The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Top 10 Global Office Markets Through 2015

Commercial News » Asia Pacific Commercial News Edition | By Francys Vallecillo | December 4, 2013 9:24 AM ET

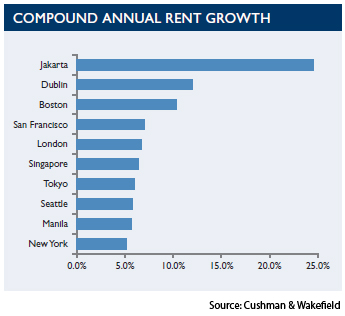

The office market in Jakarta is forecast to witness the highest rental rate growth through 2015, with rents on track to increase almost 30 percent, according to Cushman & Wakefield.

The Indonesia capital leads the global office market growth forecast for the second year in a row, with rates more than double the level in 2011. The growth already seen in Jakarta has positioned it as Asia's hottest market.

The Dublin and Boston office markets rank second and third, respectively, and join Jakarta as the regional leaders among the top cities forecast for highest rental rate growth in the next two years.

San Francisco ranks fourth, with London, Singapore, Tokyo, Seattle, Manila and New York rounding out the top 10 global markets.

San Francisco ranks fourth, with London, Singapore, Tokyo, Seattle, Manila and New York rounding out the top 10 global markets. As a whole, the global office market is expected to record steady growth in 2014, with a more robust market in 2015 with continued recovery and renewed confidence in business gains, according to the report.

"Reduced occupancy footprints and an upgrade to better quality space are two global trends that show no sign of letting up anytime soon," said Carlo Barel di Sant'Albano, executive chairman of Cushman & Wakefield. "The workplace is becoming more complex and inter-related with business performance and objectives, with modern efficient space seen as promoting increased productivity and workplace satisfaction. In certain instances, new construction can achieve both goals."

In the Americas, technology and energy continue to be main drivers for the U.S. real estate recovery, with Boston forecast for 22 percent increase in prime asking rents. On the other hand, Canada, Mexico and Brazil are expected to witness an oversupply of office space, with widespread rental growth in Brazil not expected until 2016.

Cities such as London, Stockholm and Frankfurt have led the European leasing recovery, but are now joined by the formerly distressed margin. Dublin, one of the hardest hit markets, has recovered with double-digit rental growth anticipated.

"Occupiers have a clear preference for quality space but many are encountering supply constraints in an increasing number of cities," David Hutchings, partner and head of Cushman & Wakefield's European research group, said in the report. "This is pushing rental growth and occupiers will have to move sooner than expected to secure deals on the decreasing amount of quality space that is available."

More subdued growth is forecast for Asia Pacific, with rents expected to grow by 1 to 2 percent over the next year. As rents reach high marks in central business districts, businesses are looking for low-cost options outside, while upgrading to new construction at the same time, the report says.

"With the abundance of new supply especially in the emerging markets, it remains a great time to be an occupier," Sigrid Zialcita, managing director of research for Asia Pacific, said in the report.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More