Commercial Real Estate News

Venture Backed Biotech Driving New York's Fast Growing Life Sciences Property Market

Commercial News » New York City Edition | By Michael Gerrity | June 14, 2021 8:46 AM ET

According to CBRE, one of NYC's budding commercial property sectors - the life sciences market - hasn't lost a step during the pandemic era. Even in the face of a broader economic downturn, NYC's lab tenant demand has ramped up significantly since year-end 2019, which has coincided with improvements in nearly all of the lab sector's fundamentals.

Among the milestones reached in 2020 were the first leases signed at a pair of NYC's newest life sciences developments. Protara Therapeutics leased 10,000 sq. ft. at Cure, Deerfield Management's redevelopment of 345 Park Avenue South into a premier life sciences hub and ecosystem.

Across the East River in Long Island City, ReOpen NY completed an 18,000 sq. ft. lease at Alexandria Real Estate Equities' redevelopment of the Bindery Building.

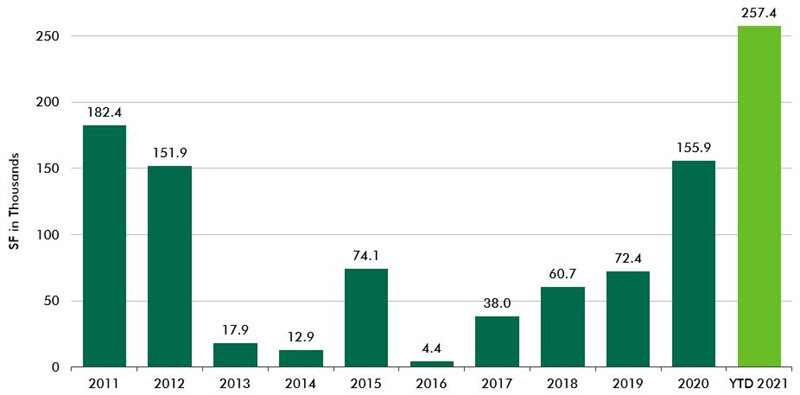

This momentum has carried into 2021, as NYC's lab leasing activity has already reached a record high for a single year, at 257,000 sq. ft. through May 2021. This year's leasing activity has been bolstered by the Icahn School of Medicine at Mount Sinai's 165,000 sq. ft. research-focused lease at 787 Eleventh Avenue and C16 Biosciences' 19,000 sq. ft. lease at the Hudson Research Center, where the Bill Gates-backed startup will relocate from its incubator space at BioLabs New York.

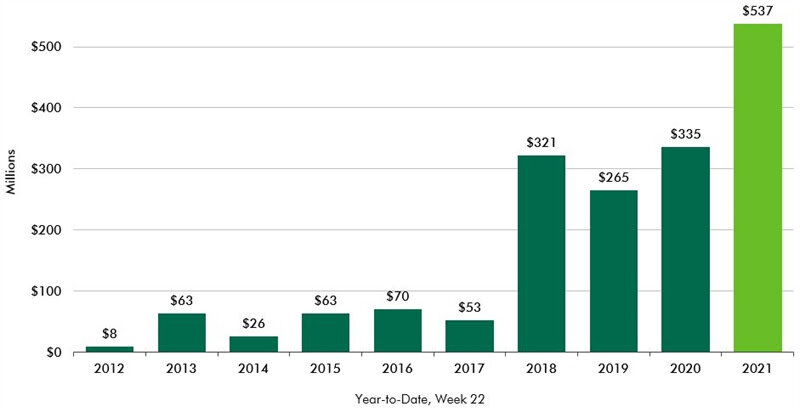

The flow of venture capital (VC) funds into the NYC life sciences market has been one of the most telling indicators in recent years of the city's expanding profile as a major hub for the sector. Following a record-setting 2017, which saw NYC's life sciences funding balloon to $1.38 billion, VC funding has seen no less than $697 million raised annually, with funding reaching its second-highest total in 2020 at $942 million.

This blistering performance has only intensified further in 2021, with NYC's life sciences VC funding off to its strongest start ever. In Q1 2021, funding amassed its highest quarterly total on record, at $393 million. And with an additional $144 million raised through roughly the first two months of Q2, 2021's year-to-date total of $537 million is now 60% ahead of the prior high point set last year through the same time frame.

Just as important as the sheer dollar volume of VC funding over the past few years is the mix of firms that are raising the capital, with a clear link between those firms receiving VC funding and those who ultimately sign lab leases in NYC. Indeed, Hibercell, a startup born out of research at the Icahn School of Medicine at Mount Sinai - which has received multiple rounds of funding including a new round in 2021 - signed a lease in early 2019 at the Hudson Research Center. Volastra Therapeutics, which inked a lease in 2020 at the Mink Building, has also received multiple funding rounds. More recently, Immunai leased space at the Alexandria Center for Life Science in Q1 2021, after receiving funding in both 2020 and 2021.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3