads and mortgage rates remained quite favorable to borrowers.

"Many regional banks provided capital across a variety of product types, including permanent, bridge and construction loans. Alternative lenders continue to be a strong source of bridge capital for transitional assets," said Brian Stoffers, Global President of Debt & Structured Finance for Capital Markets at CBRE.

CBRE's lender survey indicates that after trailing life companies and alternative lenders in Q4 2020, banks took the top spot in Q1 2021 with 39.2% of non-agency commercial mortgage originations. Construction loans, mostly for warehouse and multifamily projects, accounted for 35% of bank originations--a promising sign for a return to normal lending market conditions.

Alternative lenders accounted for 30.6% of originations, primarily providing bridge loans across multiple property types, with a particular focus on multifamily.

Life companies accounted for 19.2% of commercial mortgage originations in Q1 2021, primarily permanent loans with an average loan-to-value ratio (LTV) of 54%.

CMBS lenders made 11% of originations in Q1 2021. CMBS issuance totaled $15.2 billion in Q1 2021, down from $22.9 billion in Q1 2020. While the CMBS market is off to a modest start in 2021, higher origination volume is expected in the second half of the year as pandemic restrictions ease and acquisition and refinance activity increases.

While underwriting criteria eased and loan proceeds increased, the percentage of full-term interest-only loans fell from 66.7% to 60.6% in Q1 2021. The amortization rate, which measures the average percentage of original loan balance that pays down over the loan term, increased to 26.8% in Q1 2021 from 18.6% in Q4 2020.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3