Residential Real Estate News

New Home Mortgage Applications in U.S. Dip 5.9 Percent in May

Residential News » Washington D.C. Edition | By WPJ Staff | June 21, 2021 9:15 AM ET

The Mortgage Bankers Association's latest Builder Application Survey data for May 2021 shows mortgage applications for new home purchases decreased 5.9 percent compared from a year ago. Compared to April 2021, applications decreased by 9 percent. This change does not include any adjustment for typical seasonal patterns.

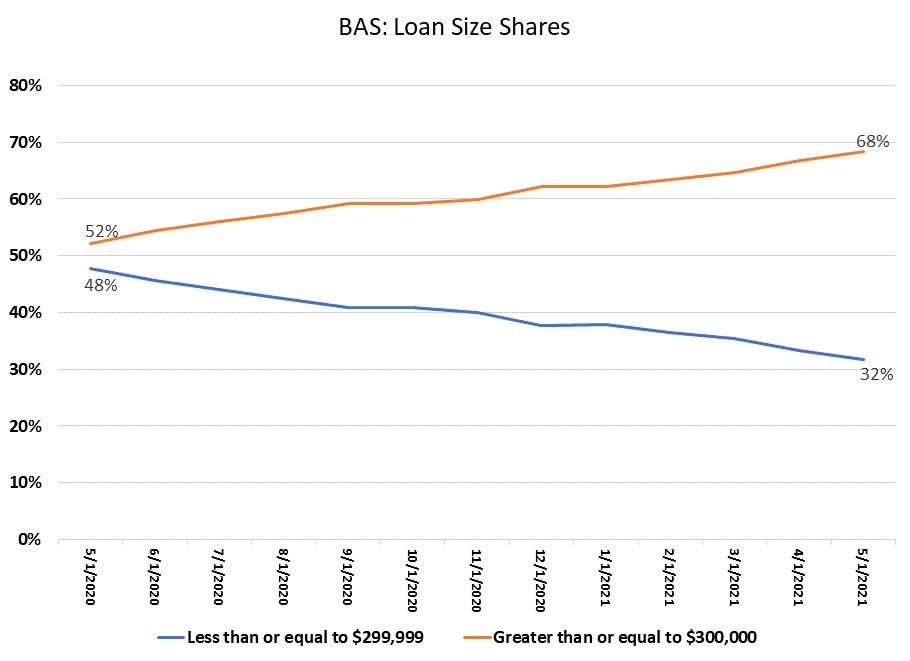

"Mortgage applications to purchase a new home decreased in May for the second straight month, while the average loan size, at $384,000, increased for the fourth consecutive month and reached a new survey high," said Joel Kan, MBA's Associate Vice President of Economic and Industry Forecasting. "Loan balances continue to rise because of a larger share of sales in the higher end of the market, as well as increased sales prices from strong demand and elevated building material costs."

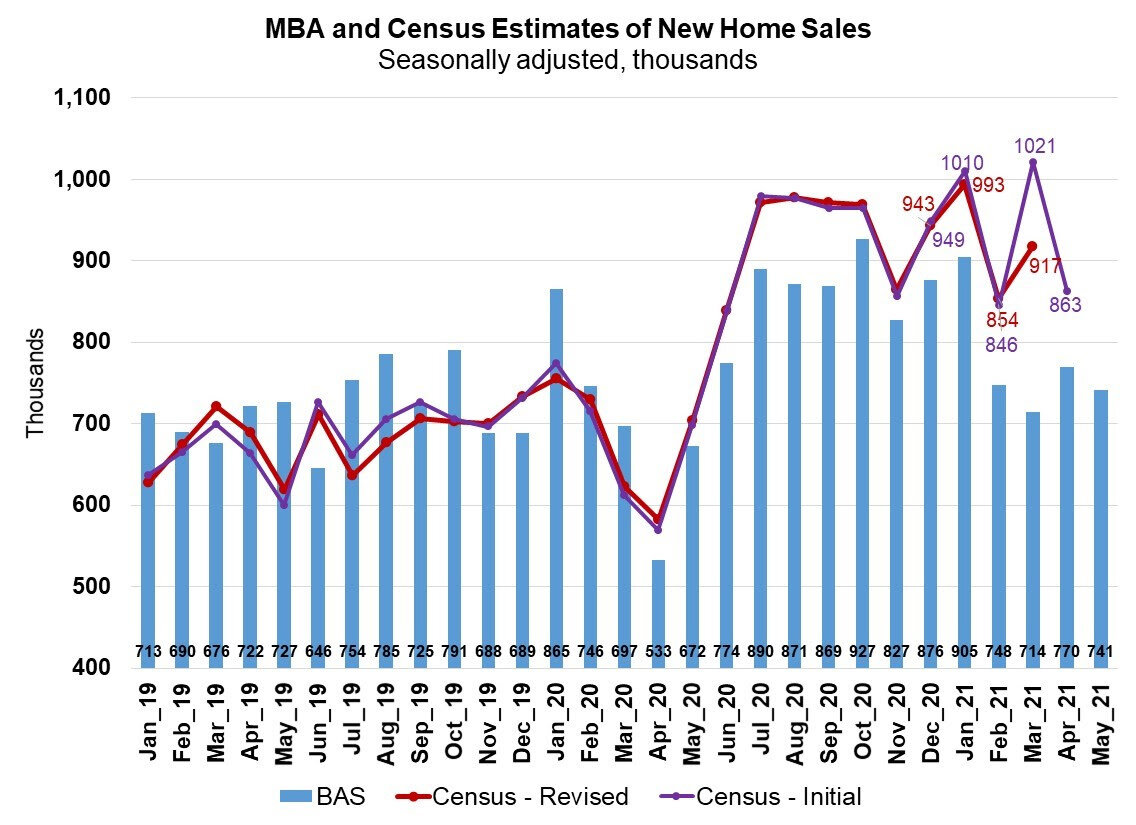

Add Kan, "MBA's estimate of new home sales showed that the seasonally adjusted annualized pace of sales dropped 4 percent in May. 2021 Since reaching a survey-high 927,000 units in October 2020, the annual pace has now fallen around 20 percent, weighed down by low housing inventory and rising prices."

MBA estimates new single-family home sales were running at a seasonally adjusted annual rate of 741,000 units in May 2021, based on data from the BAS. The new home sales estimate is derived using mortgage application information from the BAS, as well as assumptions regarding market coverage and other factors.

The seasonally adjusted estimate for May is a decrease of 3.8 percent from the April pace of 770,000 units. On an unadjusted basis, MBA estimates that there were 68,000 new home sales in May 2021, a decrease of 5.6 percent from 72,000 new home sales in April.

By product type, conventional loans composed 73.9 percent of loan applications, FHA loans composed 14.8 percent, RHS/USDA loans composed 0.9 percent and VA loans composed 10.4 percent. The average loan size of new homes increased from $377,434 in April to $384,323 in May.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership