Residential Real Estate News

There Was Twice as Many Affordable U.S. Homes for Sale in 2021 Than 2022

Residential News » Seattle Edition | By David Barley | March 6, 2023 9:03 AM ET

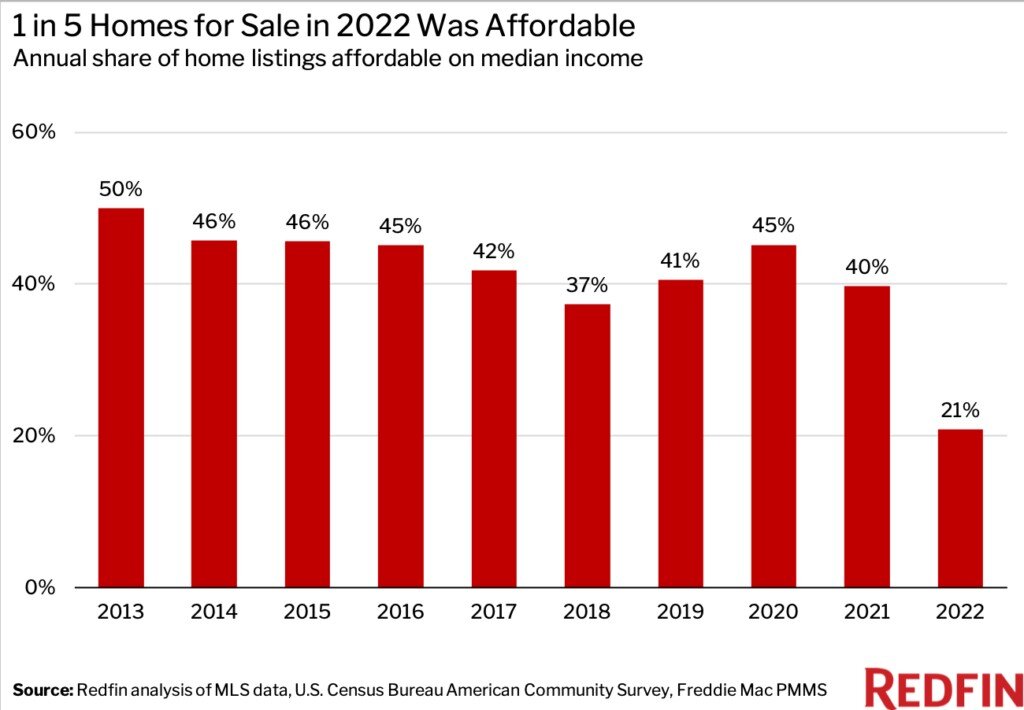

National property broker Redfin is reporting this week that roughly one in five (21%) U.S. homes for sale in 2022 was affordable for the typical household. That's down from two in five (40%) in 2021 and the lowest share on record.

A listing is considered affordable if the estimated monthly mortgage payment is no more than 30% of the local county's median income.

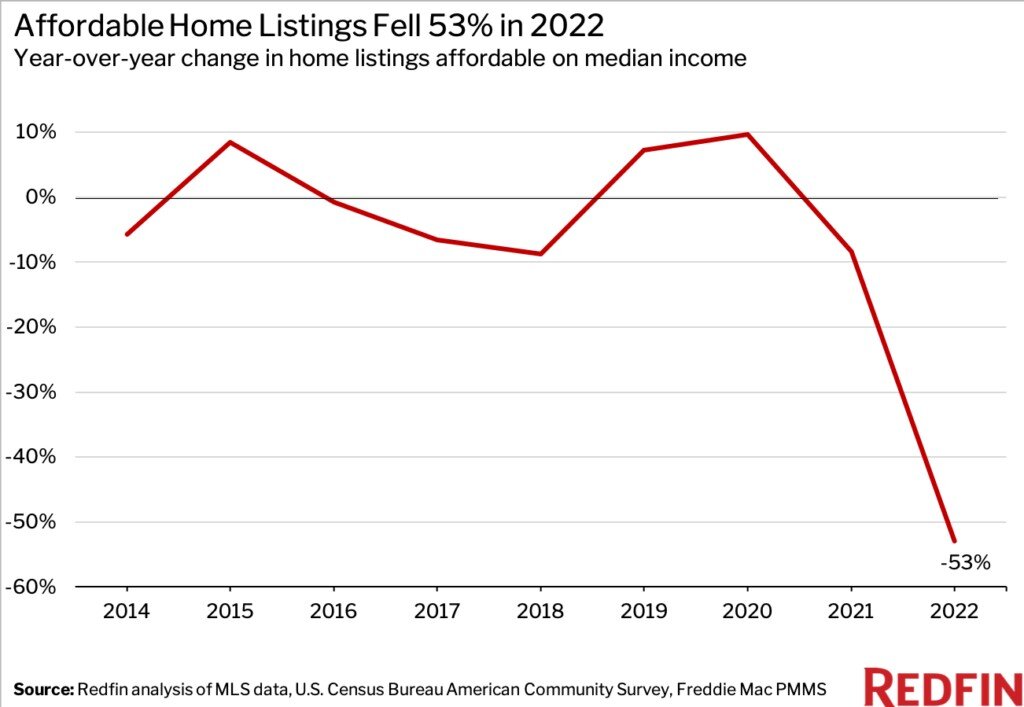

The number of affordable listings fell 53% from a year earlier in 2022--the largest annual drop in Redfin's records, which date back to 2013. While that's partly due to a decline in listings in general--new listings fell 10% year over year--it's mostly due to the fact that higher mortgage rates made the listings hitting the market less affordable.

The housing affordability crisis has intensified for three primary reasons:

- Mortgage rates have more than doubled from the all-time low of 2.65% in 2021 as the Federal Reserve seeks to quell inflation. The average 30-year-fixed mortgage rate today is 6.65%, which has caused the monthly mortgage payment on the median-asking-price home to increase by over $500 from this time last year. The average rate in 2022 was 5.34%, up from 2.96% in 2021.

- The pandemic homebuying boom caused home prices to surge, and they increased faster than incomes. While prices have fallen 12% from their May peak, they remain about 32% higher than they were before the pandemic started roughly three years ago.

- There aren't enough homes for sale, which is keeping prices afloat. There were fewer new listings in January than any month on record aside from April 2020, when the onset of the pandemic brought the housing market to a halt.

"Housing affordability is at the lowest level in history, which will widen the wealth gap--especially between millennials," said Redfin Deputy Chief Economist Taylor Marr. "Many millennials were able to buy their first home before or during the pandemic homebuying boom, but many others were priced out of homeownership and forced to keep renting. That means a lot of young adults missed out on a major wealth building opportunity: the value of homes owned by millennials has risen nearly 30% in the past year. "

Marr continued: "The good news is that housing affordability should improve. Mortgage rates will eventually come down as the Fed makes progress fighting inflation, and home prices have already begun falling. Incomes are also growing faster than the historical norm."

The Biden Administration recently announced that it's cutting mortgage-insurance rates for homebuyers who take out loans backed by the Federal Housing Administration (FHA). The move is estimated to save roughly 850,000 homebuyers, many of whom are low-income and/or first-time buyers, an average of $800 per year. It goes into effect March 20.

Some states, including California and Oregon, have also passed legislation that allows for the construction of more starter homes. Increased supply could help limit home-price growth over time. If executed well, these new laws could serve as a blueprint for other areas grappling with housing shortages.

White Households Can Afford Three Times as Many Homes as Black Households

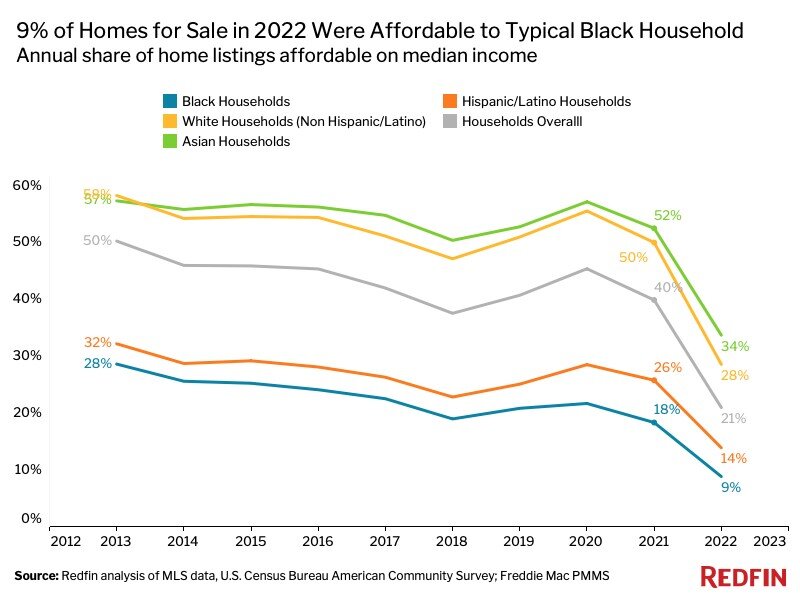

Only 9% of homes for sale last year were affordable for the typical Black household, compared with 28% for the typical white household and the lowest share of any race in this analysis. The share was nearly as low for Hispanic/Latino households (14%) and was highest for Asian households (34%).

Affordability has also fallen slightly faster for Black households than for white households. The share of listings affordable for the typical Black household was cut in half (9% in 2022 vs 18% in 2021), while the share affordable for the typical white household fell by less than half (28% vs 50%).

The number of listings affordable for the typical Black household dropped a record 57% in 2022 from the year before--a larger decline than any other race in this analysis--while the number of listings affordable for the typical white household fell a record 49%. Hispanic/Latino and Asian households also experienced record declines in the number of listings affordable.

"Housing has become incredibly unaffordable for a lot of Americans, but Black families have been hit especially hard because they're often less wealthy to begin with," said Redfin Chief Economist Daryl Fairweather. "On average, Black Americans earn less money, have less generational wealth, and have lower credit scores (and sometimes no credit scores at all) than white Americans. That makes it tougher to afford a down payment and qualify for a low mortgage rate. They also frequently face racial bias during the homebuying process."

The racial housing affordability gap exists nationwide, from the least affordable to the most affordable. In Detroit, for example, 33% of listings were affordable for the typical Black household last year--the highest share in the country. But that's still less than half the share affordable for the typical white household (70%). In Los Angeles, one of the most expensive markets in the country, people across the board have a hard time finding affordable housing. Still, Black house hunters have fewer options. Close to zero (0.1%) listings were affordable for the typical Black household in 2022, compared with 2% for the typical white household.

There are a few slivers of good news, Fairweather said. The Black unemployment rate has been falling on a seasonally-adjusted basis, helping to shrink the gap between the white and Black unemployment rates. Rent growth has also been slowing, which disproportionately affects Black Americans because they're more likely to be renters.

Pandemic Boomtowns and Pricey Coastal Cities Saw Largest Declines in Number of Affordable Homes

The 100 most populous U.S. metro areas all had fewer affordable homes for sale in 2022 than in 2021. In Boise, ID, the number of home listings affordable to the typical local household plunged 86% year over year. It was followed by San Diego (-85%), Salt Lake City (-84%), Oxnard, CA (-83%) and Austin, TX (-82%).

Some of the metros above, including San Diego and Oxnard, have long been expensive. That means that many homes were verging on unaffordable before the pandemic, and have since been pushed over the threshold due to rising prices and mortgage rates. Other metros, including Boise, Salt Lake City and Austin, were relatively affordable before the pandemic, but the homebuying boom pushed prices out of reach for many house hunters. These areas surged in popularity as scores of remote workers moved in, searching for space and affordability.

Relatively affordable places saw the smallest declines in the number of affordable homes. In Detroit, the number of affordable listings fell 16% year over year in 2022. Next came Akron, OH (-24%), Cleveland (-25%), Pittsburgh (-27%) and Philadelphia (-28%).

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Housing Market Tilts Toward Buyers as Prices Cool

- Ultra-Luxury Home Sales Surge Globally in Late 2025 as 555 Mega-Deals Close

- U.S. Luxury Home Prices Outpaced the Broader Market in 2025

- U.S. Homeowner Equity Growth Cooled in 2025 but Remained Historically Strong

- U.S. Homebuyers Scored Biggest Price Discounts Since 2012 as Market Shifts

- Ten Key Takeaways from the U.S. Housing Market in January

- Hong Kong Stock Market Front-Runs Local Home Prices by Two Months

- Mass Exodus: U.S. Homebuyers Cancel Deals at Record Levels

- U.S. Housing Outlook for 2026 Darkens After Sharp December Pullback in Contract Signings

- America's Housing 'Silver Tsunami' Is Turning Into a Trickle

- Builders Tell Congress Government Rules Are Pricing Americans Out of Housing

- California Housing Market Poised for Balanced Growth in 2026

- U.S. Housing Market Hits Largest Buyer-Seller Imbalance on Record

- Miami Housing Market Ends 2025 on Firmer Ground

- U.S. Homebuilder Confidence Dips at Start of 2026

- Remodeling Outlook Improves as U.S. Homeowners Tap Equity

- U.S. Home Sales Hit Three-Year High in December as Rates Ease

- Las Vegas Area Home Sales Hit 18-Year Low in 2025

- U.S. Mortgage Rates Hit Three-Year Low in January

- U.S. Home Affordability Closed Out 2025 Near Record Lows

- Ireland Home Prices Uptick 5.5 Percent in 2025 Amid Supply Shortages

- One Year After Los Angeles Wildfires, Investors Snap Up Burned Lots

- Greater Palm Beach Area Home Sales Surge in Late 2025

- U.S. Homebuilder Sentiment Ends 2025 in Negative Territory

- America's Single-Family Rent Boom Loses Steam in Late 2025

- Miami Home Price Gains Extend 14-Year Run in 2025

- Why Pre-Biden Mortgages Froze the U.S. Housing Market

- From Bricks to Blockchain: How Digital Dollars Could Soon Rewire Global Real Estate

- U.S. Home Sales Slightly Uptick in November

- Greater Orlando Area Home Sales Dive 22 Percent in November

- World Property Exchange Aims to Make Real Estate Ownership Instantly Tradeable and Democratized on a Planetary Scale

- Falling Home Prices Slash U.S. Homeowner Equity by $13,400 on Average in 2025

- Home Listings in U.S. See Sharpest Drop in Two Years Amid Cooling Buyer Demand

- Dutch Investors Pour Record $4.2 Billion in New Rental Housing in 2025

- U.S. Housing Markets Poised for 2026 Rebound, NAR Says

- Las Vegas Home Prices Hit Record High in November as Inventory Swells, Sales Cool

- Investors Accounted for 30 Percent of All U.S. Home Purchases in 2025

- Canadian Home Sales Recovery Continues in October

- Global Luxury Home Price Growth Cools to 2-Year Low in September

- U.S. Housing Market Recovery to Remain Fragile in 2026