Residential Real Estate News

Home Delistings Hit Record High as U.S. Buyers and Sellers Retreat in the U.S.

Residential News » Seattle Edition | By Michael Gerrity | December 6, 2022 8:45 AM ET

Sacramento, Austin and Phoenix saw the biggest jump in delistings

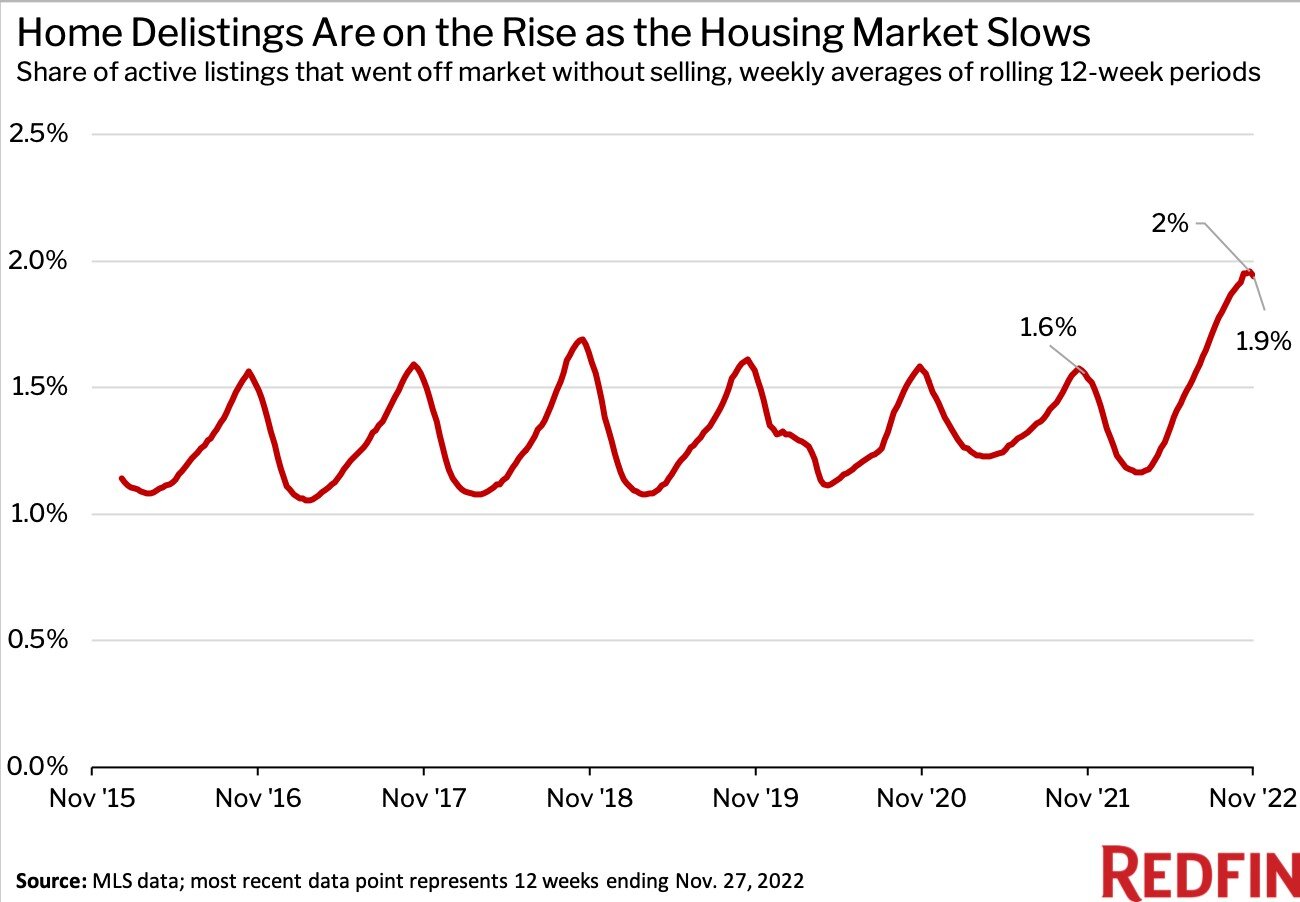

According to national property broker Redfin, a record 2% of U.S. homes for sale were delisted each week on average during the 12 weeks ending Nov. 20, compared with 1.6% one year earlier. That share has come down a touch since then, declining to 1.9% during the 12 weeks ending Nov. 27, which include the Thanksgiving holiday.

Sellers are taking their homes off the market because they're often receiving no offers for the price they want to sell for, and sometimes, no offers at all. That's due to a sharp drop in homebuyer demand driven by rising mortgage rates and persistently high home prices. While mortgage rates have dipped slightly since mid-November, the monthly mortgage payment on the median-asking-price home is still 40% higher than it was one year ago.

"Some sellers are having a hard time grasping that we're not in a housing-market frenzy anymore--it's tough for them to swallow that they missed the boat on getting a high price," said Heather Kruayai, a Redfin real estate agent in Jacksonville, FL. "By the time sellers realize their listing was priced too high, it has already been on the market for too long and is considered stale. I recently had two sellers take their homes off the market after 45-plus days."

Pandemic Boomtowns Are Seeing Biggest Jump in Delistings

In Sacramento, CA, 3.6% of active listings were delisted per week on average during the 12 weeks ending Nov. 27, up 1.6 percentage points from one year earlier--the largest increase among the metros Redfin analyzed. Next comes Austin, TX (1.5 ppts), Seattle (1.4 ppts), Phoenix (1.3 ppts) and Denver (1.2 ppts).

All five aforementioned housing markets saw home prices skyrocket during the pandemic, as most surged in popularity among remote workers. Now, with many buyers priced out, they're among the fastest cooling markets in the country. In Austin, for example, the median home-sale price was up a record 43.5% year over year in the spring of 2021, but growth had shrunk to just 3.7% as of October 2022. And in Sacramento, there was 0% annual home-price growth in October, compared with as much as 29.3% last spring.

"I've had many sellers cancel listings," said David Palmer, a Redfin real estate agent in Seattle. "Usually, sellers who pull their listings off the market in the fall do it with the intention of listing again in the spring. But with the word 'recession' out there, there's not as much optimism about spring being a better market. Now people are talking about trying again in another year or two once the economy improves."

There were six metros that saw a decrease in the share of delistings from a year earlier. The share fell by less than one percentage point in Warren, MI, Chicago, Newark, NJ, New Brunswick, NJ, Detroit, and Montgomery County, PA--markets that have been relatively resilient during the housing-market slowdown.

Expensive West Coast Markets Have Highest Share of Delistings

Sacramento not only saw the biggest year-over-year jump in delistings; it also had the highest overall share, with 3.6% of for-sale homes delisted per week on average during the 12 weeks ending Nov. 27. It was followed by San Francisco (3.4%), Oakland, CA (3.3%), Seattle (3.2%) and San Jose, CA (3%).

One reason the most expensive housing markets tend to have the highest share of delistings is that the pool of buyers who can afford pricey homes is relatively small, meaning there's a higher chance a seller will receive low interest in their home.

Pittsburgh had the lowest share of delistings, at 1.3%, followed by Cincinnati, at 1.4%. Rounding out the bottom five are New Brunswick (1.5%), Newark (1.6%) and Virginia Beach, VA (1.6%).

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Housing Market Tilts Toward Buyers as Prices Cool

- Ultra-Luxury Home Sales Surge Globally in Late 2025 as 555 Mega-Deals Close

- U.S. Luxury Home Prices Outpaced the Broader Market in 2025

- U.S. Homeowner Equity Growth Cooled in 2025 but Remained Historically Strong

- U.S. Homebuyers Scored Biggest Price Discounts Since 2012 as Market Shifts

- Ten Key Takeaways from the U.S. Housing Market in January

- Hong Kong Stock Market Front-Runs Local Home Prices by Two Months

- Mass Exodus: U.S. Homebuyers Cancel Deals at Record Levels

- U.S. Housing Outlook for 2026 Darkens After Sharp December Pullback in Contract Signings

- America's Housing 'Silver Tsunami' Is Turning Into a Trickle

- Builders Tell Congress Government Rules Are Pricing Americans Out of Housing

- California Housing Market Poised for Balanced Growth in 2026

- U.S. Housing Market Hits Largest Buyer-Seller Imbalance on Record

- Miami Housing Market Ends 2025 on Firmer Ground

- U.S. Homebuilder Confidence Dips at Start of 2026

- Remodeling Outlook Improves as U.S. Homeowners Tap Equity

- U.S. Home Sales Hit Three-Year High in December as Rates Ease

- Las Vegas Area Home Sales Hit 18-Year Low in 2025

- U.S. Mortgage Rates Hit Three-Year Low in January

- U.S. Home Affordability Closed Out 2025 Near Record Lows

- Ireland Home Prices Uptick 5.5 Percent in 2025 Amid Supply Shortages

- One Year After Los Angeles Wildfires, Investors Snap Up Burned Lots

- Greater Palm Beach Area Home Sales Surge in Late 2025

- U.S. Homebuilder Sentiment Ends 2025 in Negative Territory

- America's Single-Family Rent Boom Loses Steam in Late 2025

- Miami Home Price Gains Extend 14-Year Run in 2025

- Why Pre-Biden Mortgages Froze the U.S. Housing Market

- From Bricks to Blockchain: How Digital Dollars Could Soon Rewire Global Real Estate

- U.S. Home Sales Slightly Uptick in November

- Greater Orlando Area Home Sales Dive 22 Percent in November

- World Property Exchange Aims to Make Real Estate Ownership Instantly Tradeable and Democratized on a Planetary Scale

- Falling Home Prices Slash U.S. Homeowner Equity by $13,400 on Average in 2025

- Home Listings in U.S. See Sharpest Drop in Two Years Amid Cooling Buyer Demand

- Dutch Investors Pour Record $4.2 Billion in New Rental Housing in 2025

- U.S. Housing Markets Poised for 2026 Rebound, NAR Says

- Las Vegas Home Prices Hit Record High in November as Inventory Swells, Sales Cool

- Investors Accounted for 30 Percent of All U.S. Home Purchases in 2025

- Canadian Home Sales Recovery Continues in October

- Global Luxury Home Price Growth Cools to 2-Year Low in September

- U.S. Housing Market Recovery to Remain Fragile in 2026