Residential Real Estate News

U.S. Renters Get First Price Break in Four Years this Fall

Residential News » Seattle Edition | By WPJ Staff | October 20, 2025 8:04 AM ET

Apartment Construction Catches up with Renter Demand

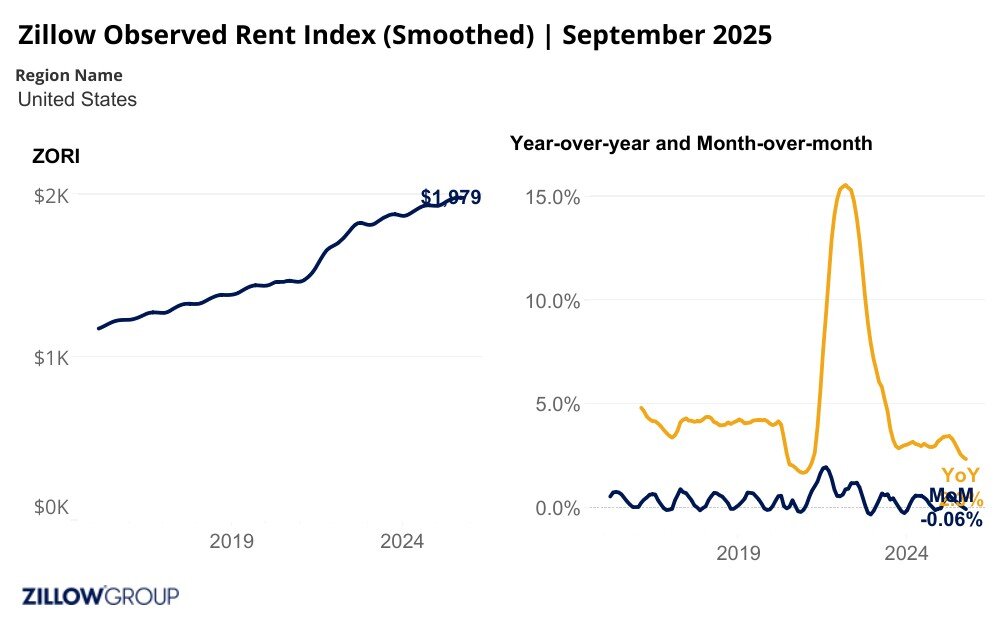

In a significant shift for the rental market, Americans looking for apartments are seeing more breathing room -- a development reflective of growing supply and waning pricing pressure. New data from Zillow shows that renter-affordability has improved for the first time in four years, driven by slower rent growth and rising landlord concessions.

New construction catches up with demand

After a pandemic-era surge in demand, the apartment-building boom of 2024 has begun to show its effect. Builders completed more multifamily units last year than in any 50-year span, responding to housing shortages that emerged between 2020 and 2023. According to Zillow's senior economist Orphe Divounguy, the results are now becoming visible: "Markets that built more -- and faster -- are seeing that investment pay off with more renters able to comfortably afford an apartment."

The southern U.S. in particular -- where zoning is often less restrictive and construction timelines faster -- is emerging as a region where rental affordability is gaining traction.

Rent growth slips; concessions climb

Nationally, rent growth in multifamily units has decelerated sharply. Zillow reports annual increases of just 1.7 % in September 2025 for the multifamily sector, the second-lowest level of growth since 2021. A softer labor market, which weakens residential mobility and thus demand, is also contributing to the slowdown.

Meanwhile, landlords are increasingly turning to inducements: nearly 37.3 % of rental listings now offer some type of freebie -- such as a month of free rent or waived parking -- a new record and up considerably from the 14.4 % that offered concessions in 2019.

Affordability improves--but unevenly

The national picture of rental affordability is improving: the typical U.S. renter now spends about 28.4 % of median household income on rent, down from roughly 28.8 % a year ago -- and below the traditional 30 % "burden" threshold. Affordability improved in 38 of the 50 largest metro areas.

Yet, the gains are far from uniform. Apartment-rents are falling year-over-year in several Sun Belt and Mountain West markets including Austin (-4.7 %), Denver (-3.4 %), San Antonio (-2.3 %), Phoenix (-2.2 %) and Orlando (-0.8 %). On the flip side, markets still constrained by supply -- such as Chicago (+6 %), San Francisco (+5.6 %), and New York (+5.3 %) -- continue to see elevated rental growth.

Single-family rentals, which had out-performed apartments for several years, are now also showing signs of strain: growth in SFR rents has dropped to 3.2 %, the smallest annual increase on record since Zillow began tracking in 2016.

What happens next?

Industry analysts expect concessions will continue to rise, typically peaking during the winter months when competition among renters is lowest. With fewer renters on the hunt during the colder months, landlords may shift from offering perks to cutting base rents.

Meanwhile, the experience of markets that rapidly expanded supply serve as a reminder: when construction keeps pace with demand, housing-cost escalation can be contained. But in many regions, regulatory obstacles will make that path harder.

Bottom line

After years of steep rent increases and shrinking affordability, the rental market is showing signs of moderation. For now, renters are enjoying a slight breather -- though the degree of relief depends heavily on where they live.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Housing Market Tilts Toward Buyers as Prices Cool

- Ultra-Luxury Home Sales Surge Globally in Late 2025 as 555 Mega-Deals Close

- U.S. Luxury Home Prices Outpaced the Broader Market in 2025

- U.S. Homeowner Equity Growth Cooled in 2025 but Remained Historically Strong

- U.S. Homebuyers Scored Biggest Price Discounts Since 2012 as Market Shifts

- Ten Key Takeaways from the U.S. Housing Market in January

- Hong Kong Stock Market Front-Runs Local Home Prices by Two Months

- Mass Exodus: U.S. Homebuyers Cancel Deals at Record Levels

- U.S. Housing Outlook for 2026 Darkens After Sharp December Pullback in Contract Signings

- America's Housing 'Silver Tsunami' Is Turning Into a Trickle

- Builders Tell Congress Government Rules Are Pricing Americans Out of Housing

- California Housing Market Poised for Balanced Growth in 2026

- U.S. Housing Market Hits Largest Buyer-Seller Imbalance on Record

- Miami Housing Market Ends 2025 on Firmer Ground

- U.S. Homebuilder Confidence Dips at Start of 2026

- Remodeling Outlook Improves as U.S. Homeowners Tap Equity

- U.S. Home Sales Hit Three-Year High in December as Rates Ease

- Las Vegas Area Home Sales Hit 18-Year Low in 2025

- U.S. Mortgage Rates Hit Three-Year Low in January

- U.S. Home Affordability Closed Out 2025 Near Record Lows

- Ireland Home Prices Uptick 5.5 Percent in 2025 Amid Supply Shortages

- One Year After Los Angeles Wildfires, Investors Snap Up Burned Lots

- Greater Palm Beach Area Home Sales Surge in Late 2025

- U.S. Homebuilder Sentiment Ends 2025 in Negative Territory

- America's Single-Family Rent Boom Loses Steam in Late 2025

- Miami Home Price Gains Extend 14-Year Run in 2025

- Why Pre-Biden Mortgages Froze the U.S. Housing Market

- From Bricks to Blockchain: How Digital Dollars Could Soon Rewire Global Real Estate

- U.S. Home Sales Slightly Uptick in November

- Greater Orlando Area Home Sales Dive 22 Percent in November

- World Property Exchange Aims to Make Real Estate Ownership Instantly Tradeable and Democratized on a Planetary Scale

- Falling Home Prices Slash U.S. Homeowner Equity by $13,400 on Average in 2025

- Home Listings in U.S. See Sharpest Drop in Two Years Amid Cooling Buyer Demand

- Dutch Investors Pour Record $4.2 Billion in New Rental Housing in 2025

- U.S. Housing Markets Poised for 2026 Rebound, NAR Says

- Las Vegas Home Prices Hit Record High in November as Inventory Swells, Sales Cool

- Investors Accounted for 30 Percent of All U.S. Home Purchases in 2025

- Canadian Home Sales Recovery Continues in October

- Global Luxury Home Price Growth Cools to 2-Year Low in September

- U.S. Housing Market Recovery to Remain Fragile in 2026