The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Manhattan Office Leasing Activity Dips in 2015, Yet Commanding Record Rents

Commercial News » New York City Edition | By Michael Gerrity | January 13, 2016 12:34 PM ET

According to Colliers International, the Manhattan office market ended 2015 with an overall leasing velocity that was down from 2014 but still above the ten-year average, while asking rents increased for the 11th consecutive quarter and investment sales for office properties achieved near-record trading volume.

The year also revealed market role-reversals, with Downtown recording the largest annual drop in activity as Midtown posted its strongest leasing figures since 2003.

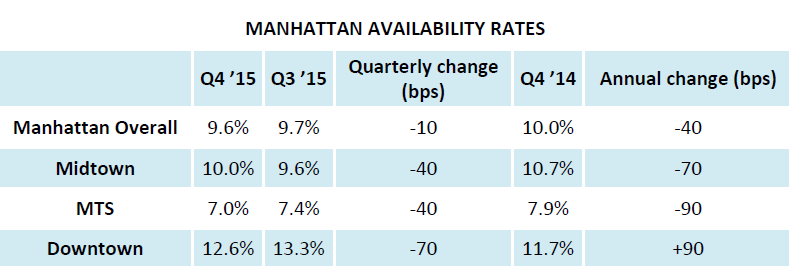

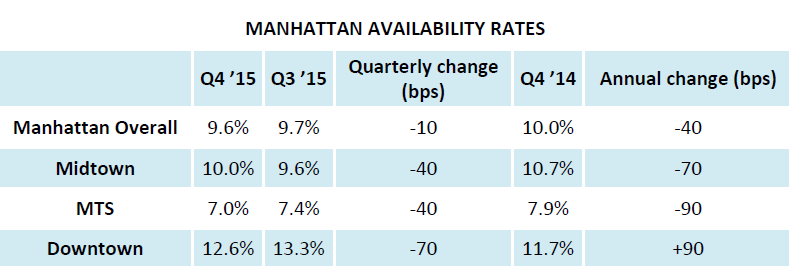

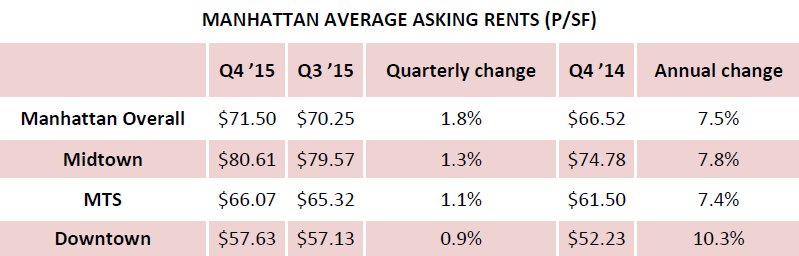

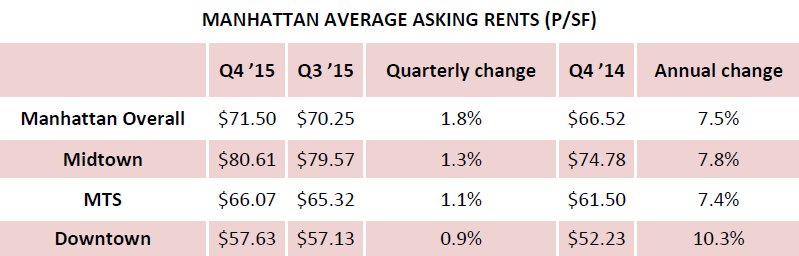

At 31.4 million square feet (msf), overall Manhattan leasing activity in 2015 was down 16.1 percent year-over-year from 37.4 msf, but still 8.4 percent above the ten-year historical average of 28.9 msf. The overall Manhattan availability rate of 9.6 percent was its lowest level since 2008, and the average asking rent of $71.50/sf was just 2.5 percent below the all-time high of $73.31/sf set during the third quarter of 2008. The FIRE sector accounted for the largest share of Manhattan leased square footage, at 36 percent.

-thumb-790x275-26837.png) "The Manhattan office market posted another solid year in 2015 as New York is still the most in-demand city in the world among employees seeking a 24/7 live/work/play environment and international investors looking for safe, value-driven opportunities compared to other global markets," said Joseph Harbert, Eastern Region President for Colliers International. "Leasing was down over the prior year, although average asking rents once again hit record highs and investment sales closed in on peak levels. There was also a Midtown resurgence at a time when Downtown cooled off. We anticipate another healthy year in 2016."

"The Manhattan office market posted another solid year in 2015 as New York is still the most in-demand city in the world among employees seeking a 24/7 live/work/play environment and international investors looking for safe, value-driven opportunities compared to other global markets," said Joseph Harbert, Eastern Region President for Colliers International. "Leasing was down over the prior year, although average asking rents once again hit record highs and investment sales closed in on peak levels. There was also a Midtown resurgence at a time when Downtown cooled off. We anticipate another healthy year in 2016."MIDTOWN

Midtown had its strongest year in more than a decade, with 16.7 msf of leasing activity -- a 12-year high. The FIRE sector had a near 50 percent share of Midtown leasing in 2015, while TAMI companies lagged at 20 percent. Availability dropped 70 basis points (bps) year-over-year, to 10 percent, while yearly net absorption was positive 1.95 msf, 62.8 percent stronger than 2014.

Meanwhile, Midtown's average asking rent increased 7.8 percent year-over-year to $80.61/sf, it's most significant annual increase since 2011 and the first time Midtown's average asking rent crossed the $80/sf threshold since 2008.

-thumb-796x259-26839.png)

MIDTOWN SOUTH

Leasing activity in Midtown South, at 10.5 msf, fell off 19.2 percent year-over-year. But leasing activity was 31.2 percent above the historical ten-year average of 8.0 msf and ranked as the second best year of Midtown South activity since 2006. TAMI tenants made up almost one-third of all 2015 Midtown South leasing activity.

At 7.0 percent Midtown South availability was 90 bps less than a year ago, resulting in the tightest market since the fourth quarter of 2007. And year-over-year the average Midtown South asking rent was up 7.4 percent, to $66.07/sf, a new all-time high. Increases occurred across all building classes, including Class B and C asking rents, which ended 2015 at record levels.

Leasing activity in Midtown South, at 10.5 msf, fell off 19.2 percent year-over-year. But leasing activity was 31.2 percent above the historical ten-year average of 8.0 msf and ranked as the second best year of Midtown South activity since 2006. TAMI tenants made up almost one-third of all 2015 Midtown South leasing activity.

At 7.0 percent Midtown South availability was 90 bps less than a year ago, resulting in the tightest market since the fourth quarter of 2007. And year-over-year the average Midtown South asking rent was up 7.4 percent, to $66.07/sf, a new all-time high. Increases occurred across all building classes, including Class B and C asking rents, which ended 2015 at record levels.

DOWNTOWN

Offsetting some of the gains in Midtown, Downtown leasing activity for 2015 was 4.1 msf, down nearly 50 percent year-over-year. Downtown was also the only major Manhattan market to post a year-over-year increase in availability, up 90 bps, to 12.6 percent.

Despite these factors, Downtown's average asking rent was up 10.3 percent to $57.63/sf, another all-time high, resulting in the largest year-over-year increase of all three Manhattan markets. With 2.1 msf leased, the Financial District supplanted the World Trade Center as the strongest performing Downtown submarket in 2015. And Tribeca, at $69.59/sf, replaced WTC as the most expensive Downtown submarket.

Offsetting some of the gains in Midtown, Downtown leasing activity for 2015 was 4.1 msf, down nearly 50 percent year-over-year. Downtown was also the only major Manhattan market to post a year-over-year increase in availability, up 90 bps, to 12.6 percent.

Despite these factors, Downtown's average asking rent was up 10.3 percent to $57.63/sf, another all-time high, resulting in the largest year-over-year increase of all three Manhattan markets. With 2.1 msf leased, the Financial District supplanted the World Trade Center as the strongest performing Downtown submarket in 2015. And Tribeca, at $69.59/sf, replaced WTC as the most expensive Downtown submarket.

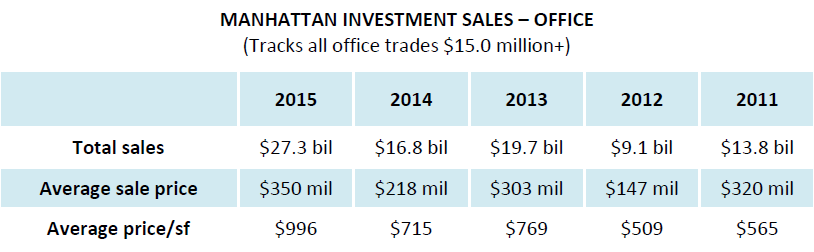

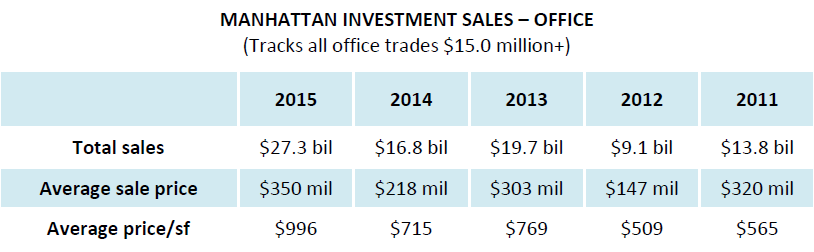

CAPITAL MARKETS

Total Manhattan office sales volume for 2015 reached $27.3 billion, with record pricing of $996/sf, led by the $2.6 billion sale of 11 Madison Avenue, the largest office trade of the year. The average transaction size for office sales was $350 million, with foreign buyers accounting for 31 percent of all 2015 purchases, totaling approximately $8.3 billion. Direct foreign investment is expected to accelerate in 2016 due to changes in FIRPTA regulations.

Total Manhattan office sales volume for 2015 reached $27.3 billion, with record pricing of $996/sf, led by the $2.6 billion sale of 11 Madison Avenue, the largest office trade of the year. The average transaction size for office sales was $350 million, with foreign buyers accounting for 31 percent of all 2015 purchases, totaling approximately $8.3 billion. Direct foreign investment is expected to accelerate in 2016 due to changes in FIRPTA regulations.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More