Commercial Real Estate News

Rents Hit 18-Year High in Tokyo as Japan's Office Market Defies Gravity

Commercial News » Tokyo Edition | By Michael Gerrity | October 28, 2025 8:59 AM ET

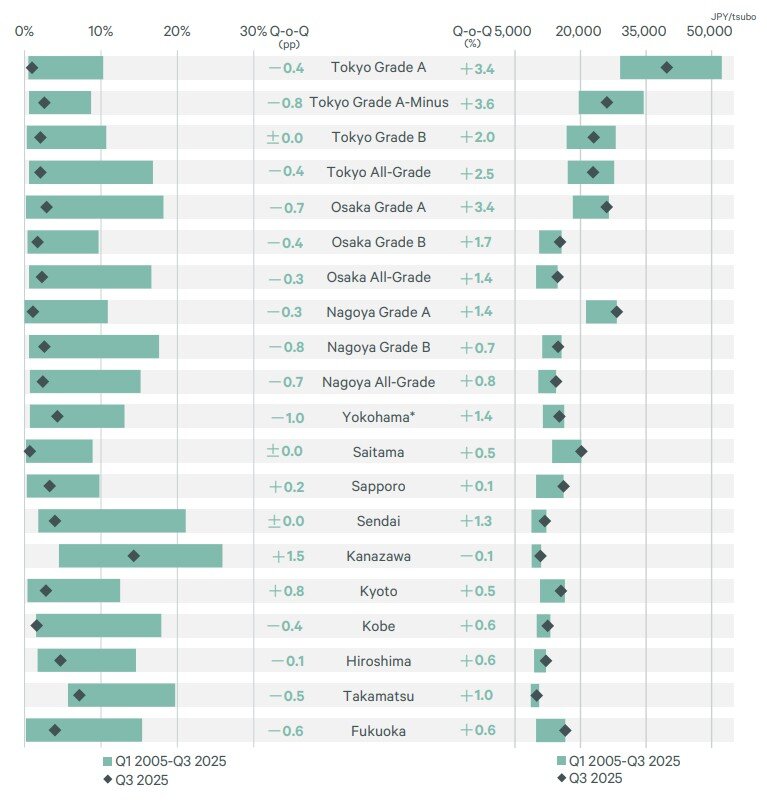

Japan's office market tightened further in the third quarter of 2025, with vacancies falling in half of the nation's major cities and rents climbing to record levels, according to a new report by CBRE. The data underscores a broad recovery in office demand across Japan's regional markets, led by strong absorption in Yokohama, Fukuoka, and Tokyo.

Vacancy Rates Decline Across Major Markets

CBRE reported that all-grade office vacancies declined quarter-over-quarter in five of the 10 cities surveyed, held steady in two, and rose in three. Yokohama once again posted the sharpest improvement, as its vacancy rate dropped by one percentage point to 4.3%. The decline was driven by relocations from company-owned properties and steady demand for expansion and new office openings.

Fukuoka followed with a 0.6-point drop to 4.0%, supported by several relocations into larger spaces exceeding 100 tsubo. Many tenants were moving temporarily to accommodate building redevelopments, while others upgraded or expanded operations--signs, CBRE said, of resilient underlying demand.

Among cities where vacancies increased, new supply was the main factor. Sapporo saw about 3,000 tsubo of new space enter the market, lifting vacancies slightly by 0.2 points, even as tenants continued upgrading into existing prime stock. Kanazawa recorded a 1.5-point increase as new supply equivalent to 3% of existing inventory exceeded take-up. In Kyoto, limited new supply opened fully leased, but downsizing and consolidations elsewhere caused vacancies to rise by 0.8 points.

Rents Climb in Nearly Every Market

Office rents rose in nine of the 10 surveyed cities, continuing a nationwide uptrend. Only Kanazawa posted a marginal decline. Yokohama, Sendai, and Takamatsu saw rents jump more than 1% quarter-over-quarter--the strongest gains in years. For Yokohama and Sendai, it marked their first such increases since early 2020 and late 2019, respectively.

Landlords lifted rents around Yokohama Station and Kannai, while in Sendai, newer high-grade buildings with little vacancy commanded higher rates. CBRE noted that "almost no properties reported lower rents nationwide," with Sapporo, Saitama, and Hiroshima each setting new record highs.

Tokyo Tightens Further as Rents Surge to 18-Year High

Tokyo's office market remains exceptionally tight. The all-grade vacancy rate fell 0.4 points to 2.1%, while Grade A vacancies dropped to just 1.0%. Strong tenant demand for limited large-floor plates pushed Grade A rents up 3.4% to approximately $1,075 per tsubo--marking the sharpest quarterly rise since 2007 and surpassing the pre-pandemic peak of about $1,055 set in Q1 2020.

"Tokyo's premium space is now commanding its highest rents in nearly two decades," CBRE said, noting that competition for top-tier buildings in central wards remains fierce.

Osaka and Nagoya Set New Records

In Osaka, vacancies slipped 0.3 points to 2.3% as existing buildings filled steadily. Average all-grade rents climbed 1.4% to roughly $400 per tsubo--an all-time high. Grade A landlords in both the Umeda district and secondary areas implemented across-the-board increases.

Nagoya also saw record highs, with the all-grade vacancy rate dropping 0.7 points to 2.4%, its lowest since mid-2021. Grade A rents rose 1.4% to about $765, while all-grade rents gained 0.8% to $390, the highest levels since CBRE began its survey.

Market Outlook

CBRE said Japan's office markets continue to demonstrate "remarkable stability," supported by solid tenant demand, limited speculative construction, and expansion-driven relocations. While new supply in some secondary cities may briefly lift vacancies, overall fundamentals remain robust heading into 2026, particularly in Tokyo and other major metropolitan hubs.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Commercial Property Investors Poised to Increase Allocations in 2026

- U.S. Commercial Mortgage Debt Climbs Toward $5 Trillion

- AI Sparks a Global $3 Trillion Data Center Supercycle

- AI Rewrites Playbook for Global Property Dealmakers, Says PwC

- Hong Kong's Central Office Market Enjoys First Rent Increase Since 2022

- U.S. Commercial Real Estate Lending Spikes in Q3

- Commercial Lending Surges in America

- North America Real Estate Enters a Tech-Driven, Boomers-Fueled Era in 2026

- U.S. Commercial Mortgage Delinquencies Ease in Q3

- Rents Hit 18-Year High in Tokyo as Japan's Office Market Defies Gravity

- Hong Kong Office Market Rebounds, IPO Activity Spurs Leasing Demand

- Poland's Commercial Markets Enjoy Rising Property Investment Activity

- Asia-Pacific Property Markets Show Signs of Revival as Investment Rises

- World Property Ventures Raising Capital to Digitize the Global Real Estate Economy

- U.S. Data Center Boom Tests Power Grid as AI Demand Outpaces Supply

- Commercial, Multifamily Mortgage Debt Climbs to Record $4.88 Trillion in U.S.

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs