Commercial Real Estate News

Investor Demand for U.S. Commercial Properties in Late 2021 Surpasses 2019 Levels

Commercial News » San Diego Edition | By Monsef Rachid | December 22, 2021 8:45 AM ET

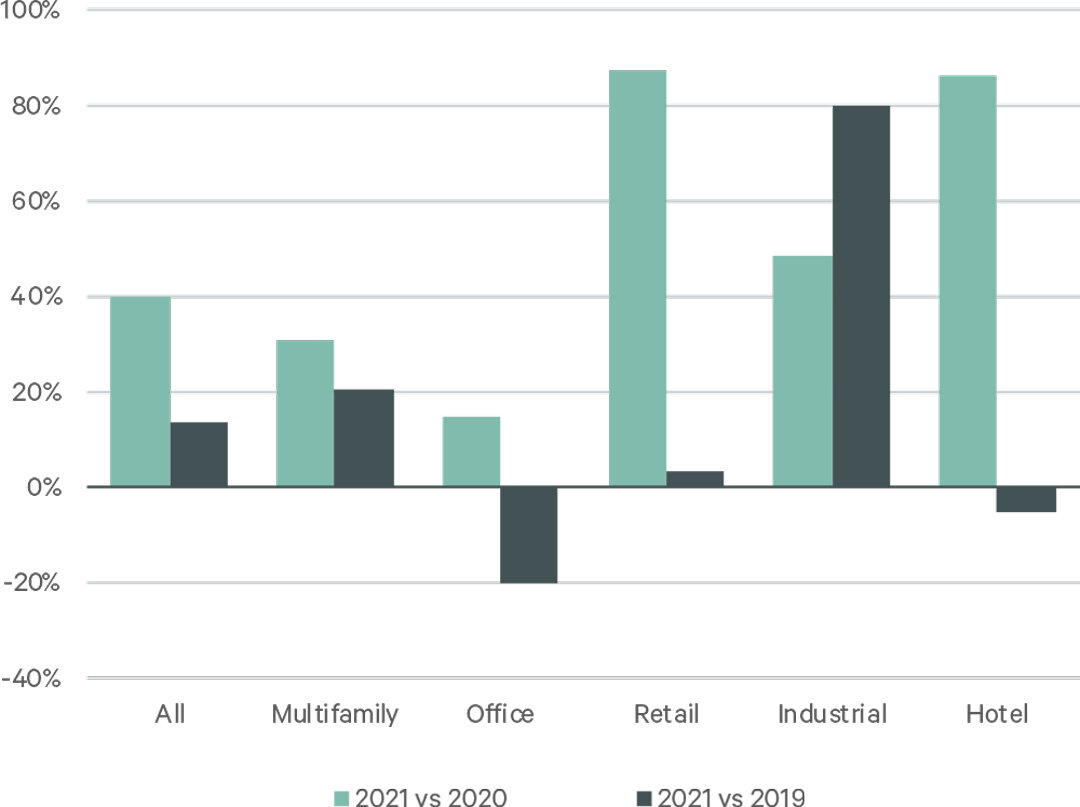

Global property consultant CBRE is reporting this week that commercial property investor inquiries (confidentiality agreements signed by prospective buyers) through the first week of December 2021 have surpassed the total for all of 2019. Robust investor interest in the second half of the year fueled this strength, with inquiries up 40% year-over-year from July 1 through December 8 and 14% compared with the same period in 2019.

Investor Activity Picks Up in Most Challenged Sectors

Strong investor interest continued despite increased uncertainty due to rising COVID-19 infections and a reduction in the Federal Reserve's bond purchasing program.

Retail inquiries surged more than 87% since 2020 and were slightly above 2019 levels. The hotel and office sectors also saw increases from 2020 but were down by 5% and 20%, respectively, from pre-pandemic 2019 levels. Multifamily and industrial inquiries continued their momentum from the past year with increases of 31% and 48%, respectively, compared with the same period in 2020. The pickup in investor inquiries coincides with an increase in investment transaction volume, which has also surpassed 2019 levels.

Days on the Market Decreasing

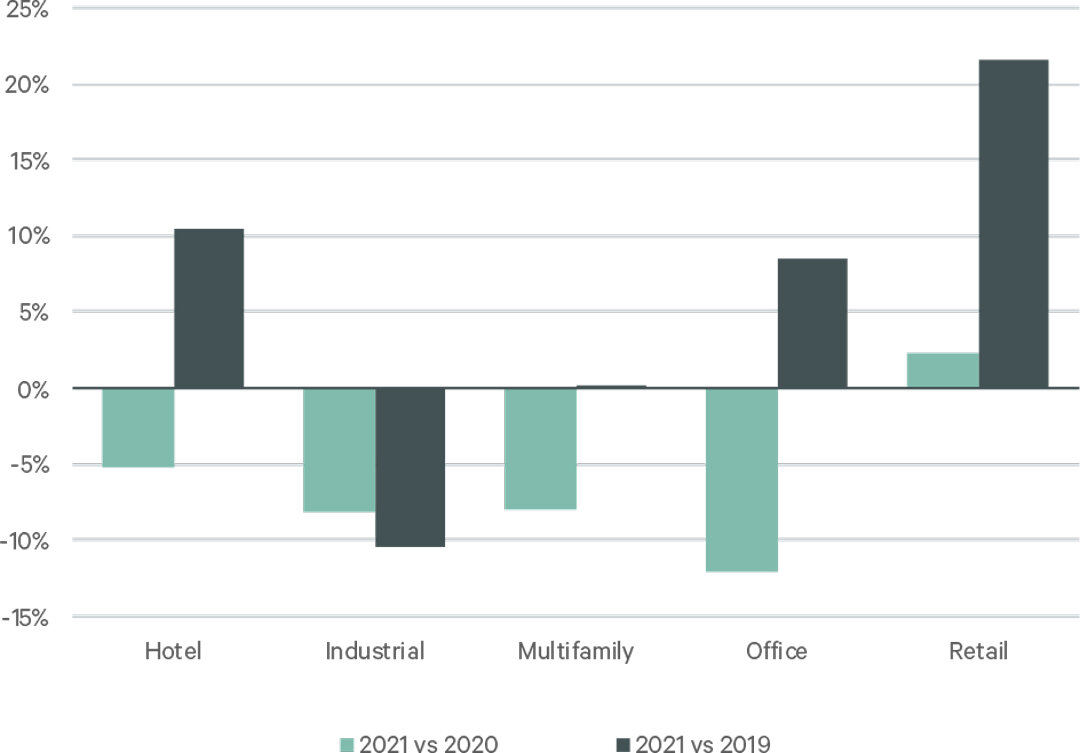

Also striking a positive note is a decrease in the average number of days on the market for property sale listings, says CBRE. Property listings came off the market faster in the hotel, industrial, multifamily and office sectors than they did in the same period last year. Retail listings saw a 3% increase in average number of days on the market.

Although improved compared with 2020, most sectors saw listings stay on the market longer than in the comparable pre-pandemic 2019 period, with retail listing longevity up by 22%, followed by hotel listings up 11% and office by 9%. Days on the market were nearly the same for multifamily compared with pre-pandemic levels, while industrial assets had a 10% decrease according to CBRE.

Positive Outlook Despite Uncertainty

CBRE also expects continued strong investment activity in 2022. Total investment volume is expected to increase between 5% and 10% over 2021 levels. There are potential headwinds, such as a more hawkish Fed and a Q1 surge in COVID cases due to the omicron variant. Nevertheless, the economy is expected to grow by 4.6% in 2022. Strong economic growth will fuel continued improvement in property market fundamentals and embolden investor confidence.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Commercial Property Investors Poised to Increase Allocations in 2026

- U.S. Commercial Mortgage Debt Climbs Toward $5 Trillion

- AI Sparks a Global $3 Trillion Data Center Supercycle

- AI Rewrites Playbook for Global Property Dealmakers, Says PwC

- Hong Kong's Central Office Market Enjoys First Rent Increase Since 2022

- U.S. Commercial Real Estate Lending Spikes in Q3

- Commercial Lending Surges in America

- North America Real Estate Enters a Tech-Driven, Boomers-Fueled Era in 2026

- U.S. Commercial Mortgage Delinquencies Ease in Q3

- Rents Hit 18-Year High in Tokyo as Japan's Office Market Defies Gravity

- Hong Kong Office Market Rebounds, IPO Activity Spurs Leasing Demand

- Poland's Commercial Markets Enjoy Rising Property Investment Activity

- Asia-Pacific Property Markets Show Signs of Revival as Investment Rises

- World Property Ventures Raising Capital to Digitize the Global Real Estate Economy

- U.S. Data Center Boom Tests Power Grid as AI Demand Outpaces Supply

- Commercial, Multifamily Mortgage Debt Climbs to Record $4.88 Trillion in U.S.

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs