The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Life Sciences Real Estate Sector Getting Big Boost from COVID Research Demand

Commercial News » San Diego Edition | By Michael Gerrity | October 16, 2020 8:00 AM ET

According to CBRE, the pandemic has accelerated momentum in the U.S. life sciences industry, particularly amid the race to produce a COVID-19 vaccine and develop other medicines for human ailments. The sector, which has reached new highs this year in R&D employment and venture-capital funding, is seeing a surge in demand for life sciences real estate in markets from longstanding centers like Boston to emerging hubs such as Pittsburgh.

The decades-long expansion of the life sciences industry, which accelerated with the mapping of the human genome in 2003, has pushed vacancy rates for lab space near all-time lows in many markets, fueled rent growth and spurred new development that, nonetheless, still isn't keeping pace with demand.

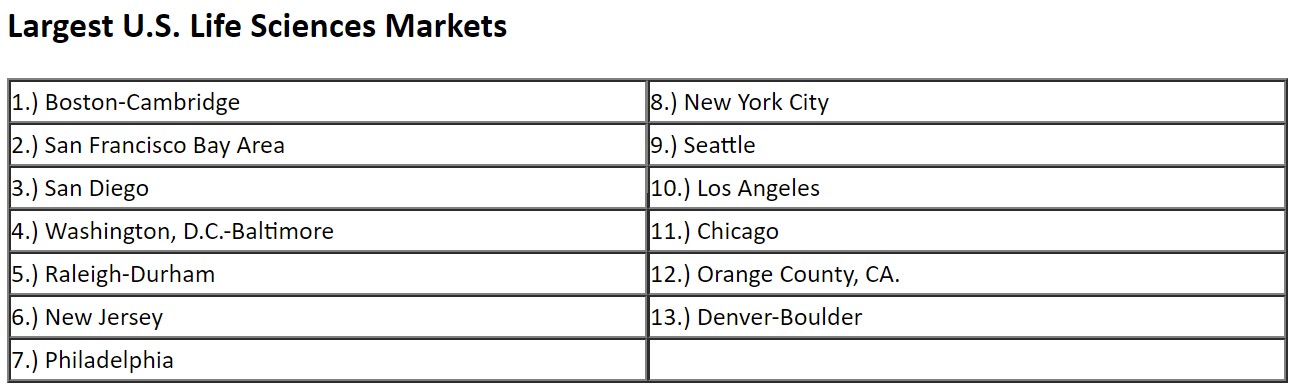

For example, CBRE found that speculative construction of life sciences facilities in the 13 largest U.S. markets totaled roughly 13.9 million sq. ft., as of July, which falls short of the cumulative 14.7 million sq. ft. of life sciences space that companies currently are seeking in those markets. Lab-space vacancy averaged 6.1 percent across the 13 largest life sciences markets at the end of the second quarter, and rents are rising in most.

The real estate gains have come as venture-capital investment in the sector grew to a rolling annual total of $17.8 billion in the second quarter, the largest amount on record, according to the PwC/CB Insights MoneyTree survey. Employment in U.S. biotechnology research and development professions exceeded 220,000 in July, extending a decade-long growth trajectory.

"Interest in the life sciences sector from developers, investors and financial backers already was strong in recent years, and the unfortunate arrival of COVID-19 brought even more attention and capital into the sector," said Steve Purpura, a Vice Chairman leading CBRE's Life Sciences Practice in the Northeast U.S. "That has boosted the market for lab space across the U.S., not only in the industry's flagship markets like San Francisco, Boston and San Diego but also in emerging research centers such as New York City, Philadelphia, Raleigh-Durham and Seattle."

CBRE identified the top U.S. life sciences markets by assessing each market's life-sciences job base, the size of its lab-space inventory, and the amount of funding it attracts from venture capital firms and the National Institutes of Health.

CBRE's determined its list of emerging life-sciences markets through a slightly narrower set of criteria. Those markets are (in order): Pittsburgh, Houston, Austin, Detroit, Phoenix, Dallas-Fort Worth, St. Louis, Atlanta, Portland and Minneapolis.

Investors continue to consider lab and R&D space to be slightly more valuable on average than conventional office space, a trend that began in 2015.

"Nearly every indicator points to increasing demand for life sciences real estate in the U.S., be it expanding R&D employment, public and private investment in combatting the pandemic, or the health needs of our aging population," said Ian Anderson, CBRE Americas Head of Office Research. "The factors fueling this sector are great enough to support demand for more lab space in the top markets and beyond."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More