Residential Real Estate News

Housing Choice Vouchers Not Keeping Up Rising U.S. Rents

Residential News » Washington D.C. Edition | By WPJ Staff | April 26, 2023 8:28 AM ET

Based on Zillow's latest research, Housing Choice Vouchers are failing to keep up with rising rents, exposing rent-burdened households to economic uncertainty or homelessness.

Zillow found nearly 10 times more qualified voucher recipients than vouchers in most large U.S. metros. The analysis also found voucher values grew at less than half the pace of typical rent during the pandemic.

"Renters across the country are struggling as costs have skyrocketed and vouchers have failed to keep up," said Orphe Divounguy, senior economist at Zillow. "Better calculating for voucher values and more funding are good short-term solutions, but building more homes is the long-term answer."

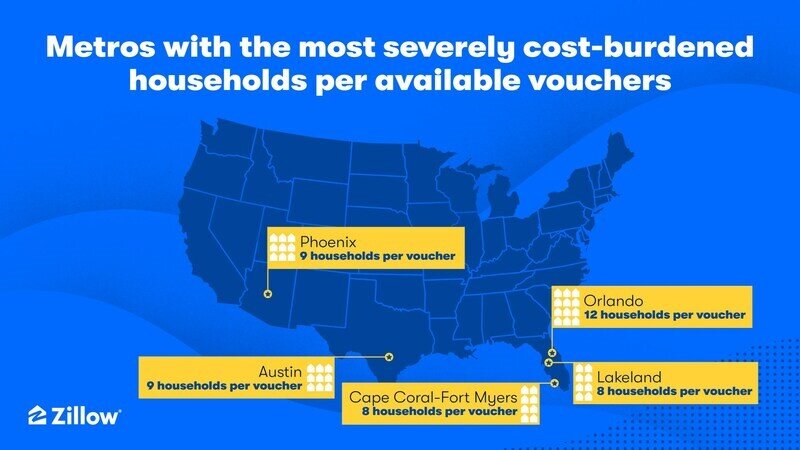

Zillow research found there was not a single large metro area with enough vouchers to meet demand. Across the country, there were nearly 10 times as many eligible voucher recipients as there were vouchers. In addition, there were nearly four times more severely cost-burdened households than voucher recipients.

Several metros in Florida stand out for their extreme mismatches between vouchers and those who need them. Orlando had the highest mismatch in the nation, with 12 severely cost-burdened households for every available voucher.

Between February 2020 and February 2022, the typical U.S. rent grew by an astonishing 18%, but voucher values grew by only 7%. Counties with the biggest disparity between rent growth and voucher values were scattered throughout the country, but Florida -- a state that experienced among the fastest rent increases in the country -- stood out again with several counties suffering the largest gaps. In Miami-Dade County, rent growth outpaced voucher values by almost 50 percentage points in those two years.

How vouchers work

The Housing Choice Voucher Program is a critical rental assistance program provided by the U.S. Department of Housing and Urban Development (HUD), and is sometimes referred to as Section 8. The program pays landlords a portion of the rent directly on behalf of the tenant, and the tenant pays the difference.

Eligibility for a housing voucher is based on income and family size. In general, a family's income may not exceed 50% of the median income for the county or metropolitan area in which the family chooses to live. Typically, a voucher holder pays about 30% of their income as rent and the program pays the rest, up to a ceiling determined by HUD as the fair market value.

Recent Zillow research found that it would take four full-time minimum wage workers to reasonably afford a two-bedroom rental, illustrating the daunting financial challenges many renters face today. With voucher values eroding, voucher holders will have fewer options for places to rent and will likely be forced farther away from neighborhoods with amenities and job centers. The increase in rents leaves many rent-burdened families exposed to eviction, health crises and homelessness.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Housing Market Tilts Toward Buyers as Prices Cool

- Ultra-Luxury Home Sales Surge Globally in Late 2025 as 555 Mega-Deals Close

- U.S. Luxury Home Prices Outpaced the Broader Market in 2025

- U.S. Homeowner Equity Growth Cooled in 2025 but Remained Historically Strong

- U.S. Homebuyers Scored Biggest Price Discounts Since 2012 as Market Shifts

- Ten Key Takeaways from the U.S. Housing Market in January

- Hong Kong Stock Market Front-Runs Local Home Prices by Two Months

- Mass Exodus: U.S. Homebuyers Cancel Deals at Record Levels

- U.S. Housing Outlook for 2026 Darkens After Sharp December Pullback in Contract Signings

- America's Housing 'Silver Tsunami' Is Turning Into a Trickle

- Builders Tell Congress Government Rules Are Pricing Americans Out of Housing

- California Housing Market Poised for Balanced Growth in 2026

- U.S. Housing Market Hits Largest Buyer-Seller Imbalance on Record

- Miami Housing Market Ends 2025 on Firmer Ground

- U.S. Homebuilder Confidence Dips at Start of 2026

- Remodeling Outlook Improves as U.S. Homeowners Tap Equity

- U.S. Home Sales Hit Three-Year High in December as Rates Ease

- Las Vegas Area Home Sales Hit 18-Year Low in 2025

- U.S. Mortgage Rates Hit Three-Year Low in January

- U.S. Home Affordability Closed Out 2025 Near Record Lows

- Ireland Home Prices Uptick 5.5 Percent in 2025 Amid Supply Shortages

- One Year After Los Angeles Wildfires, Investors Snap Up Burned Lots

- Greater Palm Beach Area Home Sales Surge in Late 2025

- U.S. Homebuilder Sentiment Ends 2025 in Negative Territory

- America's Single-Family Rent Boom Loses Steam in Late 2025

- Miami Home Price Gains Extend 14-Year Run in 2025

- Why Pre-Biden Mortgages Froze the U.S. Housing Market

- From Bricks to Blockchain: How Digital Dollars Could Soon Rewire Global Real Estate

- U.S. Home Sales Slightly Uptick in November

- Greater Orlando Area Home Sales Dive 22 Percent in November

- World Property Exchange Aims to Make Real Estate Ownership Instantly Tradeable and Democratized on a Planetary Scale

- Falling Home Prices Slash U.S. Homeowner Equity by $13,400 on Average in 2025

- Home Listings in U.S. See Sharpest Drop in Two Years Amid Cooling Buyer Demand

- Dutch Investors Pour Record $4.2 Billion in New Rental Housing in 2025

- U.S. Housing Markets Poised for 2026 Rebound, NAR Says

- Las Vegas Home Prices Hit Record High in November as Inventory Swells, Sales Cool

- Investors Accounted for 30 Percent of All U.S. Home Purchases in 2025

- Canadian Home Sales Recovery Continues in October

- Global Luxury Home Price Growth Cools to 2-Year Low in September

- U.S. Housing Market Recovery to Remain Fragile in 2026