Residential Real Estate News

Living Alone Carries Growing U.S. Housing Premium as Costs Outrun Paychecks

Residential News » Seattle Edition | By David Barley | February 16, 2026 9:45 AM ET

A growing divide is emerging in the U.S. housing market between Americans living alone and those sharing expenses with a spouse or partner, underscoring how the affordability crisis is reshaping household economics across the country.

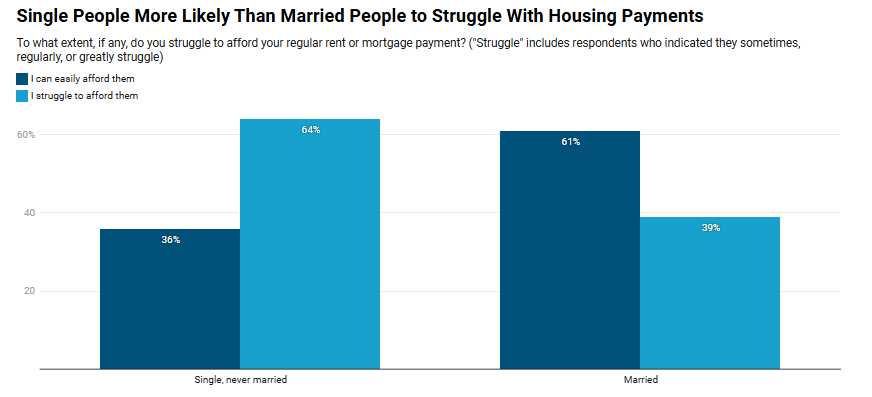

A recent consumer survey commissioned by real-estate brokerage Redfin found that roughly 64% of unmarried respondents report difficulty meeting monthly rent or mortgage obligations, compared with 39% of married households. The gap highlights how rising shelter costs -- layered atop inflation in everyday goods -- are disproportionately pressuring one-income households.

Housing Inflation Outruns Wage Growth

Homeownership and renting alike have become more expensive over the past several years as property values surged and borrowing costs climbed. Although mortgage rates have retreated from their most recent highs, they remain well above levels common before 2020. At the same time, national home-sale prices have risen by nearly half compared with pre-pandemic benchmarks, while asking rents are up about one-fifth, according to industry data.

Wages have advanced, but not at the same pace. The mismatch has eroded financial cushions for millions of households already contending with higher food, transportation and healthcare bills. For single earners, the squeeze is especially acute because fixed housing expenses consume a larger share of take-home pay.

Income and Structural Advantages Favor Couples

Survey results suggest the disparity is driven in large part by income distribution. Nearly half of single respondents reported annual household earnings below $50,000, compared with fewer than one in ten married participants. Conversely, married couples were roughly three times as likely to report six-figure household incomes.

Beyond income, couples benefit from structural advantages embedded in both tax policy and daily living costs. Joint filers often qualify for deductions or credits unavailable to individuals, while shared expenses -- from groceries to utilities and childcare -- dilute per-person financial strain. Singles, by contrast, absorb those costs alone.

Demographics compound the effect. Unmarried adults skew younger on average, placing many earlier in their careers and further from peak earning years. Student-loan balances also remain a common obligation among millennials and Generation Z, limiting savings and down-payment capacity.

Policy Implications as Household Patterns Shift

The financial burden arrives at a time when married couples represent a shrinking share of total U.S. households. Housing economists say that shift carries implications for zoning and development policy, particularly in high-cost metropolitan regions. Smaller units, accessory dwelling units and single-occupancy housing formats are increasingly viewed as tools to expand supply for one-person households. Streamlining approval processes for studio and one-bedroom developments is also gaining traction among municipal planners seeking faster relief from tight inventory.

The 'Living-Alone Premium' in Major Cities

The cost of maintaining a solo household is most visible in large urban markets, where condominium prices and homeowners' association fees amplify monthly obligations.

In Washington, D.C., for example, a mid-priced condominium purchase can translate into a monthly outlay approaching $3,000 once mortgage payments and association dues are included. For a single buyer, the entire burden falls on one paycheck; a cohabiting pair effectively halves the expense. Over a year, that difference can reach tens of thousands of dollars.

San Francisco presents an even starker illustration. With typical condominium prices nearing seven figures and elevated HOA costs, a lone owner may face monthly payments approaching $7,000. Shared across two incomes, the per-person obligation drops dramatically -- a gap that amounts to what some analysts describe as a de facto "living-alone premium" exceeding $40,000 annually.

Mobility Slows as Costs Climb

The affordability strain is also curbing geographic mobility. Unmarried Americans are significantly more likely than married peers to cite cost as the primary reason for staying put. Roughly one quarter of singles surveyed said they cannot afford the type of home they would prefer to move into, and more than 40% pointed to moving expenses themselves as prohibitive. Among married respondents, those figures were markedly lower.

The trend suggests that for many one-income households, housing has shifted from a ladder of upward mobility to a constraint on it -- limiting not only buying power but also the ability to relocate for career opportunities or lifestyle changes. As prices remain elevated and supply tight, the economics of living alone are increasingly becoming a defining feature of the post-pandemic housing landscape.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Housing Market Tilts Toward Buyers as Prices Cool

- Ultra-Luxury Home Sales Surge Globally in Late 2025 as 555 Mega-Deals Close

- U.S. Luxury Home Prices Outpaced the Broader Market in 2025

- U.S. Homeowner Equity Growth Cooled in 2025 but Remained Historically Strong

- U.S. Homebuyers Scored Biggest Price Discounts Since 2012 as Market Shifts

- Ten Key Takeaways from the U.S. Housing Market in January

- Hong Kong Stock Market Front-Runs Local Home Prices by Two Months

- Mass Exodus: U.S. Homebuyers Cancel Deals at Record Levels

- U.S. Housing Outlook for 2026 Darkens After Sharp December Pullback in Contract Signings

- America's Housing 'Silver Tsunami' Is Turning Into a Trickle

- Builders Tell Congress Government Rules Are Pricing Americans Out of Housing

- California Housing Market Poised for Balanced Growth in 2026

- U.S. Housing Market Hits Largest Buyer-Seller Imbalance on Record

- Miami Housing Market Ends 2025 on Firmer Ground

- U.S. Homebuilder Confidence Dips at Start of 2026

- Remodeling Outlook Improves as U.S. Homeowners Tap Equity

- U.S. Home Sales Hit Three-Year High in December as Rates Ease

- Las Vegas Area Home Sales Hit 18-Year Low in 2025

- U.S. Mortgage Rates Hit Three-Year Low in January

- U.S. Home Affordability Closed Out 2025 Near Record Lows

- Ireland Home Prices Uptick 5.5 Percent in 2025 Amid Supply Shortages

- One Year After Los Angeles Wildfires, Investors Snap Up Burned Lots

- Greater Palm Beach Area Home Sales Surge in Late 2025

- U.S. Homebuilder Sentiment Ends 2025 in Negative Territory

- America's Single-Family Rent Boom Loses Steam in Late 2025

- Miami Home Price Gains Extend 14-Year Run in 2025

- Why Pre-Biden Mortgages Froze the U.S. Housing Market

- From Bricks to Blockchain: How Digital Dollars Could Soon Rewire Global Real Estate

- U.S. Home Sales Slightly Uptick in November

- Greater Orlando Area Home Sales Dive 22 Percent in November

- World Property Exchange Aims to Make Real Estate Ownership Instantly Tradeable and Democratized on a Planetary Scale

- Falling Home Prices Slash U.S. Homeowner Equity by $13,400 on Average in 2025

- Home Listings in U.S. See Sharpest Drop in Two Years Amid Cooling Buyer Demand

- Dutch Investors Pour Record $4.2 Billion in New Rental Housing in 2025

- U.S. Housing Markets Poised for 2026 Rebound, NAR Says

- Las Vegas Home Prices Hit Record High in November as Inventory Swells, Sales Cool

- Investors Accounted for 30 Percent of All U.S. Home Purchases in 2025

- Canadian Home Sales Recovery Continues in October

- Global Luxury Home Price Growth Cools to 2-Year Low in September

- U.S. Housing Market Recovery to Remain Fragile in 2026