The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

U.S. Foreclosure Inventory Down 21.8 Percent from November 2014

Residential News » United States Edition | By WPJ Staff | January 12, 2016 11:31 AM ET

According to CoreLogic's November 2015 National Foreclosure Report, U.S. foreclosure inventory declined by 21.8 percent and completed foreclosures declined by 18.8 percent compared with November 2014. The number of completed foreclosures nationwide decreased year over year from 41,000 in November 2014 to 33,000 in November 2015. The number of completed foreclosures in November 2015 was down 71.6 percent from the peak of 117,657 in September 2010.

The foreclosure inventory represents the number of homes at some stage of the foreclosure process and completed foreclosures reflect the total number of homes lost to foreclosure. Since the financial crisis began in September 2008, there have been approximately 6 million completed foreclosures across the country, and since homeownership rates peaked in the second quarter of 2004, there have been about 8 million homes lost to foreclosure.

As of November 2015, the national foreclosure inventory included approximately 448,000, or 1.2 percent, of all homes with a mortgage compared with 573,000 homes, or 1.5 percent, in November 2014. The November 2015 foreclosure inventory rate is the lowest for any month since November 2007.

CoreLogic also reports that the number of mortgages in serious delinquency (defined as 90 days or more past due, including loans in foreclosure or REO) declined by 21.7 percent from November 2014 to November 2015, with 1.3 million mortgages, or 3.3 percent, in this category. The November 2015 serious delinquency rate is the lowest since December 2007.

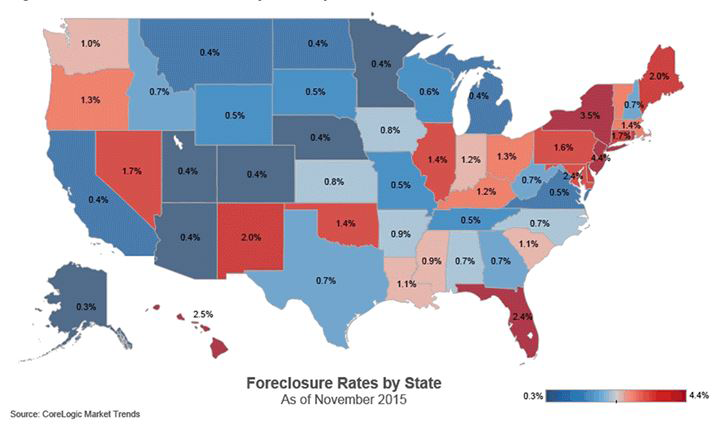

"After peaking at 3.6 percent in January 2011, the foreclosure rate currently stands at 1.2 percent-a remarkable improvement," said Dr. Frank Nothaft, chief economist for CoreLogic. "While there are still pockets of areas with high foreclosure activity, 30 states have foreclosure rates below the national average which is evidence of the solid improvement."

"Tight post-crash underwriting standards coupled with much improved economic and housing market fundamentals have combined to push new mortgage delinquencies to 15-year-lows," said Anand Nallathambi, president and CEO of CoreLogic. "Although judicial states will likely continue to lag, given current trends, it is reasonable to expect a continued and significant drop in the rate of serious delinquencies and foreclosure starts in 2016."

Additional November 2015 highlights:

- On a month-over-month basis, completed foreclosures decreased by 10.9 percent to 33,000 in November 2015 from the 38,000 reported in October 2015.* As a basis of comparison, before the decline in the housing market in 2007, completed foreclosures averaged 21,000 per month nationwide between 2000 and 2006.

- The five states with the highest number of completed foreclosures for the 12 months ending in November 2015 were Florida (83,000), Michigan (51,000), Texas (29,000), California (24,000) and Georgia (24,000). These five states accounted for almost half of all completed foreclosures nationally.

- Four states and the District of Columbia had the lowest number of completed foreclosures for the 12 months ending in November 2015: the District of Columbia (78), North Dakota (225), Wyoming (543), West Virginia (565) and Hawaii (686).

- Four states and the District of Columbia had the highest foreclosure inventory rate in November 2015: New Jersey (4.4 percent), New York (3.5 percent), Hawaii (2.5 percent), Florida (2.4 percent) and the District of Columbia (2.4 percent).

- The five states with the lowest foreclosure inventory rate in November 2015 were Alaska (0.3 percent), Minnesota (0.3 percent), Arizona (0.4 percent), Colorado (0.4 percent) and Utah (0.4 percent).

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More