Vacation Real Estate News

Global Hotel Performance Remained Stagnant in 2025

Vacation News » Hong Kong Edition | By David Barley | December 26, 2025 6:03 AM ET

AI Adoption and Luxury Demand Offset Weak International Travel

Global hotel performance remained largely stagnant over the past year, with modest pricing gains offset by declining occupancy. Year-to-date revenue per available room (RevPAR) rose 0.2% through August 2025, according to STR, as a 1.0% increase in average daily rate was outweighed by a 0.8% drop in occupancy.

According to PwC, structural forces are increasingly shaping the sector's outlook. Artificial intelligence adoption is accelerating across pricing, marketing, and operations, enabling more granular personalization, dynamic revenue management, and cost efficiencies. AI is also emerging as a new demand-generation channel as travelers increasingly turn to AI platforms for trip planning and hotel recommendations, reducing reliance on traditional search and online travel agencies.

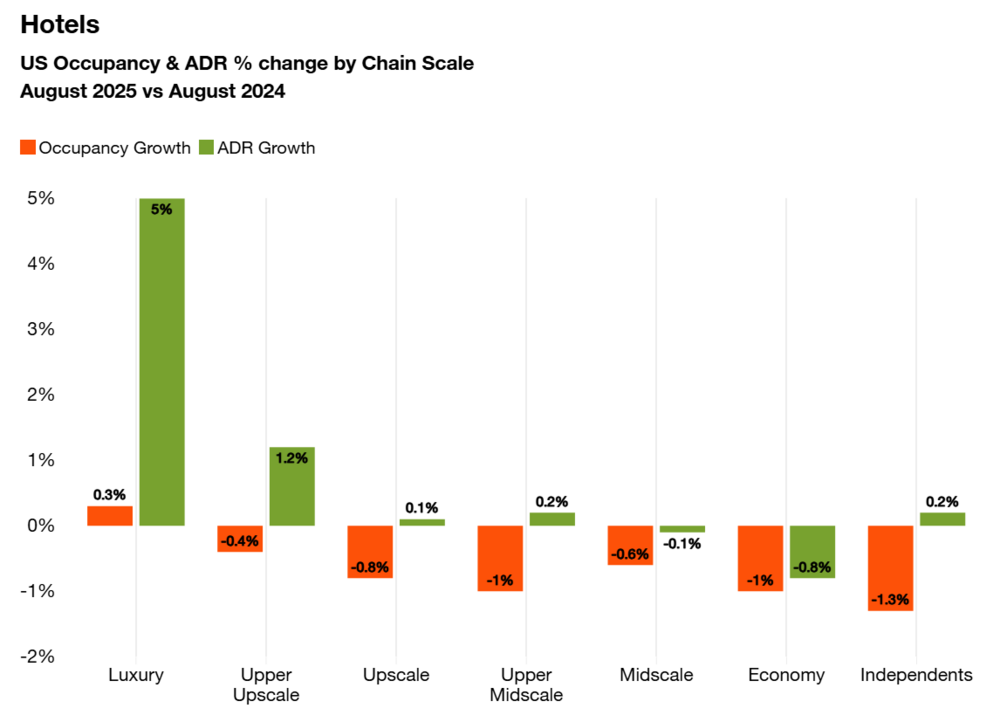

Performance bifurcation across chain scales has widened. Luxury hotels posted 5.3% RevPAR growth year-to-date through August, while the economy segment declined 1.8%. Luxury and upper-upscale properties were the only segments to record positive growth, driven by pricing power and resilient demand from higher-income travelers. Softer consumer sentiment and increased competition from short-term rentals continue to pressure lower-priced segments.

Premiumization remains the industry's primary growth driver. Luxury operators are capturing demand through higher rates, experiential offerings, and elevated service expectations, reinforcing the segment's resilience amid broader economic uncertainty.

International travel remains a headwind. The World Travel & Tourism Council projects a $12.5 billion decline in U.S. international visitor spending in 2025, while Tourism Economics forecasts an 8.2% drop in arrivals. Canadian visitation has fallen sharply, down 23.7% year-to-date through June, amid policy and trade tensions.

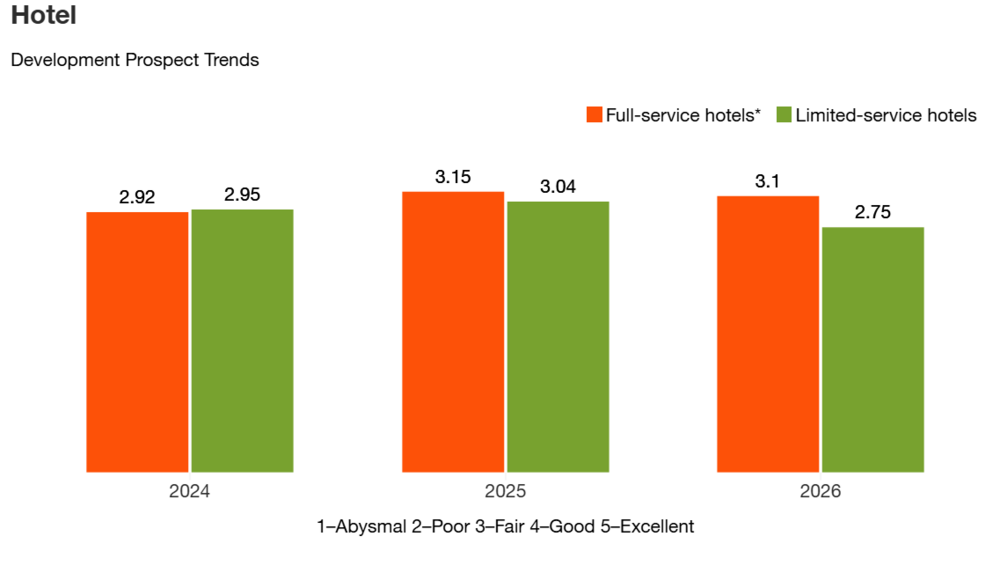

PwC's outlook for 2026 is more constructive. Stabilizing geopolitical conditions and the FIFA World Cup, hosted in the U.S., are expected to support a rebound in inbound travel and provide a potential inflection point for hotel demand.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Vacation Real Estate Headlines

- Cuba's Tourism Could Boom if Trump Liberates Its People Like Venezuela

- Global Hotel Performance Remained Stagnant in 2025

- Record-Breaking 122 Million Americans Will Travel This 2025 Holiday Season

- Record 81.8 Million Americans to Travel for Thanksgiving

- Hong Kong Hotel Investment Skyrockets 106 Percent in 2025

- Asia-Pacific Hotels See Modest Profits Ahead While Navigating Global Volatility

- Asia Pacific Hotel Investment Slows Amid Selective Capital Flows

- Asia Pacific Hotel Investment Cools in First Half of 2025

- Short Term Rental Occupancies Plunge Mid-2025 as U.S. Travelers Pull Back

- Short-term Vacation Rentals Outperform U.S. Hotels in Q2

- Record Setting 72.2 Million Americans Traveling for July Fourth Holiday

- Record 45.1 Million Americans to Travel Over 2025 Memorial Day Weekend

- U.S. Vacation Home Sales Fall to Lowest Level Since 2018

- Disney Announces New Landmark Theme Park Resort in Abu Dhabi

- Despite Geopolitical Uncertainty, European Hotel Values Rise

- Record 119 Million Americans Traveling Over the Christmas Holidays

- 80 Million Americans to Hit the Road, Skies and Seas for 2024 Thanksgiving Holiday

- Asia Pacific Hotel Investment to Exceed $12 Billion in 2024

- Asia Pacific Hotel Investment Tops $12 Billion in 2024

- Seattle, Orlando and New York Top Labor Day Destinations in 2024

- Record 71 Million Americans Traveling Over July Fourth Week

- Major Hotel Operators Expanding Rapidly Across Asia Pacific in 2024

- 44 Million Traveling Memorial Day Weekend, Second Most in History

- South Korea is Asia Pacific's Top Performing Hotel Market

- Florida Dominates Top 10 U.S. Cities List to Invest in Short Term Rentals

- Investment in South Korea Hotels Dipped in 2023

- European Hotel Values Still Below Pre-Covid Prices

- Over 115 Million Americans Traveling Over Christmas Holidays

- 55.4 Million Americans on the Move Thanksgiving Holiday

- Asia Pacific Tourism to Approach Full Recovery in 2024, Driving Hotel Sector Growth

- Asia Pacific Hotel Revenues to Rise in 2024 Despite Economic Volatility

- Tourist Bookings to Hawaii Down 50 Percent Since Maui Wildfires

- Demand for Vacation Homes in U.S. Hit 7-Year Low in August

- International Travel for Americans Jumps Over 200 Percent in 2023

- U.S. Labor Day Weekend Travel To Uptick in 2023

- Asia Pacific Hotel Investment Collapses 51 Percent in 2023

- As Summer Travel Season Winds Down, U.S. Gas Prices Rise Again

- Record Setting 50.7 Million Americans to Travel This July Fourth Holiday

- Israel Hotels Poised for Growth as International Visitors Set to Return

- Over 42 Million Americans to Travel This Memorial Holiday Weekend