Residential Real Estate News

U.S. Home Prices Go Flat in September as Inventory Climbs to Six-Year High

Residential News » Irvine Edition | By Michael Gerrity | November 6, 2025 7:52 AM ET

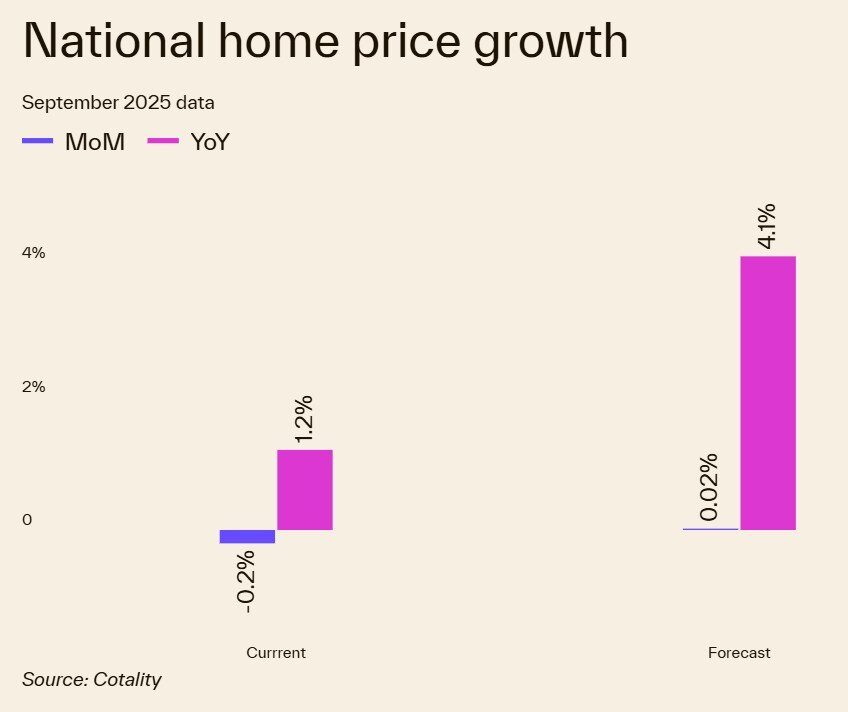

According to the latest Cotality Home Price Index, U.S. home price growth slowed to its weakest pace in nearly two years in September 2025, as rising housing inventory and cooling demand weighed on values across much of the country.

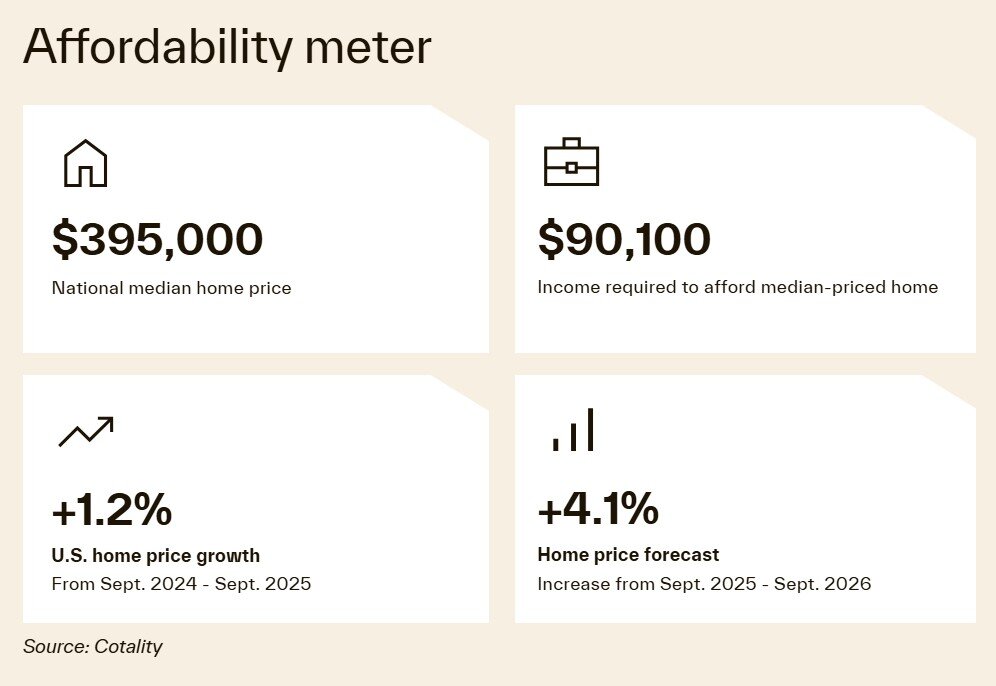

The index showed national prices up 1.2% from a year earlier, underscoring a market that is gradually losing steam. Total housing inventory reached its highest level since 2019, giving buyers more choices but also contributing to a moderation in price gains.

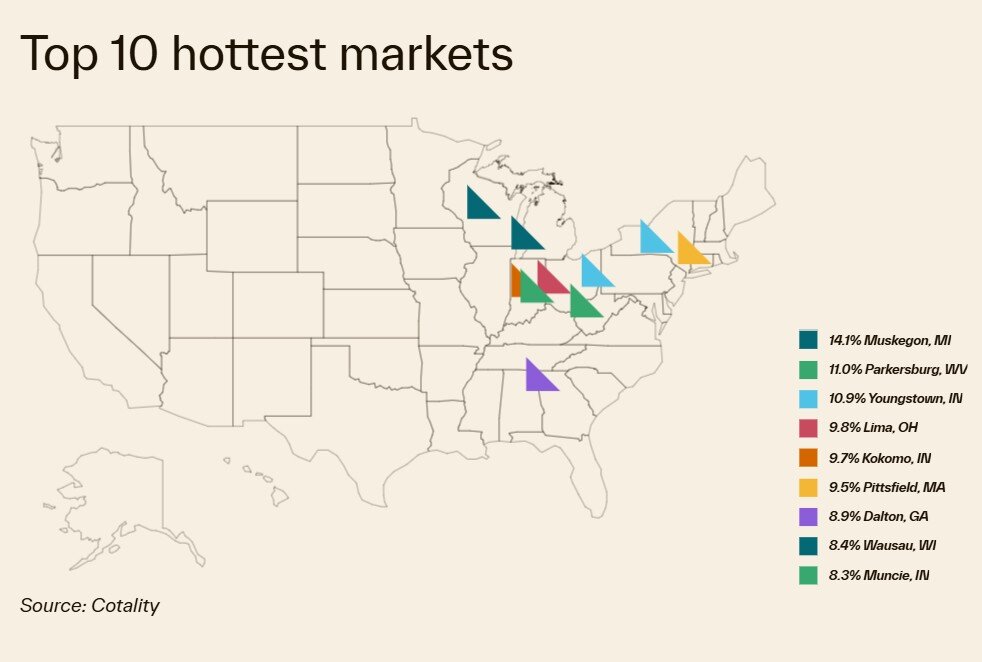

While the Northeast continues to defy the slowdown, with home values climbing at a high single-digit rate, other regions are seeing uneven performance. Alaska and Wyoming, which had lagged for much of the past two years, posted a surprise rebound with price gains above 5% year-over-year.

At the metro level, signs of weakness are spreading. About 20% of the 411 metropolitan areas tracked by Cotality recorded annual price declines in September -- the largest share since June 2023, when surging mortgage rates last cooled the market.

"Much like the K-shaped trend in consumer spending -- where higher-income households continue to spend while lower-income groups pull back -- today's housing market reflects widening affordability gaps," said Dr. Selma Hepp, Cotality's chief economist. "Weaker job growth, sluggish wages, and deteriorating household finances are dampening demand among lower-income buyers, putting downward pressure on prices."

Though mortgage rates have eased in recent weeks and home prices have softened in some markets, affordability remains a major hurdle. Cotality's analysis found that three-quarters of the top 100 housing markets remain overvalued, and real mortgage payments -- excluding taxes and insurance -- are up 72% from pre-pandemic levels.

Still, strength in the Northeast is propping up national averages. "Major metros such as Boston, New York, and Philadelphia remain resilient thanks to strong finance, biotech, healthcare, and education sectors," Hepp said. "These industries provide income stability and attract high-earning professionals who can sustain elevated home prices. Nearby mid-sized metros offering better value are also benefiting as hybrid workers look beyond city centers."

Analysts say that while the recent dip in borrowing costs could spark a modest pickup in demand heading into 2026, a broader recovery will likely depend on a steadier labor market and stronger consumer confidence.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Housing Market Tilts Toward Buyers as Prices Cool

- Ultra-Luxury Home Sales Surge Globally in Late 2025 as 555 Mega-Deals Close

- U.S. Luxury Home Prices Outpaced the Broader Market in 2025

- U.S. Homeowner Equity Growth Cooled in 2025 but Remained Historically Strong

- U.S. Homebuyers Scored Biggest Price Discounts Since 2012 as Market Shifts

- Ten Key Takeaways from the U.S. Housing Market in January

- Hong Kong Stock Market Front-Runs Local Home Prices by Two Months

- Mass Exodus: U.S. Homebuyers Cancel Deals at Record Levels

- U.S. Housing Outlook for 2026 Darkens After Sharp December Pullback in Contract Signings

- America's Housing 'Silver Tsunami' Is Turning Into a Trickle

- Builders Tell Congress Government Rules Are Pricing Americans Out of Housing

- California Housing Market Poised for Balanced Growth in 2026

- U.S. Housing Market Hits Largest Buyer-Seller Imbalance on Record

- Miami Housing Market Ends 2025 on Firmer Ground

- U.S. Homebuilder Confidence Dips at Start of 2026

- Remodeling Outlook Improves as U.S. Homeowners Tap Equity

- U.S. Home Sales Hit Three-Year High in December as Rates Ease

- Las Vegas Area Home Sales Hit 18-Year Low in 2025

- U.S. Mortgage Rates Hit Three-Year Low in January

- U.S. Home Affordability Closed Out 2025 Near Record Lows

- Ireland Home Prices Uptick 5.5 Percent in 2025 Amid Supply Shortages

- One Year After Los Angeles Wildfires, Investors Snap Up Burned Lots

- Greater Palm Beach Area Home Sales Surge in Late 2025

- U.S. Homebuilder Sentiment Ends 2025 in Negative Territory

- America's Single-Family Rent Boom Loses Steam in Late 2025

- Miami Home Price Gains Extend 14-Year Run in 2025

- Why Pre-Biden Mortgages Froze the U.S. Housing Market

- From Bricks to Blockchain: How Digital Dollars Could Soon Rewire Global Real Estate

- U.S. Home Sales Slightly Uptick in November

- Greater Orlando Area Home Sales Dive 22 Percent in November

- World Property Exchange Aims to Make Real Estate Ownership Instantly Tradeable and Democratized on a Planetary Scale

- Falling Home Prices Slash U.S. Homeowner Equity by $13,400 on Average in 2025

- Home Listings in U.S. See Sharpest Drop in Two Years Amid Cooling Buyer Demand

- Dutch Investors Pour Record $4.2 Billion in New Rental Housing in 2025

- U.S. Housing Markets Poised for 2026 Rebound, NAR Says

- Las Vegas Home Prices Hit Record High in November as Inventory Swells, Sales Cool

- Investors Accounted for 30 Percent of All U.S. Home Purchases in 2025

- Canadian Home Sales Recovery Continues in October

- Global Luxury Home Price Growth Cools to 2-Year Low in September

- U.S. Housing Market Recovery to Remain Fragile in 2026